Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The NFI46Z strategy is a trading strategy implemented as a class that inherits from the IStrategy class. It consists of several methods that define the behavior of the strategy. The populate_indicators method takes a DataFrame and a metadata dictionary as inputs and returns a modified DataFrame.

It populates indicators on the DataFrame by merging informative data from a 1-hour timeframe and normal timeframe indicators.

The populate_buy_trend method takes a DataFrame and a metadata dictionary as inputs and returns a modified DataFrame.

It defines a set of conditions for initiating buy orders based on various indicators and parameters. The conditions are organized as a list of tuples, where each tuple represents a specific condition. The conditions include checks for moving averages (ema_50_1h and ema_200_1h), safe dips, safe pump signals, relative strength index (RSI), money flow index (MFI), volume, and other technical indicators. The strategy seems to have multiple buy conditions (numbered 1 to 10) that can be individually enabled or disabled. Each buy condition consists of a set of logical expressions that need to be satisfied for a buy order to be initiated. The expressions involve comparisons between different indicators, rolling averages, and predefined thresholds. The strategy focuses on identifying potential buying opportunities based on the specified conditions and indicators. However, without additional information about the specific indicators, parameters, and the overall trading logic, it is difficult to provide a comprehensive understanding of the strategy's exact functionality and performance.

It populates indicators on the DataFrame by merging informative data from a 1-hour timeframe and normal timeframe indicators.

The populate_buy_trend method takes a DataFrame and a metadata dictionary as inputs and returns a modified DataFrame.

It defines a set of conditions for initiating buy orders based on various indicators and parameters. The conditions are organized as a list of tuples, where each tuple represents a specific condition. The conditions include checks for moving averages (ema_50_1h and ema_200_1h), safe dips, safe pump signals, relative strength index (RSI), money flow index (MFI), volume, and other technical indicators. The strategy seems to have multiple buy conditions (numbered 1 to 10) that can be individually enabled or disabled. Each buy condition consists of a set of logical expressions that need to be satisfied for a buy order to be initiated. The expressions involve comparisons between different indicators, rolling averages, and predefined thresholds. The strategy focuses on identifying potential buying opportunities based on the specified conditions and indicators. However, without additional information about the specific indicators, parameters, and the overall trading logic, it is difficult to provide a comprehensive understanding of the strategy's exact functionality and performance.

startup_candle_count : 400 ema_100_1h: 0.001% ema_200_1h: 0.078% ewo: 0.086%

Unable to parse Traceback (Logfile Exceeded Limit)

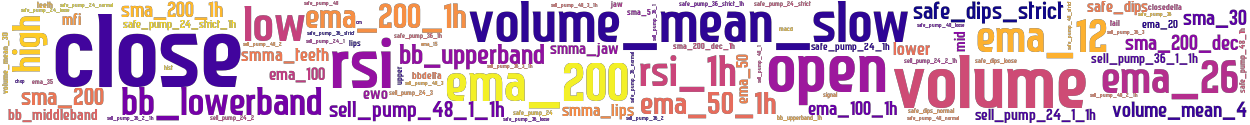

stoploss: -0.99 timeframe: 5m hash(sha256): 590e7fc9a7060f5094d0eb0ad4cf7537f2792d3b0dbc9d01d94f1020ae12d131 indicators: sell_pump_36_3_1h sma_200_1h upper close ema_15 sell_pump_36_2 sma_5 safe_pump_36_strict sell_pump_24_1_1h bb_lowerband ema_200_1h ewo safe_pump_24 volume sell_pump_36_1_1h ema_20 safe_pump_48_1h safe_pump_24_1h sell_pump_48_1_1h bb_upperband_1h safe_pump_36_1h high safe_pump_24_normal sell_pump_48_3 rsi_1h hist ema_12 sell_pump_48_2 ema_26 safe_pump_24_strict_1h sell_pump_24_1 jaw safe_pump_36 smma_jaw chop safe_pump_36_strict_1h bbdelta closedelta safe_dips_loose safe_dips_normal safe_pump_48_

Similar Strategies: (based on used indicators)

Strategy: NFI46Z_212, Similarity Score: 97.62%

Strategy: NFI46, Similarity Score: 95.24%

Strategy: NFI46_217, Similarity Score: 95.24%

Strategy: NFI47, Similarity Score: 90.48%

Strategy: NFI47V2, Similarity Score: 90.48%

Strategy: NFI46Offset, Similarity Score: 88.1%

Strategy: NFI46OffsetHOA1, Similarity Score: 88.1%

Strategy: NFI46OffsetHOA1_222, Similarity Score: 88.1%

last change: 2025-01-13 04:53:17