Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The NFI46Z strategy is a trading strategy implemented as a class that inherits from the IStrategy interface. The strategy consists of two main methods: populate_indicators and populate_buy_trend. The populate_indicators method takes a DataFrame and metadata as input and returns a modified DataFrame.

It first calculates informative indicators based on the 1-hour timeframe using the informative_1h_indicators method.

Then, it merges the informative indicators with the original DataFrame using the merge_informative_pair function, ensuring forward-filling of missing values.

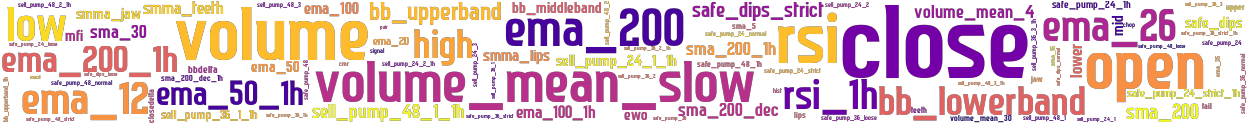

Lastly, it calculates additional indicators for the normal timeframe using the normal_tf_indicators method. The populate_buy_trend method is responsible for generating buy signals based on a set of predefined conditions. It appends conditions to a list, each represented by a logical expression. These conditions incorporate various technical indicators and market factors, including moving averages (EMA and SMA), relative strength index (RSI), money flow index (MFI), Bollinger Bands, and volume analysis. Each condition evaluates specific criteria such as price movements, trend direction, volatility, and volume. By evaluating these conditions, the strategy aims to identify favorable buying opportunities. The conditions are numbered from 1 to 10, and each condition can be enabled or disabled individually using boolean flags (e.g., self.buy_condition_1_enable.value). Overall, the NFI46Z strategy utilizes a combination of technical indicators and market signals to determine when to enter a buy position in a trading scenario.

It first calculates informative indicators based on the 1-hour timeframe using the informative_1h_indicators method.

Then, it merges the informative indicators with the original DataFrame using the merge_informative_pair function, ensuring forward-filling of missing values.

Lastly, it calculates additional indicators for the normal timeframe using the normal_tf_indicators method. The populate_buy_trend method is responsible for generating buy signals based on a set of predefined conditions. It appends conditions to a list, each represented by a logical expression. These conditions incorporate various technical indicators and market factors, including moving averages (EMA and SMA), relative strength index (RSI), money flow index (MFI), Bollinger Bands, and volume analysis. Each condition evaluates specific criteria such as price movements, trend direction, volatility, and volume. By evaluating these conditions, the strategy aims to identify favorable buying opportunities. The conditions are numbered from 1 to 10, and each condition can be enabled or disabled individually using boolean flags (e.g., self.buy_condition_1_enable.value). Overall, the NFI46Z strategy utilizes a combination of technical indicators and market signals to determine when to enter a buy position in a trading scenario.

stoploss: -0.99 timeframe: 5m hash(sha256): 83777a83f236152b0cb86044fafdb2b32c8a3e7d74fbaaf2d261343f3045a634 indicators: sell_pump_36_3_1h sma_200_1h upper close ema_15 sell_pump_36_2 sma_5 safe_pump_36_strict sell_pump_24_1_1h bb_lowerband ema_200_1h ewo safe_pump_24 volume sell_pump_36_1_1h ema_20 safe_pump_48_1h safe_pump_24_1h sell_pump_48_1_1h bb_upperband_1h safe_pump_36_1h high safe_pump_24_normal sell_pump_48_3 rsi_1h hist ema_12 sell_pump_48_2 ema_26 safe_pump_24_strict_1h sell_pump_24_1 jaw safe_pump_36 smma_jaw chop safe_pump_36_strict_1h bbdelta closedelta safe_dips_loose safe_dips_normal safe_pump_48_

Similar Strategies: (based on used indicators)

Strategy: NFI46Z, Similarity Score: 97.62%

Strategy: NFI46, Similarity Score: 95.24%

Strategy: NFI46_217, Similarity Score: 95.24%

Strategy: NFI47, Similarity Score: 90.48%

Strategy: NFI47V2, Similarity Score: 90.48%

Strategy: NFI46Offset, Similarity Score: 88.1%

Strategy: NFI46OffsetHOA1, Similarity Score: 88.1%

Strategy: NFI46OffsetHOA1_222, Similarity Score: 88.1%

last change: 2023-07-05 15:48:25