Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The NFI5MOHO_WIP strategy is a trading strategy that involves backtesting multiple conditions to determine buy signals in the market. Here's a breakdown of the important parts of the strategy:

The populate_indicators function is responsible for calculating various indicators based on the provided dataframe and metadata. It merges the informative 1-hour indicators with the normal timeframe indicators.

The populate_buy_trend function determines the buy conditions for the strategy.

It checks multiple conditions using boolean expressions.

Here's a summary of some of the conditions: Condition 1: It checks for conditions related to moving averages (EMA and SMA), safe dips, safe pumps, relative strength index (RSI), and money flow index (MFI). Condition 2: It checks for conditions related to moving averages, safe pumps, volume, RSI, and Bollinger Bands. Condition 3: It checks for conditions related to price, moving averages, safe pumps, Bollinger Bands, and volume. Condition 4: It checks for conditions related to moving averages, safe dips, safe pumps, Bollinger Bands, and volume. Condition 5: It checks for conditions related to moving averages, safe dips, safe pumps, exponential moving averages (EMA), and volume. Condition 6: It checks for conditions related to moving averages, safe dips, safe pumps, exponential moving averages, and volume. Condition 7: It checks for conditions related to moving averages, safe dips, safe pumps, volume, exponential moving averages, and RSI. Condition 8: It checks for conditions related to moving averages, safe dips, safe pumps, RSI, volume, and price. Condition 9: It checks for conditions related to moving averages, safe dips, safe pumps, volume, exponential moving averages, RSI, and MFI. Condition 10: It checks for conditions related to moving averages, safe dips, safe pumps, volume, exponential moving averages, and RSI. Condition 11: It checks for conditions related to moving averages, safe dips, safe pumps, volume, and price. The strategy evaluates these conditions and determines buy signals based on the criteria met by the market data.

The populate_buy_trend function determines the buy conditions for the strategy.

It checks multiple conditions using boolean expressions.

Here's a summary of some of the conditions: Condition 1: It checks for conditions related to moving averages (EMA and SMA), safe dips, safe pumps, relative strength index (RSI), and money flow index (MFI). Condition 2: It checks for conditions related to moving averages, safe pumps, volume, RSI, and Bollinger Bands. Condition 3: It checks for conditions related to price, moving averages, safe pumps, Bollinger Bands, and volume. Condition 4: It checks for conditions related to moving averages, safe dips, safe pumps, Bollinger Bands, and volume. Condition 5: It checks for conditions related to moving averages, safe dips, safe pumps, exponential moving averages (EMA), and volume. Condition 6: It checks for conditions related to moving averages, safe dips, safe pumps, exponential moving averages, and volume. Condition 7: It checks for conditions related to moving averages, safe dips, safe pumps, volume, exponential moving averages, and RSI. Condition 8: It checks for conditions related to moving averages, safe dips, safe pumps, RSI, volume, and price. Condition 9: It checks for conditions related to moving averages, safe dips, safe pumps, volume, exponential moving averages, RSI, and MFI. Condition 10: It checks for conditions related to moving averages, safe dips, safe pumps, volume, exponential moving averages, and RSI. Condition 11: It checks for conditions related to moving averages, safe dips, safe pumps, volume, and price. The strategy evaluates these conditions and determines buy signals based on the criteria met by the market data.

startup_candle_count : 300 ema_100_1h: -0.001% ema_200_1h: -0.187% ema_100: 0.003% ema_200: -0.004% ewo: -1.064%

Unable to parse Traceback (Logfile Exceeded Limit)

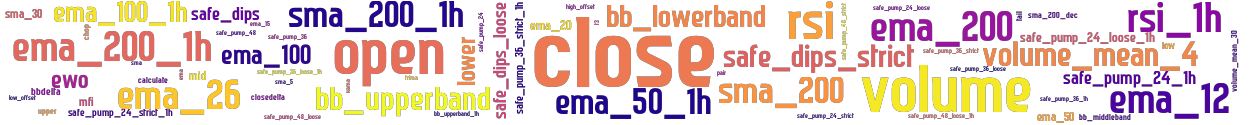

stoploss: -0.99 timeframe: 5m hash(sha256): c7af15ccfb7cbe1a43c6ad91af42d96a7a380fbc29f24aab48544ab40af81df9 indicators: sma_200_1h upper ema_200 ema_50 safe_dips safe_pump_24_loose_1h close safe_pump_36 ema_15 tail sma_5 safe_pump_36_strict chop bb_lowerband safe_pump_24_strict mfi safe_pump_48_strict ema_200_1h sma ema trima t3 kama bbdelta ewo safe_pump_36_strict_1h safe_pump_24 volume low_offset ema_100_1h i_offset_buy closedelta ema_20 high_offset open safe_pump_36_loose safe_dips_loose safe_pump_24_1h safe_dips_strict volume_mean_30 ema_50_1h bb_upperband_1h sma_200 safe_pump_48_loose volume_mean_4 safe_pump

Similar Strategies: (based on used indicators)

Strategy: NFI5MOHO2, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_118, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_153, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_479, Similarity Score: 97.87%

Strategy: NFIV5HYPERALL, Similarity Score: 97.87%

Strategy: NostalgiaForInfinityV5MultiOffsetAndHO, Similarity Score: 97.87%

Strategy: NostalgiaForInfinityV5MultiOffsetAndHO2, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_1, Similarity Score: 85.11%

Strategy: NostalgiaForInfinityV5, Similarity Score: 85.11%

Strategy: NostalgiaForInfinityV5_856, Similarity Score: 85.11%

Strategy: babylon, Similarity Score: 85.11%

Strategy: GeneStrategy, Similarity Score: 80.85%

Strategy: GeneStrategy_3, Similarity Score: 80.85%

Strategy: GeneTrader_gen1_1733508206_5694, Similarity Score: 80.85%

Strategy: GeneTrader_gen20_1733545619_1965, Similarity Score: 80.85%

Strategy: NFI5MOHO, Similarity Score: 80.85%

Strategy: NFI5MOHOJP, Similarity Score: 80.85%

Strategy: GeneTrader_gen1_1733507617_9095, Similarity Score: 76.6%

Strategy: GeneTrader_gen1_1733511779_5325, Similarity Score: 76.6%

Strategy: GeneTrader_gen1_1733518980_5053, Similarity Score: 76.6%

last change: 2025-06-02 01:18:05