Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The "ElliotV4" strategy is a trading strategy that uses various technical indicators to generate buy and sell signals. In the "populate_indicators" function, the strategy calculates and adds multiple indicators to the dataframe, including ADX, PLUS_DM, PLUS_DI, MINUS_DM, MINUS_DI, AROON, Awesome Oscillator, Keltner Channels, Ultimate Oscillator, Commodity Channel Index (CCI), RSI, Fisher RSI, Stochastic Oscillator, Stochastic Fast, Stochastic RSI, MACD, Money Flow Index (MFI), Rate of Change (ROC), Bollinger Bands, SAR, Triple Exponential Moving Average (TEMA), Hilbert Transform - SineWave, and various candlestick patterns. The "ElliotV4" strategy also defines the "populate_buy_trend" and "populate_sell_trend" functions to determine the buy and sell signals based on the calculated indicators.

The buy conditions include criteria such as the closing price being below a moving average, the EWO (Elliott Wave Oscillator) being within certain thresholds, the RSI (Relative Strength Index) being below a specified value, and the volume being greater than zero.

The sell conditions involve the closing price being above a moving average and the volume being greater than zero.

Overall, the strategy aims to identify potential buying opportunities when certain conditions are met and selling opportunities when other conditions are satisfied, based on the calculated technical indicators.

The buy conditions include criteria such as the closing price being below a moving average, the EWO (Elliott Wave Oscillator) being within certain thresholds, the RSI (Relative Strength Index) being below a specified value, and the volume being greater than zero.

The sell conditions involve the closing price being above a moving average and the volume being greater than zero.

Overall, the strategy aims to identify potential buying opportunities when certain conditions are met and selling opportunities when other conditions are satisfied, based on the calculated technical indicators.

Unable to parse Traceback (Logfile Exceeded Limit)

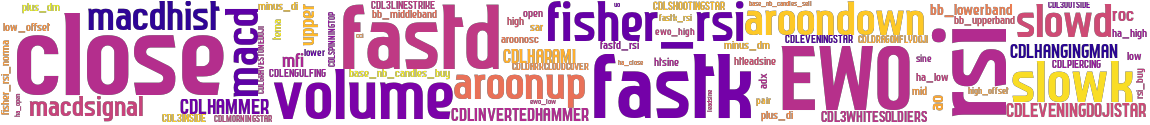

stoploss: -0.325 timeframe: 5m hash(sha256): 06b3a317e99eb4c03b71f2e1f7401ce21ac75eac843dea432e8a14a58531bd20 indicators: rsi_buy upper CDLDRAGONFLYDOJI CDLGRAVESTONEDOJI close CDLSPINNINGTOP bb_lowerband bb_percent CDL3WHITESOLDIERS kc_middleband volume low_offset high fisher_rsi_norma cci ha_high adx aroonosc minus_dm plus_dm ewo_high CDLHANGINGMAN ewo_low aroondown ma_sell_val CDLEVENINGDOJISTAR plus_di ha_open base_nb_candles_buy slowk macdsignal fastk_rsi minus_di roc lower rsi sine kc_percent htsine tema uo mfi kc_width macdhist CDLHAMMER htleadsine ma_buy_val CDLEVENINGSTAR sar CDL3OUTSIDE mid fisher_rsi bb_

Similar Strategies: (based on used indicators)

Strategy: Discord_3_ElliotV5, Similarity Score: 98.15%

Strategy: Discord_ElliotV4, Similarity Score: 98.15%

Strategy: Discord_ElliotV5, Similarity Score: 98.15%

Strategy: ElliotV2, Similarity Score: 98.15%

Strategy: ElliotV2_1, Similarity Score: 98.15%

Strategy: ElliotV2_dca_meneguzzo, Similarity Score: 98.15%

Strategy: ElliotV3_983, Similarity Score: 98.15%

Strategy: ElliotV4, Similarity Score: 98.15%

Strategy: ElliotV4_984, Similarity Score: 98.15%

Strategy: ElliotV5HO_264, Similarity Score: 98.15%

Strategy: ElliotV5_SMA, Similarity Score: 98.15%

Strategy: MarwoSkipVol, Similarity Score: 98.15%

Strategy: MarwoSkipVol15, Similarity Score: 98.15%

Strategy: Discord_ElliotV2, Similarity Score: 96.3%

Strategy: Discord_ElliotV5HO, Similarity Score: 96.3%

Strategy: ElliotV531, Similarity Score: 96.3%

Strategy: ElliotV5_309, Similarity Score: 96.3%

Strategy: MarwoHeiken, Similarity Score: 92.59%

Strategy: BBands, Similarity Score: 85.19%

Strategy: FRAYSTRAT_BTCUSDT_1H, Similarity Score: 85.19%

Strategy: TenderEnter, Similarity Score: 85.19%

Strategy: sample_strategy_284, Similarity Score: 85.19%

Strategy: sample_strategy_3, Similarity Score: 85.19%

Strategy: stoploss, Similarity Score: 85.19%

Strategy: BotE, Similarity Score: 83.33%

Strategy: Neat_RL, Similarity Score: 83.33%

Strategy: TestStrategy, Similarity Score: 83.33%

Strategy: macd_strategy, Similarity Score: 83.33%

Strategy: poimacd, Similarity Score: 83.33%

Strategy: Discord_BuzzzMoneyV1, Similarity Score: 81.48%

Strategy: bbl3h1rsi, Similarity Score: 81.48%

Strategy: MACDCross, Similarity Score: 77.78%

Strategy: MACDcross, Similarity Score: 77.78%

Strategy: EV5X, Similarity Score: 74.07%

last change: 2025-01-13 18:41:41