Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The NFI46 strategy is a backtesting strategy that aims to identify potential buying opportunities in trading. Here is a brief explanation of how the strategy works:

populate_indicators: This method populates the indicators used by the strategy, including informative 1-hour indicators and normal time frame indicators. populate_buy_trend: This method determines the conditions for buying based on various criteria.

The strategy uses multiple conditions (from 1 to 10) to evaluate if a buying opportunity exists.

Each condition is represented by a set of logical expressions.

Here are some of the important conditions: Condition 1: Considers factors like the 1-hour exponential moving averages (ema_50_1h, ema_200_1h), the 200-period simple moving average (sma_200), safe dips, safe pump, relative increase in price, RSI values, and MFI values. Condition 2: Considers factors like 1-hour exponential moving averages, safe pump conditions, volume requirements, RSI values, and Bollinger Bands. Condition 3: Considers factors like price being above a certain moving average, safe pump conditions, specific price patterns, and volume conditions. Condition 4: Considers factors like 1-hour exponential moving averages, safe dips conditions, safe pump conditions, price below certain moving averages, and volume conditions. Condition 5: Considers factors like moving averages, safe dips conditions, safe pump conditions, volume requirements, specific price patterns, and exponential moving average differences. Condition 6: Considers factors like 1-hour exponential moving averages, safe dips conditions, volume requirements, and exponential moving average differences. Condition 7: Considers factors like moving averages, safe dips conditions, volume requirements, exponential moving average differences, RSI values, and volume conditions. Condition 8: Considers factors like price being above a certain moving average, moving average relationships, specific price patterns, and RSI values. Condition 9: Considers factors like moving averages, safe dips conditions, volume requirements, specific price patterns, RSI values, and MFI values. Condition 10: Considers factors like 1-hour exponential moving averages, safe dips conditions, safe pump conditions, volume requirements, and specific price patterns. The strategy evaluates these conditions and adds them to a list of conditions. Each condition represents a potential buying opportunity. The strategy combines these conditions to generate buy signals for the backtested trading strategy. Note: The provided code snippet appears to be incomplete, and there might be additional methods or sections that are not included.

The strategy uses multiple conditions (from 1 to 10) to evaluate if a buying opportunity exists.

Each condition is represented by a set of logical expressions.

Here are some of the important conditions: Condition 1: Considers factors like the 1-hour exponential moving averages (ema_50_1h, ema_200_1h), the 200-period simple moving average (sma_200), safe dips, safe pump, relative increase in price, RSI values, and MFI values. Condition 2: Considers factors like 1-hour exponential moving averages, safe pump conditions, volume requirements, RSI values, and Bollinger Bands. Condition 3: Considers factors like price being above a certain moving average, safe pump conditions, specific price patterns, and volume conditions. Condition 4: Considers factors like 1-hour exponential moving averages, safe dips conditions, safe pump conditions, price below certain moving averages, and volume conditions. Condition 5: Considers factors like moving averages, safe dips conditions, safe pump conditions, volume requirements, specific price patterns, and exponential moving average differences. Condition 6: Considers factors like 1-hour exponential moving averages, safe dips conditions, volume requirements, and exponential moving average differences. Condition 7: Considers factors like moving averages, safe dips conditions, volume requirements, exponential moving average differences, RSI values, and volume conditions. Condition 8: Considers factors like price being above a certain moving average, moving average relationships, specific price patterns, and RSI values. Condition 9: Considers factors like moving averages, safe dips conditions, volume requirements, specific price patterns, RSI values, and MFI values. Condition 10: Considers factors like 1-hour exponential moving averages, safe dips conditions, safe pump conditions, volume requirements, and specific price patterns. The strategy evaluates these conditions and adds them to a list of conditions. Each condition represents a potential buying opportunity. The strategy combines these conditions to generate buy signals for the backtested trading strategy. Note: The provided code snippet appears to be incomplete, and there might be additional methods or sections that are not included.

Unable to parse Traceback (Logfile Exceeded Limit)

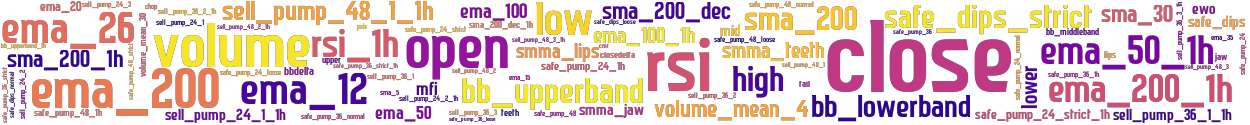

stoploss: -0.99 timeframe: 5m hash(sha256): 75dd03a60094f93fdb1841054c65dc52a8c495f0cccc78652242b3a8a6695cee indicators: sell_pump_36_3_1h sma_200_1h upper close ema_15 sell_pump_36_2 sma_5 safe_pump_36_strict sell_pump_24_1_1h bb_lowerband ema_200_1h ewo safe_pump_24 volume sell_pump_36_1_1h ema_20 safe_pump_48_1h safe_pump_24_1h sell_pump_48_1_1h bb_upperband_1h safe_pump_36_1h high safe_pump_24_normal sell_pump_48_3 rsi_1h ema_12 sell_pump_48_2 ema_26 safe_pump_24_strict_1h sell_pump_24_1 jaw safe_pump_36 smma_jaw chop safe_pump_36_strict_1h bbdelta closedelta safe_dips_loose safe_dips_normal safe_pump_48_loose

Similar Strategies: (based on used indicators)

Strategy: NFI46, Similarity Score: 97.56%

Strategy: NFI46Z, Similarity Score: 95.12%

Strategy: NFI46Z_212, Similarity Score: 95.12%

Strategy: NFI47, Similarity Score: 90.24%

Strategy: NFI47V2, Similarity Score: 90.24%

Strategy: NFI46Offset, Similarity Score: 87.8%

Strategy: NFI46OffsetHOA1, Similarity Score: 87.8%

Strategy: NFI46OffsetHOA1_222, Similarity Score: 87.8%

Strategy: Combined_NFIv6_SMA, Similarity Score: 80.49%

Strategy: Combined_NFIv6_SMA_863, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityNext_76, Similarity Score: 80.49%

last change: 2025-06-02 00:10:26