You will be redirected to the original Strategy in 15 seconds.

The NostalgiaForInfinityV7 strategy is a trading strategy implemented as a class in Python. It extends the IStrategy class. Here is a brief description of what the strategy does:

The populate_indicators method takes a dataframe of trading data and additional metadata as input and returns a modified dataframe with populated indicators.

It first calculates informative indicators based on 1-hour data and merges them into the original dataframe.

Then, it calculates normal timeframe indicators and adds them to the dataframe.

The populate_entry_trend method populates the entry trend based on certain conditions. It initializes a list called conditions to store the conditions for potential buy signals. It defines various protection conditions (buy_01_protections, buy_02_protections, buy_03_protections) based on user-defined parameters such as exponential moving averages (EMA), simple moving averages (SMA), close price above EMAs, safe dips, and safe pump indicators. For each protection, it appends the corresponding condition to the protection list. Then, it defines separate logic lists (buy_01_logic, buy_02_logic, buy_03_logic) for each buy condition, which combine the protection conditions and additional criteria such as relative strength index (RSI), money flow index (MFI), and volume. The resulting logic lists are combined using the logical AND operator, and the final result is stored in columns named buy_01_trigger, buy_02_trigger, and buy_03_trigger in the dataframe. The strategy allows enabling or disabling each buy condition through user-defined parameters. If enabled, the corresponding trigger condition is added to the conditions list. These conditions will be used to determine potential entry points for the strategy. Overall, the NostalgiaForInfinityV7 strategy utilizes various indicators and conditions to generate buy signals based on specific protection rules and additional criteria.

It first calculates informative indicators based on 1-hour data and merges them into the original dataframe.

Then, it calculates normal timeframe indicators and adds them to the dataframe.

The populate_entry_trend method populates the entry trend based on certain conditions. It initializes a list called conditions to store the conditions for potential buy signals. It defines various protection conditions (buy_01_protections, buy_02_protections, buy_03_protections) based on user-defined parameters such as exponential moving averages (EMA), simple moving averages (SMA), close price above EMAs, safe dips, and safe pump indicators. For each protection, it appends the corresponding condition to the protection list. Then, it defines separate logic lists (buy_01_logic, buy_02_logic, buy_03_logic) for each buy condition, which combine the protection conditions and additional criteria such as relative strength index (RSI), money flow index (MFI), and volume. The resulting logic lists are combined using the logical AND operator, and the final result is stored in columns named buy_01_trigger, buy_02_trigger, and buy_03_trigger in the dataframe. The strategy allows enabling or disabling each buy condition through user-defined parameters. If enabled, the corresponding trigger condition is added to the conditions list. These conditions will be used to determine potential entry points for the strategy. Overall, the NostalgiaForInfinityV7 strategy utilizes various indicators and conditions to generate buy signals based on specific protection rules and additional criteria.

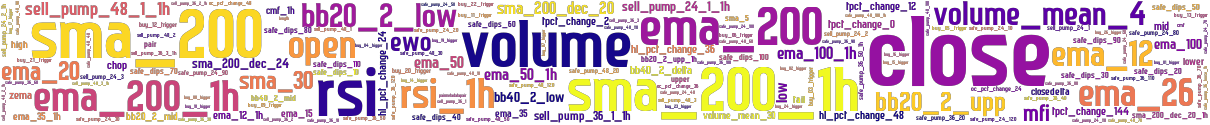

stoploss: -0.99 timeframe: 5m hash(sha256): eb10d5ded51b265661c6a2bcd7084ac0b1cdf123d49bd36b0412cb3bb2a82fe8 indicators: sell_pump_36_3_1h sma_200_1h upper safe_pump_24_30 close ema_15 sell_pump_36_2 sma_5 sell_pump_24_1_1h buy_22_trigger ema_200_1h ewo buy_17_trigger safe_pump_24_100 volume sma_200_dec_20 buy_09_trigger safe_pump_24_120 safe_dips_70 sell_pump_36_1_1h ema_20 buy_21_trigger safe_pump_48_30 safe_pump_48_100_1h oc_pct_change_48 sell_pump_48_1_1h high tpct_change_2 safe_dips_30 sell_pump_48_3 safe_pump_48_10 safe_dips_80 rsi_1h bb20_2_mid ema_12 tpct_change_12 safe_pump_48_50 sell_pump_48_2 safe_pump_

Similar Strategies: (based on used indicators)

Strategy: NostalgiaForInfinityNext_223, Similarity Score: 97.5%

Strategy: NostalgiaForInfinityV7, Similarity Score: 97.5%

Strategy: NostalgiaForInfinityV7_476, Similarity Score: 97.5%

Strategy: NostalgiaForInfinityV7_5, Similarity Score: 97.5%

Strategy: NostalgiaForInfinityV7_7, Similarity Score: 97.5%

Strategy: NostalgiaForInfinityV7_974, Similarity Score: 97.5%

Strategy: NostalgiaForInfinityX_2, Similarity Score: 97.5%

Strategy: NostalgiaVIP, Similarity Score: 97.5%

Strategy: sample_strategy_129, Similarity Score: 97.5%

Strategy: NFI7MOHO, Similarity Score: 95%

Strategy: AlphaNFISMA_2, Similarity Score: 92.5%

Strategy: Combined_NFIv7_SMA_bAdBoY_20211030, Similarity Score: 92.5%

Strategy: Combined_NFIv7_SMA_bAdBoY_20211204, Similarity Score: 92.5%

Strategy: NFIV7_SMA, Similarity Score: 92.5%

Strategy: NFIV7_SMA_2, Similarity Score: 92.5%

Strategy: NostalgiaForInfinityV7_SMA_174, Similarity Score: 92.5%

Strategy: NostalgiaForInfinityV7_SMAv22, Similarity Score: 92.5%

Strategy: NostalgiaForInfinityV7_SMAv2202, Similarity Score: 92.5%

Strategy: NostalgiaForInfinityV7_SMAv2_12, Similarity Score: 92.5%

Strategy: NostalgiaForInfinityV7_SMAv2_1202, Similarity Score: 92.5%

Strategy: NostalgiaForInfinityV7_SMA, Similarity Score: 90%

Strategy: Vail2, Similarity Score: 90%

Strategy: Comb_ho4_7_H9, Similarity Score: 85%

Strategy: Comb_ho4_7_H9_2, Similarity Score: 85%

Strategy: NFI7HO2, Similarity Score: 80%

Strategy: NostalgiaForInfinityNext_2, Similarity Score: 80%

Strategy: NostalgiaForInfinityNext_919, Similarity Score: 80%

Strategy: NostalgiaForInfinityV8, Similarity Score: 80%

last change: 2022-10-08 06:56:14