Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The NostalgiaForInfinityV5 strategy is a trading strategy that involves backtesting various conditions to determine when to buy assets. The strategy uses a combination of technical indicators and price data to identify potential buying opportunities. The populate_indicators function is responsible for calculating and merging different indicators into the main dataframe.

This includes informative indicators from a 1-hour timeframe and normal timeframe indicators.

The populate_buy_trend function defines multiple conditions that need to be satisfied for a buy signal to be generated.

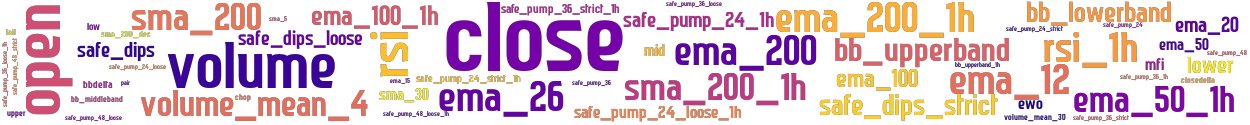

These conditions are implemented using boolean expressions and involve comparing various indicators and price data. Some of the important conditions include checking moving averages (EMA and SMA), safe dips and pumps, relative strength index (RSI), money flow index (MFI), volume, and Bollinger Bands. Each condition is represented as an element in the conditions list. If any of the conditions are met, a buy signal is generated for the corresponding asset. Overall, the strategy aims to identify potential buying opportunities based on a set of predefined conditions and technical indicators. It is designed to be used in a backtesting environment to evaluate its performance with historical data.

This includes informative indicators from a 1-hour timeframe and normal timeframe indicators.

The populate_buy_trend function defines multiple conditions that need to be satisfied for a buy signal to be generated.

These conditions are implemented using boolean expressions and involve comparing various indicators and price data. Some of the important conditions include checking moving averages (EMA and SMA), safe dips and pumps, relative strength index (RSI), money flow index (MFI), volume, and Bollinger Bands. Each condition is represented as an element in the conditions list. If any of the conditions are met, a buy signal is generated for the corresponding asset. Overall, the strategy aims to identify potential buying opportunities based on a set of predefined conditions and technical indicators. It is designed to be used in a backtesting environment to evaluate its performance with historical data.

Unable to parse Traceback (Logfile Exceeded Limit)

stoploss: -0.99 timeframe: 5m hash(sha256): fe7e72a316fbca9eb6b2b815f4df8710832fe32ab6443eec90dfd8538dc02adf indicators: sma_200_1h upper ema_200 ema_50 safe_dips safe_pump_24_loose_1h close safe_pump_36 ema_15 tail sma_5 safe_pump_36_strict chop bb_lowerband safe_pump_24_strict mfi safe_pump_48_strict ema_200_1h safe_pump_36_strict_1h bbdelta ewo safe_pump_24 volume ema_100_1h closedelta ema_20 open safe_pump_36_loose safe_dips_loose safe_pump_24_1h safe_dips_strict volume_mean_30 ema_50_1h bb_upperband_1h sma_200 safe_pump_48_loose volume_mean_4 safe_pump_36_1h mid safe_pump_48 safe_pump_24_loose rsi_1h ema_100

Similar Strategies: (based on used indicators)

Strategy: NostalgiaForInfinityV5, Similarity Score: 95.56%

Strategy: NFI5MOHO2, Similarity Score: 88.89%

Strategy: NFI5MOHO_WIP, Similarity Score: 88.89%

Strategy: NFI5MOHO_WIP_118, Similarity Score: 88.89%

Strategy: NFI5MOHO_WIP_153, Similarity Score: 88.89%

Strategy: NFI5MOHO_WIP_479, Similarity Score: 88.89%

Strategy: NFI5MOHO_WIP_71, Similarity Score: 88.89%

Strategy: NFIV5HYPERALL, Similarity Score: 88.89%

Strategy: NostalgiaForInfinityV5MultiOffsetAndHO, Similarity Score: 88.89%

Strategy: NostalgiaForInfinityV5MultiOffsetAndHO2, Similarity Score: 88.89%

Strategy: NFI5MOHOJP, Similarity Score: 86.67%

Strategy: NostalgiaForInfinityV4, Similarity Score: 82.22%

Strategy: NostalgiaForInfinityV4HO, Similarity Score: 82.22%

Strategy: NostalgiaForInfinityV4_774, Similarity Score: 82.22%

Strategy: babylon, Similarity Score: 82.22%

Strategy: GeneStrategy, Similarity Score: 80%

Strategy: GeneTrader_gen1_1733511779_5325, Similarity Score: 80%

Strategy: GeneTrader_gen1_1733518980_5053, Similarity Score: 80%

Strategy: GeneTrader_gen1_1733560186_7429, Similarity Score: 80%

Strategy: GeneTrader_gen20_1733545619_1965, Similarity Score: 80%

Strategy: NFI5MOHO_WIP_1, Similarity Score: 80%

Strategy: GeneStrategy_3, Similarity Score: 77.78%

Strategy: GeneTrader_gen1_1733508206_5694, Similarity Score: 77.78%

last change: 2025-06-02 01:57:41