Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The strategy, named CombinedBinHClucAndMADV9, is designed to backtest trading decisions based on various conditions. Here's a summary of what the strategy does:

populate_indicators function:

Populates the indicators used in the strategy by merging informative data from a 1-hour timeframe with the current timeframe. Returns the updated dataframe with indicators.

populate_buy_trend function: Determines buy signals based on multiple conditions.

The buy conditions include checks on moving averages (ema_200 and ema_200_1h), Bollinger Bands (bb_lowerband), volume metrics, and open/close price relationships.

Each buy condition is controlled by a boolean flag (buy_condition_X_enable) and specific parameters (buy_bb20_close_bblowerband_safe_X, buy_volume_pump_X, buy_volume_drop_X, buy_rsi_X, buy_rsi_1h_X, buy_macd_X). If any of the buy conditions are met, the corresponding row in the dataframe is marked as 'buy' (1). Returns the updated dataframe with 'buy' signals. populate_sell_trend function: Determines sell signals based on a single condition. The sell condition checks if the close price is above the Bollinger Bands' middle band (bb_middleband) multiplied by 1.01, indicating a potential overbought condition. If the sell condition is met, the corresponding row in the dataframe is marked as 'sell' (1). Returns the updated dataframe with 'sell' signals. Overall, the strategy combines multiple technical indicators, such as moving averages, Bollinger Bands, relative strength index (RSI), and volume metrics, to generate buy and sell signals for backtesting trading strategies.

populate_buy_trend function: Determines buy signals based on multiple conditions.

The buy conditions include checks on moving averages (ema_200 and ema_200_1h), Bollinger Bands (bb_lowerband), volume metrics, and open/close price relationships.

Each buy condition is controlled by a boolean flag (buy_condition_X_enable) and specific parameters (buy_bb20_close_bblowerband_safe_X, buy_volume_pump_X, buy_volume_drop_X, buy_rsi_X, buy_rsi_1h_X, buy_macd_X). If any of the buy conditions are met, the corresponding row in the dataframe is marked as 'buy' (1). Returns the updated dataframe with 'buy' signals. populate_sell_trend function: Determines sell signals based on a single condition. The sell condition checks if the close price is above the Bollinger Bands' middle band (bb_middleband) multiplied by 1.01, indicating a potential overbought condition. If the sell condition is met, the corresponding row in the dataframe is marked as 'sell' (1). Returns the updated dataframe with 'sell' signals. Overall, the strategy combines multiple technical indicators, such as moving averages, Bollinger Bands, relative strength index (RSI), and volume metrics, to generate buy and sell signals for backtesting trading strategies.

Unable to parse Traceback (Logfile Exceeded Limit)

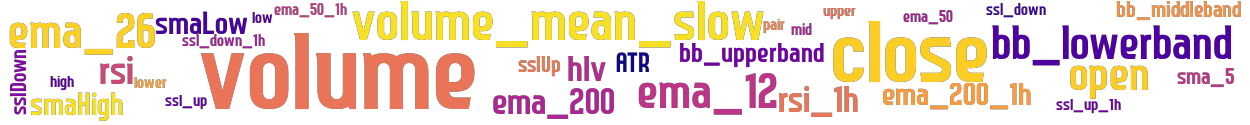

stoploss: -0.99 timeframe: 5m hash(sha256): 2912169aa11311698de26c28f9b64f994d132d69d5cb23d2d349c4ee34eeac42 indicators: upper ema_200 ema_50 close sma_5 bb_lowerband ema_200_1h volume smaHigh ATR ssl_up sslDown open hlv volume_mean_slow ema_50_1h smaLow high sslUp mid ssl_down_1h ssl_down rsi_1h lower ema_12 bb_middleband rsi bb_upperband ema_26 low ssl_up_1h

Similar Strategies: (based on used indicators)

Strategy: 02_CombinedBinHClucAndMADV5, Similarity Score: 96.88%

Strategy: 02_CombinedBinHClucAndMADV6, Similarity Score: 96.88%

Strategy: 04_CombinedBinHAndClucV8, Similarity Score: 96.88%

Strategy: 06_CombinedBinHAndClucV9, Similarity Score: 96.88%

Strategy: CBPete9, Similarity Score: 96.88%

Strategy: CombinedAMD, Similarity Score: 96.88%

Strategy: CombinedBinHAndClucV8Hyper, Similarity Score: 96.88%

Strategy: CombinedBinHAndClucV8Hyper_2, Similarity Score: 96.88%

Strategy: CombinedBinHAndClucV8Hyper_4, Similarity Score: 96.88%

Strategy: CombinedBinHAndClucV8Hyper_8, Similarity Score: 96.88%

Strategy: CombinedBinHAndClucV8XH, Similarity Score: 96.88%

Strategy: CombinedBinHAndClucV8XHO, Similarity Score: 96.88%

Strategy: CombinedBinHAndClucV8XH_3, Similarity Score: 96.88%

Strategy: CombinedBinHClucAndMADV5, Similarity Score: 96.88%

Strategy: CombinedBinHClucAndMADV5_2, Similarity Score: 96.88%

Strategy: CombinedBinHClucAndMADV6_3, Similarity Score: 96.88%

Strategy: CombinedBinHClucAndMADV6_5, Similarity Score: 96.88%

Strategy: CombinedBinHClucAndMADV6_6, Similarity Score: 96.88%

Strategy: CombinedBinHClucAndMADV9_11, Similarity Score: 96.88%

Strategy: CombinedBinHClucAndMADV9_269, Similarity Score: 96.88%

Strategy: CombinedBinHClucAndMADV9_5, Similarity Score: 96.88%

Strategy: CombinedBinHClucAndMADV9_8, Similarity Score: 96.88%

Strategy: CombinedBinHClucAndMADV9_9, Similarity Score: 96.88%

Strategy: FrankenStrat, Similarity Score: 96.88%

Strategy: FrankenStrat_259, Similarity Score: 96.88%

Strategy: MACD_23, Similarity Score: 96.88%

Strategy: MadV9HO, Similarity Score: 96.88%

Strategy: mad, Similarity Score: 96.88%

Strategy: 01_CombinedBinHAndClucV7_OPT, Similarity Score: 90.63%

Strategy: 01_CombinedBinHAndClucV7_OPT_02, Similarity Score: 90.63%

Strategy: CombinedBinHAndClucV7, Similarity Score: 90.63%

Strategy: CombinedBinHAndClucV7_2, Similarity Score: 90.63%

Strategy: CombinedBinHAndClucV7_702, Similarity Score: 90.63%

Strategy: CombinedBinHClucAndSMAOffset, Similarity Score: 90.63%

Strategy: CombinedBinHClucAndSMAOffset_2, Similarity Score: 90.63%

Strategy: Discord_1_TEST, Similarity Score: 90.63%

Strategy: Discord_1_test, Similarity Score: 90.63%

Strategy: Discord_Bzed, Similarity Score: 90.63%

Strategy: 08_NostalgiaForInfinityV2_OPT, Similarity Score: 87.5%

Strategy: 08_NostalgiaForInfinityV2_OPT_02, Similarity Score: 87.5%

Strategy: CombinedBinHAndClucV6, Similarity Score: 87.5%

Strategy: CombinedBinHAndClucV6_2, Similarity Score: 87.5%

Strategy: CombinedBinHAndClucV6_3, Similarity Score: 87.5%

Strategy: HybridMonster, Similarity Score: 87.5%

Strategy: NostalgiaForInfinityV1, Similarity Score: 87.5%

Strategy: NostalgiaForInfinityV2, Similarity Score: 87.5%

last change: 2025-01-13 23:56:56