You will be redirected to the original Strategy in 15 seconds.

The FrankenStrat strategy is a backtesting strategy that aims to identify buying and selling opportunities in trading. Here's a brief description of what the strategy does:

In the method populate_indicators, the strategy calculates various indicators based on the provided dataframe and metadata. It merges informative data from a 1-hour timeframe and populates indicators for the normal timeframe.

In the method populate_buy_trend, the strategy determines the conditions for buying.

The following conditions are checked: If the closing price is below a certain moving average multiplied by a low offset, and the EWO (Elliott Wave Oscillator) is greater than -1, and the volume is greater than 0.

OR If the closing price is below a TEMA (Triple Exponential Moving Average) multiplied by a TEMA low offset, and the EWO is greater than -1, and the volume is greater than 0. OR If the closing price is above the 200-day exponential moving average (ema_200) and the 1-hour exponential moving average (ema_200_1h), and below the "ema_slow," and below 0.99 times the lower Bollinger Band (bb_lowerband), and the slow volume mean is greater than 40% of the volume mean shifted by 30 periods, and the volume is greater than 0. OR If the closing price is below the "ema_slow," and below 0.975 times the lower Bollinger Band (bb_lowerband), and the volume is less than 4 times the previous volume, and the 1-hour RSI (Relative Strength Index) is less than 15, and the slow volume mean is greater than 40% of the volume mean shifted by 30 periods, and the volume is greater than 0. OR If the closing price is above the 200-day exponential moving average (ema_200) and the 1-hour exponential moving average (ema_200_1h), and the 26-day exponential moving average (ema_26) is above the 12-day exponential moving average (ema_12), and the difference between ema_26 and ema_12 is greater than 2% of the opening price, and the difference between the shifted ema_26 and ema_12 is greater than the opening price divided by 100, and the volume is less than 4 times the previous volume, and the closing price is below the lower Bollinger Band (bb_lowerband), and the slow volume mean is greater than 40% of the volume mean shifted by 30 periods, and the volume is greater than 0. OR If the 26-day exponential moving average (ema_26) is above the 12-day exponential moving average (ema_12), and the difference between ema_26 and ema_12 is greater than 3% of the opening price, and the difference between the shifted ema_26 and ema_12 is greater than the opening price divided by 100, and the volume is less than 4 times the previous volume, and the closing price is below the lower Bollinger Band (bb_lowerband), and the volume is greater than 0. OR If the closing price is below the 5-day simple moving average (sma_5), and the SSL up indicator on the 1-hour timeframe (ssl_up_1h) is greater than the SSL down indicator on the 1-hour timeframe (ssl_down_1h), and the "ema_slow" is greater than the 200-day exponential moving average (ema_200), and the 50-day exponential moving average on the 1-hour

In the method populate_buy_trend, the strategy determines the conditions for buying.

The following conditions are checked: If the closing price is below a certain moving average multiplied by a low offset, and the EWO (Elliott Wave Oscillator) is greater than -1, and the volume is greater than 0.

OR If the closing price is below a TEMA (Triple Exponential Moving Average) multiplied by a TEMA low offset, and the EWO is greater than -1, and the volume is greater than 0. OR If the closing price is above the 200-day exponential moving average (ema_200) and the 1-hour exponential moving average (ema_200_1h), and below the "ema_slow," and below 0.99 times the lower Bollinger Band (bb_lowerband), and the slow volume mean is greater than 40% of the volume mean shifted by 30 periods, and the volume is greater than 0. OR If the closing price is below the "ema_slow," and below 0.975 times the lower Bollinger Band (bb_lowerband), and the volume is less than 4 times the previous volume, and the 1-hour RSI (Relative Strength Index) is less than 15, and the slow volume mean is greater than 40% of the volume mean shifted by 30 periods, and the volume is greater than 0. OR If the closing price is above the 200-day exponential moving average (ema_200) and the 1-hour exponential moving average (ema_200_1h), and the 26-day exponential moving average (ema_26) is above the 12-day exponential moving average (ema_12), and the difference between ema_26 and ema_12 is greater than 2% of the opening price, and the difference between the shifted ema_26 and ema_12 is greater than the opening price divided by 100, and the volume is less than 4 times the previous volume, and the closing price is below the lower Bollinger Band (bb_lowerband), and the slow volume mean is greater than 40% of the volume mean shifted by 30 periods, and the volume is greater than 0. OR If the 26-day exponential moving average (ema_26) is above the 12-day exponential moving average (ema_12), and the difference between ema_26 and ema_12 is greater than 3% of the opening price, and the difference between the shifted ema_26 and ema_12 is greater than the opening price divided by 100, and the volume is less than 4 times the previous volume, and the closing price is below the lower Bollinger Band (bb_lowerband), and the volume is greater than 0. OR If the closing price is below the 5-day simple moving average (sma_5), and the SSL up indicator on the 1-hour timeframe (ssl_up_1h) is greater than the SSL down indicator on the 1-hour timeframe (ssl_down_1h), and the "ema_slow" is greater than the 200-day exponential moving average (ema_200), and the 50-day exponential moving average on the 1-hour

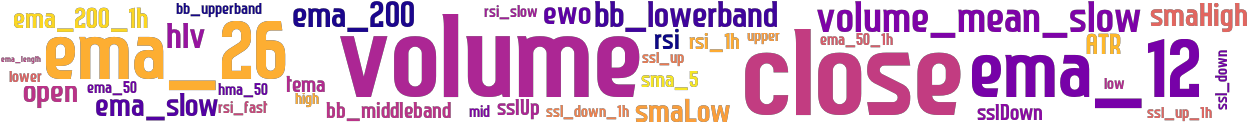

stoploss: -0.99 timeframe: 5m hash(sha256): 52f8bcaf5112ff2bf37b055f470588ea1acf94a757925b87de34b745eacab7bd indicators: upper tema ema_200 ema_50 close sma_5 bb_lowerband ema_200_1h ewo rsi_fast volume smaHigh ATR ssl_up sslDown open hlv volume_mean_slow ema_50_1h smaLow high sslUp mid ssl_down_1h hma_50 ssl_down rsi_1h lower rsi_slow ema_12 bb_middleband rsi ema_length bb_upperband ema_slow ema_26 low ssl_up_1h

Similar Strategies: (based on used indicators)

Strategy: FrankenStrat, Similarity Score: 97.44%

Strategy: 02_CombinedBinHClucAndMADV5, Similarity Score: 82.05%

Strategy: 02_CombinedBinHClucAndMADV6, Similarity Score: 82.05%

Strategy: 04_CombinedBinHAndClucV8, Similarity Score: 82.05%

Strategy: CombinedBinHAndClucV8Hyper, Similarity Score: 82.05%

Strategy: CombinedBinHAndClucV8Hyper_2, Similarity Score: 82.05%

Strategy: CombinedBinHAndClucV8Hyper_4, Similarity Score: 82.05%

Strategy: CombinedBinHAndClucV8Hyper_8, Similarity Score: 82.05%

Strategy: CombinedBinHAndClucV8XH, Similarity Score: 82.05%

Strategy: CombinedBinHAndClucV8XHO, Similarity Score: 82.05%

Strategy: CombinedBinHAndClucV8XH_3, Similarity Score: 82.05%

Strategy: CombinedBinHClucAndMADV5, Similarity Score: 82.05%

Strategy: CombinedBinHClucAndMADV5_2, Similarity Score: 82.05%

Strategy: CombinedBinHClucAndMADV6_3, Similarity Score: 82.05%

Strategy: CombinedBinHClucAndMADV6_5, Similarity Score: 82.05%

Strategy: CombinedBinHClucAndMADV6_6, Similarity Score: 82.05%

Strategy: MACD_23, Similarity Score: 82.05%

last change: 2022-07-02 19:54:08