Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The NostalgiaForInfinityV5MultiOffsetAndHO2 strategy is a backtesting strategy designed for trading. It consists of various conditions that determine when to enter a buy trade. Here is a breakdown of the important parts of the strategy:

The populate_indicators function is responsible for calculating and merging different indicators used in the strategy.

It takes a dataframe and metadata as input and returns the updated dataframe.

The populate_buy_trend function is where the buy conditions are defined.

It takes a dataframe and metadata as input and returns the updated dataframe with additional buy signals based on the defined conditions. The strategy utilizes different indicators such as exponential moving averages (ema), simple moving averages (sma), relative strength index (rsi), money flow index (mfi), Bollinger Bands (bb), and volume. The strategy includes multiple buy conditions (labeled as buy_condition_X_enable). Each condition consists of a set of logical checks using the indicators and their respective thresholds. If a condition is met, it adds a buy signal to the dataframe. The conditions involve checks for trends, dips, pumps, candlestick patterns, moving average crossovers, and volume criteria. Some conditions compare values between different timeframes, such as hourly and normal timeframes. The conditions consider various offset values, relative values, and thresholds to determine the buy signals. The strategy incorporates rolling calculations, such as rolling minimum and rolling mean, to compare the current price or volume with historical values. The conditions also involve calculations based on open, close, high, low, and their relationships with indicators and their respective values. Overall, the NostalgiaForInfinityV5MultiOffsetAndHO2 strategy aims to identify favorable market conditions for entering buy trades based on a combination of technical indicators, trend analysis, and volume considerations.

It takes a dataframe and metadata as input and returns the updated dataframe.

The populate_buy_trend function is where the buy conditions are defined.

It takes a dataframe and metadata as input and returns the updated dataframe with additional buy signals based on the defined conditions. The strategy utilizes different indicators such as exponential moving averages (ema), simple moving averages (sma), relative strength index (rsi), money flow index (mfi), Bollinger Bands (bb), and volume. The strategy includes multiple buy conditions (labeled as buy_condition_X_enable). Each condition consists of a set of logical checks using the indicators and their respective thresholds. If a condition is met, it adds a buy signal to the dataframe. The conditions involve checks for trends, dips, pumps, candlestick patterns, moving average crossovers, and volume criteria. Some conditions compare values between different timeframes, such as hourly and normal timeframes. The conditions consider various offset values, relative values, and thresholds to determine the buy signals. The strategy incorporates rolling calculations, such as rolling minimum and rolling mean, to compare the current price or volume with historical values. The conditions also involve calculations based on open, close, high, low, and their relationships with indicators and their respective values. Overall, the NostalgiaForInfinityV5MultiOffsetAndHO2 strategy aims to identify favorable market conditions for entering buy trades based on a combination of technical indicators, trend analysis, and volume considerations.

startup_candle_count : 300 ema_100_1h: -0.001% ema_200_1h: -0.187% ema_100: 0.003% ema_200: -0.004% ewo: -1.064% ema_offset_buy: 0.001%

Unable to parse Traceback (Logfile Exceeded Limit)

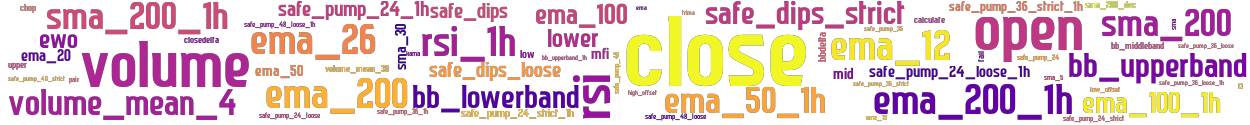

stoploss: -0.99 timeframe: 5m hash(sha256): 6b6ec1065ded3b09041d2882e8af37f204b67154a78ed1efabfc5f24a8735c50 indicators: sma_200_1h upper ema_200 ema_50 safe_dips safe_pump_24_loose_1h close safe_pump_36 ema_15 tail sma_5 safe_pump_36_strict chop bb_lowerband safe_pump_24_strict mfi safe_pump_48_strict ema_200_1h sma ema trima t3 kama bbdelta ewo safe_pump_36_strict_1h safe_pump_24 volume low_offset ema_100_1h i_offset_buy closedelta ema_20 high_offset open safe_pump_36_loose safe_dips_loose safe_pump_24_1h safe_dips_strict volume_mean_30 ema_50_1h bb_upperband_1h sma_200 safe_pump_48_loose volume_mean_4 safe_pump

Similar Strategies: (based on used indicators)

Strategy: NFI5MOHO2, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_118, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_153, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_479, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_71, Similarity Score: 97.87%

Strategy: NFIV5HYPERALL, Similarity Score: 97.87%

Strategy: NostalgiaForInfinityV5MultiOffsetAndHO, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_1, Similarity Score: 85.11%

Strategy: NostalgiaForInfinityV5, Similarity Score: 85.11%

Strategy: NostalgiaForInfinityV5_856, Similarity Score: 85.11%

Strategy: babylon, Similarity Score: 85.11%

Strategy: GeneStrategy, Similarity Score: 80.85%

Strategy: GeneStrategy_3, Similarity Score: 80.85%

Strategy: GeneTrader_gen1_1733508206_5694, Similarity Score: 80.85%

Strategy: GeneTrader_gen20_1733545619_1965, Similarity Score: 80.85%

Strategy: NFI5MOHO, Similarity Score: 80.85%

Strategy: NFI5MOHOJP, Similarity Score: 80.85%

Strategy: GeneTrader_gen1_1733507617_9095, Similarity Score: 76.6%

Strategy: GeneTrader_gen1_1733511779_5325, Similarity Score: 76.6%

Strategy: GeneTrader_gen1_1733518980_5053, Similarity Score: 76.6%

last change: 2025-01-15 17:15:40