The Comb_ho4_7_H9 strategy is a trading strategy implemented as a class in Python. Here is a brief description of what the strategy does:

The strategy has two main functions: populate_indicators and populate_buy_trend. In the populate_indicators function, the strategy calculates various indicators based on the input dataframe and metadata.

It merges the informative 1-hour indicators with the main timeframe indicators and returns the updated dataframe.

In the populate_buy_trend function, the strategy defines several buy conditions based on different combinations of indicators and values.

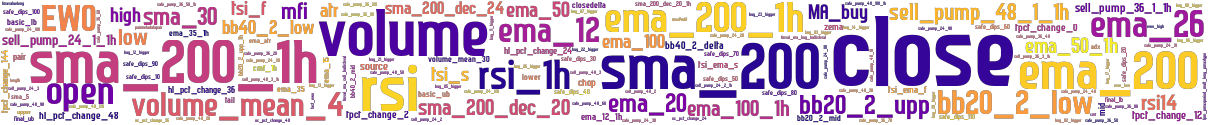

It creates a list of conditions using logical operators such as & (AND) and | (OR). These conditions involve comparisons between different columns of the dataframe and specific threshold values. If any of the conditions are satisfied, the strategy sets a corresponding trigger in the dataframe. The conditions involve indicators like moving averages, close prices, EWO (Elliott Wave Oscillator), RSI (Relative Strength Index), and volume. The strategy also includes additional protection measures represented by the buy_01_protections, buy_02_protections, and buy_03_protections lists. These protections involve comparisons between different columns of the dataframe and specific threshold values, similar to the buy conditions. The protection measures aim to further filter out potential buy signals based on additional criteria, such as exponential moving averages (EMA), simple moving averages (SMA), and safe dips or pumps. Overall, the Comb_ho4_7_H9 strategy combines multiple indicators and conditions to generate buy signals for trading. It uses a variety of technical analysis techniques to identify potentially profitable trading opportunities based on the provided input data.

It merges the informative 1-hour indicators with the main timeframe indicators and returns the updated dataframe.

In the populate_buy_trend function, the strategy defines several buy conditions based on different combinations of indicators and values.

It creates a list of conditions using logical operators such as & (AND) and | (OR). These conditions involve comparisons between different columns of the dataframe and specific threshold values. If any of the conditions are satisfied, the strategy sets a corresponding trigger in the dataframe. The conditions involve indicators like moving averages, close prices, EWO (Elliott Wave Oscillator), RSI (Relative Strength Index), and volume. The strategy also includes additional protection measures represented by the buy_01_protections, buy_02_protections, and buy_03_protections lists. These protections involve comparisons between different columns of the dataframe and specific threshold values, similar to the buy conditions. The protection measures aim to further filter out potential buy signals based on additional criteria, such as exponential moving averages (EMA), simple moving averages (SMA), and safe dips or pumps. Overall, the Comb_ho4_7_H9 strategy combines multiple indicators and conditions to generate buy signals for trading. It uses a variety of technical analysis techniques to identify potentially profitable trading opportunities based on the provided input data.

stoploss: -0.99 timeframe: 5m hash(sha256): cea8b12f4a461dcf9d2496dac2c72685b58e2d7a8ea6b360e0f432a3678209fa indicators: sell_pump_36_3_1h sma_200_1h upper safe_pump_24_30 close ema_15 sell_pump_36_2 sma_5 sell_pump_24_1_1h buy_22_trigger ema_200_1h ewo buy_17_trigger safe_pump_24_100 volume tsi_s sma_200_dec_20 buy_09_trigger tsi_ safe_pump_24_120 safe_dips_70 sell_pump_36_1_1h ema_20 source safe_pump_48_30 safe_pump_48_100_1h buy_21_trigger oc_pct_change_48 sell_pump_48_1_1h high mval_ma_sell_bearishval fast_ewo tpct_change_2 safe_dips_30 mval_ma_buy_bearishval sell_pump_48_3 safe_pump_48_10 safe_dips_80 rsi_1h

Similar Strategies: (based on used indicators)

Strategy: Comb_ho4_7_H9, Similarity Score: 95.12%

Strategy: AlphaNFISMA_2, Similarity Score: 80.49%

Strategy: Combined_NFIv7_SMA_bAdBoY_20211030, Similarity Score: 80.49%

Strategy: Combined_NFIv7_SMA_bAdBoY_20211204, Similarity Score: 80.49%

Strategy: NFI7MOHO, Similarity Score: 80.49%

Strategy: NFIV7_SMA, Similarity Score: 80.49%

Strategy: NFIV7_SMA_2, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityNext_223, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityV7, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityV7_2, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityV7_476, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityV7_5, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityV7_7, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityV7_974, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityV7_SMA, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityV7_SMA_174, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityV7_SMAv22, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityV7_SMAv2202, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityV7_SMAv2_12, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityV7_SMAv2_1202, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityX_2, Similarity Score: 80.49%

Strategy: NostalgiaVIP, Similarity Score: 80.49%

Strategy: Vail2, Similarity Score: 80.49%

Strategy: sample_strategy_129, Similarity Score: 80.49%

last change: 2025-01-07 15:28:21