Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The NFI5MOHO2 strategy is a trading strategy that involves multiple conditions for buying assets. Here's a summary of the important parts of the strategy:

The strategy first populates various indicators using the populate_indicators function, including informative 1-hour indicators and normal timeframe indicators. The populate_buy_trend function defines several conditions for buying assets based on different indicators and market factors.

Each condition is represented as a list of logical expressions, and the conditions are appended to a list called conditions.

The conditions involve different technical indicators such as moving averages (EMA and SMA), relative strength index (RSI), money flow index (MFI), Bollinger Bands (BB), and volume.

Each condition is enabled or disabled based on certain configuration values (e.g., buy_condition_1_enable, buy_condition_2_enable). The conditions evaluate price movements, trends, safe pump/dip signals, volume thresholds, and various calculations based on historical price data. The conditions consider both the current timeframe and informative 1-hour data for making buying decisions. The strategy aims to identify potential buying opportunities based on the specified conditions and the current market state. This summary provides a high-level overview of the strategy's structure and the key elements involved in determining the buying signals.

Each condition is represented as a list of logical expressions, and the conditions are appended to a list called conditions.

The conditions involve different technical indicators such as moving averages (EMA and SMA), relative strength index (RSI), money flow index (MFI), Bollinger Bands (BB), and volume.

Each condition is enabled or disabled based on certain configuration values (e.g., buy_condition_1_enable, buy_condition_2_enable). The conditions evaluate price movements, trends, safe pump/dip signals, volume thresholds, and various calculations based on historical price data. The conditions consider both the current timeframe and informative 1-hour data for making buying decisions. The strategy aims to identify potential buying opportunities based on the specified conditions and the current market state. This summary provides a high-level overview of the strategy's structure and the key elements involved in determining the buying signals.

startup_candle_count : 300 ema_100_1h: -0.001% ema_200_1h: -0.187% ema_100: 0.003% ema_200: -0.004% ewo: 2.941% t3_offset_buy: -0.009%

Unable to parse Traceback (Logfile Exceeded Limit)

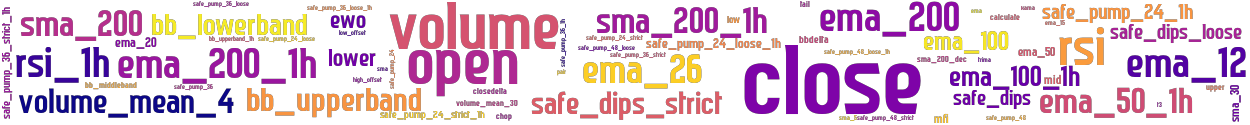

stoploss: -0.99 timeframe: 5m hash(sha256): 977cb72948c8fa55c3da7837d3dff65c5cb85e4587841f5214e75f4d404a0443 indicators: sma_200_1h upper ema_200 ema_50 safe_dips safe_pump_24_loose_1h close safe_pump_36 ema_15 tail sma_5 safe_pump_36_strict chop bb_lowerband safe_pump_24_strict mfi safe_pump_48_strict ema_200_1h sma ema trima t3 kama bbdelta ewo safe_pump_36_strict_1h safe_pump_24 volume low_offset ema_100_1h i_offset_buy closedelta ema_20 high_offset open safe_pump_36_loose safe_dips_loose safe_pump_24_1h safe_dips_strict volume_mean_30 ema_50_1h bb_upperband_1h sma_200 safe_pump_48_loose volume_mean_4 safe_pump

Similar Strategies: (based on used indicators)

Strategy: NFI5MOHO_WIP, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_118, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_153, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_479, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_71, Similarity Score: 97.87%

Strategy: NFIV5HYPERALL, Similarity Score: 97.87%

Strategy: NostalgiaForInfinityV5MultiOffsetAndHO, Similarity Score: 97.87%

Strategy: NostalgiaForInfinityV5MultiOffsetAndHO2, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_1, Similarity Score: 85.11%

Strategy: NostalgiaForInfinityV5, Similarity Score: 85.11%

Strategy: NostalgiaForInfinityV5_856, Similarity Score: 85.11%

Strategy: babylon, Similarity Score: 85.11%

Strategy: GeneStrategy, Similarity Score: 80.85%

Strategy: GeneStrategy_3, Similarity Score: 80.85%

Strategy: GeneTrader_gen1_1733508206_5694, Similarity Score: 80.85%

Strategy: GeneTrader_gen20_1733545619_1965, Similarity Score: 80.85%

Strategy: NFI5MOHO, Similarity Score: 80.85%

Strategy: NFI5MOHOJP, Similarity Score: 80.85%

Strategy: GeneTrader_gen1_1733507617_9095, Similarity Score: 76.6%

Strategy: GeneTrader_gen1_1733511779_5325, Similarity Score: 76.6%

Strategy: GeneTrader_gen1_1733518980_5053, Similarity Score: 76.6%

last change: 2025-06-02 00:36:11