The NostalgiaForInfinityV2_OPT strategy is designed for backtesting trading strategies. Here's a brief explanation of what it does:

The strategy first populates indicators using the provided dataframe and metadata. It merges informative data from a 1-hour timeframe and fills any missing values.

Next, it populates the "buy" trend based on various conditions: If the close price is below the 9-day simple moving average (sma_9) and above the 200-day exponential moving average (ema_200_1h) on the current timeframe.

The 50-day exponential moving average (ema_50) is above the 200-day exponential moving average (ema_200).

The 50-day exponential moving average on the 1-hour timeframe (ema_50_1h) is above the 200-day exponential moving average on the 1-hour timeframe (ema_200_1h). The lower value (from a Bollinger Bands indicator) in the previous period is greater than 0. The difference between the current period's close price and the previous period's close price is greater than the product of the current period's close price and a specified value (buy_bb40_closedelta_close). The tail value (a measure of how far the current close price is from the lower Bollinger Bands value) is less than the product of the current period's Bollinger Bands delta value (bbdelta) and a specified value (buy_bb40_tail_bbdelta). The current close price is below the previous period's lower Bollinger Bands value. The current close price is less than or equal to the previous period's close price. The volume is greater than 0. If the close price is below the 9-day simple moving average (sma_9) and above the 200-day exponential moving average (ema_200). The close price is also above the 200-day exponential moving average on the 1-hour timeframe (ema_200_1h). The close price is below a specified value (buy_bb20_close_bblowerband) multiplied by the current period's lower Bollinger Bands value (bb_lowerband). The volume is less than the previous period's slow-moving average volume (volume_mean_slow) multiplied by a specified value (buy_bb20_volume). If the close price is below the 5-day simple moving average (sma_5) and above the 200-day exponential moving average (ema_200). The close price is also above the 200-day exponential moving average on the 1-hour timeframe (ema_200_1h). The SSL up value on the 1-hour timeframe (ssl_up_1h) is greater than the SSL down value on the 1-hour timeframe (ssl_down_1h). The 50-day exponential moving average (ema_50) is above the 200-day exponential moving average (ema_200). The 50-day exponential moving average on the 1-hour timeframe (ema_50_1h) is above the 200-day exponential moving average on the 1-hour timeframe (ema_200_1h). The relative strength index (rsi) is less than the previous period's relative strength index on the 1-hour timeframe (rsi_1h) minus a specified value (buy_rsi_diff). The volume is greater than 0. The strategy also populates the "sell" trend based on various conditions: If the relative strength index (rsi) is greater than a specified value (sell_rsi_bb). The close price is above the current period's upper Bollinger Bands value. The close price in the previous two periods is above the corresponding upper Bollinger Bands values. The volume is greater than 0. If the relative strength index (rsi) is greater than a specified value (sell_rsi_main). The volume is greater than 0. If the close price is below the 200-day exponential moving average (ema_200) and above the 50-day exponential moving average (ema_50). The relative strength index (rsi) is greater than a specified value (sell_rsi_2). The volume is greater than 0. If the close price is below the 200-day exponential moving average (ema_200) and the difference between the 200-day exponential moving average and the close price divided by the close price is less than a specified value (sell_ema_relative). The relative strength index (rsi) is greater than the previous period's relative strength index on the 1-hour timeframe (rsi_1h) plus a specified value (sell_rsi_diff). The volume is greater than 0. In summary, the strategy generates "buy" signals when certain conditions are met based on moving averages, Bollinger Bands, SSL values, and relative strength index, and it generates "sell" signals based on the relative strength index, Bollinger Bands, moving averages, and the difference between the close price and the 200-day exponential moving average.

Next, it populates the "buy" trend based on various conditions: If the close price is below the 9-day simple moving average (sma_9) and above the 200-day exponential moving average (ema_200_1h) on the current timeframe.

The 50-day exponential moving average (ema_50) is above the 200-day exponential moving average (ema_200).

The 50-day exponential moving average on the 1-hour timeframe (ema_50_1h) is above the 200-day exponential moving average on the 1-hour timeframe (ema_200_1h). The lower value (from a Bollinger Bands indicator) in the previous period is greater than 0. The difference between the current period's close price and the previous period's close price is greater than the product of the current period's close price and a specified value (buy_bb40_closedelta_close). The tail value (a measure of how far the current close price is from the lower Bollinger Bands value) is less than the product of the current period's Bollinger Bands delta value (bbdelta) and a specified value (buy_bb40_tail_bbdelta). The current close price is below the previous period's lower Bollinger Bands value. The current close price is less than or equal to the previous period's close price. The volume is greater than 0. If the close price is below the 9-day simple moving average (sma_9) and above the 200-day exponential moving average (ema_200). The close price is also above the 200-day exponential moving average on the 1-hour timeframe (ema_200_1h). The close price is below a specified value (buy_bb20_close_bblowerband) multiplied by the current period's lower Bollinger Bands value (bb_lowerband). The volume is less than the previous period's slow-moving average volume (volume_mean_slow) multiplied by a specified value (buy_bb20_volume). If the close price is below the 5-day simple moving average (sma_5) and above the 200-day exponential moving average (ema_200). The close price is also above the 200-day exponential moving average on the 1-hour timeframe (ema_200_1h). The SSL up value on the 1-hour timeframe (ssl_up_1h) is greater than the SSL down value on the 1-hour timeframe (ssl_down_1h). The 50-day exponential moving average (ema_50) is above the 200-day exponential moving average (ema_200). The 50-day exponential moving average on the 1-hour timeframe (ema_50_1h) is above the 200-day exponential moving average on the 1-hour timeframe (ema_200_1h). The relative strength index (rsi) is less than the previous period's relative strength index on the 1-hour timeframe (rsi_1h) minus a specified value (buy_rsi_diff). The volume is greater than 0. The strategy also populates the "sell" trend based on various conditions: If the relative strength index (rsi) is greater than a specified value (sell_rsi_bb). The close price is above the current period's upper Bollinger Bands value. The close price in the previous two periods is above the corresponding upper Bollinger Bands values. The volume is greater than 0. If the relative strength index (rsi) is greater than a specified value (sell_rsi_main). The volume is greater than 0. If the close price is below the 200-day exponential moving average (ema_200) and above the 50-day exponential moving average (ema_50). The relative strength index (rsi) is greater than a specified value (sell_rsi_2). The volume is greater than 0. If the close price is below the 200-day exponential moving average (ema_200) and the difference between the 200-day exponential moving average and the close price divided by the close price is less than a specified value (sell_ema_relative). The relative strength index (rsi) is greater than the previous period's relative strength index on the 1-hour timeframe (rsi_1h) plus a specified value (sell_rsi_diff). The volume is greater than 0. In summary, the strategy generates "buy" signals when certain conditions are met based on moving averages, Bollinger Bands, SSL values, and relative strength index, and it generates "sell" signals based on the relative strength index, Bollinger Bands, moving averages, and the difference between the close price and the 200-day exponential moving average.

Unable to parse Traceback (Logfile Exceeded Limit)

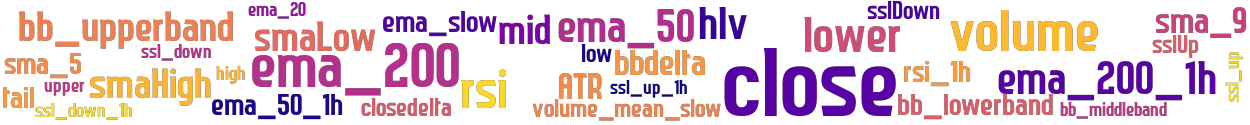

stoploss: -1 timeframe: 5m hash(sha256): d5c29ae9f258a32d171e4d0132da318087e67a2d70964817b966daae5888598d indicators: upper ema_200 ema_50 close sma_5 tail bb_lowerband ema_200_1h bbdelta volume smaHigh ATR ssl_up closedelta sslDown ema_20 hlv volume_mean_slow ema_50_1h smaLow high sslUp mid ssl_down_1h ssl_down rsi_1h sma_9 lower bb_middleband rsi bb_upperband ema_slow low ssl_up_1h

Similar Strategies: (based on used indicators)

Strategy: 08_NostalgiaForInfinityV2_OPT_02, Similarity Score: 97.14%

Strategy: NostalgiaForInfinityV1, Similarity Score: 97.14%

Strategy: NostalgiaForInfinityV2, Similarity Score: 97.14%

Strategy: 01_CombinedBinHAndClucV7_OPT, Similarity Score: 94.29%

Strategy: 01_CombinedBinHAndClucV7_OPT_02, Similarity Score: 94.29%

Strategy: 02_CombinedBinHClucAndMADV5, Similarity Score: 94.29%

Strategy: 04_CombinedBinHAndClucV8, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV6, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV6_2, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV6_3, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV7, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV7_2, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV7_702, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV8Hyper, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV8Hyper_2, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV8Hyper_4, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV8Hyper_8, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV8XH, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV8XHO, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV8XH_3, Similarity Score: 94.29%

Strategy: CombinedBinHClucAndMADV5, Similarity Score: 94.29%

Strategy: CombinedBinHClucAndMADV5_2, Similarity Score: 94.29%

Strategy: Discord_1_TEST, Similarity Score: 94.29%

Strategy: Discord_1_test, Similarity Score: 94.29%

Strategy: Discord_Bzed, Similarity Score: 94.29%

Strategy: CombinedBinHClucAndSMAOffset, Similarity Score: 91.43%

Strategy: CombinedBinHClucAndSMAOffset_2, Similarity Score: 91.43%

Strategy: HybridMonster, Similarity Score: 88.57%

Strategy: 02_CombinedBinHClucAndMADV6, Similarity Score: 85.71%

Strategy: CombinedBinHClucAndMADV6_3, Similarity Score: 85.71%

Strategy: CombinedBinHClucAndMADV6_5, Similarity Score: 85.71%

Strategy: CombinedBinHClucAndMADV6_6, Similarity Score: 85.71%

Strategy: FrankenStrat, Similarity Score: 85.71%

Strategy: FrankenStrat_259, Similarity Score: 85.71%

Strategy: MACD_23, Similarity Score: 85.71%

Strategy: 06_CombinedBinHAndClucV9, Similarity Score: 82.86%

Strategy: CBPete9, Similarity Score: 82.86%

Strategy: CombinedAMD, Similarity Score: 82.86%

Strategy: CombinedBinHClucAndMADV9_11, Similarity Score: 82.86%

Strategy: CombinedBinHClucAndMADV9_269, Similarity Score: 82.86%

Strategy: CombinedBinHClucAndMADV9_5, Similarity Score: 82.86%

Strategy: CombinedBinHClucAndMADV9_8, Similarity Score: 82.86%

Strategy: CombinedBinHClucAndMADV9_858, Similarity Score: 82.86%

Strategy: CombinedBinHClucAndMADV9_9, Similarity Score: 82.86%

Strategy: MadV9HO, Similarity Score: 82.86%

Strategy: mad, Similarity Score: 82.86%

last change: 2025-01-14 11:18:18