Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The NFI46OffsetHOA1 strategy is a trading strategy that involves multiple conditions for determining when to buy assets. Here is a brief description of each buy condition:

Condition 1:

The 1-hour EMA 50 is greater than the 1-hour EMA 200. The 200-day SMA is greater than the 20-day shifted SMA.

Safe dips are present.

Safe pump conditions are met.

The percentage increase in close price over the rolling 36 periods is greater than a specified threshold. The 1-hour RSI is within a specified range. The regular RSI is below a specified threshold. The MFI is below a specified threshold. Volume is greater than zero. Condition 2: Similar to Condition 1 but with additional criteria related to volume, RSI, and Bollinger Bands. Condition 3: The close price is above a specified multiple of the 1-hour EMA 200. The 100-day EMA is greater than the 200-day EMA. Various conditions related to EMA 50, safe pump, Bollinger Bands, and volume are satisfied. Condition 4: Similar to Condition 1 but with additional criteria related to safe dips, safe pump, close price, and volume. Condition 5: Similar to Condition 3 but with additional criteria related to EMA 26 and its relationship with EMA 12. Condition 6: Similar to Condition 5 but with additional criteria related to volume. Condition 7: Similar to Condition 5 but with additional criteria related to RSI. Condition 8: Similar to Condition 3 but with additional criteria related to SMMA (smoothed moving average) and RSI. Condition 9: Similar to Condition 5 but with additional criteria related to moving averages and Bollinger Bands. Each condition is evaluated independently, and if any of the conditions are met, a buy signal is generated. The strategy combines multiple technical indicators and patterns to identify potential buying opportunities in the market.

Safe dips are present.

Safe pump conditions are met.

The percentage increase in close price over the rolling 36 periods is greater than a specified threshold. The 1-hour RSI is within a specified range. The regular RSI is below a specified threshold. The MFI is below a specified threshold. Volume is greater than zero. Condition 2: Similar to Condition 1 but with additional criteria related to volume, RSI, and Bollinger Bands. Condition 3: The close price is above a specified multiple of the 1-hour EMA 200. The 100-day EMA is greater than the 200-day EMA. Various conditions related to EMA 50, safe pump, Bollinger Bands, and volume are satisfied. Condition 4: Similar to Condition 1 but with additional criteria related to safe dips, safe pump, close price, and volume. Condition 5: Similar to Condition 3 but with additional criteria related to EMA 26 and its relationship with EMA 12. Condition 6: Similar to Condition 5 but with additional criteria related to volume. Condition 7: Similar to Condition 5 but with additional criteria related to RSI. Condition 8: Similar to Condition 3 but with additional criteria related to SMMA (smoothed moving average) and RSI. Condition 9: Similar to Condition 5 but with additional criteria related to moving averages and Bollinger Bands. Each condition is evaluated independently, and if any of the conditions are met, a buy signal is generated. The strategy combines multiple technical indicators and patterns to identify potential buying opportunities in the market.

startup_candle_count : 400 ema_100_1h: 0.001% ema_200_1h: 0.078% ewo: 0.086% kama_offset_buy: 0.001%

Unable to parse Traceback (Logfile Exceeded Limit)

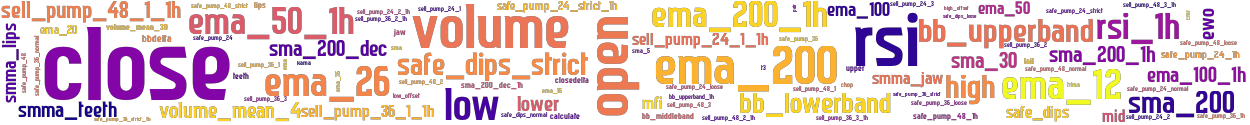

stoploss: -0.99 timeframe: 5m hash(sha256): 3a919e723fd58d08baeb28d35aca8b9b5d2651bf499435420eb49777fc626b35 indicators: sell_pump_36_3_1h sma_200_1h upper close ema_15 sell_pump_36_2 sma_5 safe_pump_36_strict sell_pump_24_1_1h bb_lowerband ema_200_1h ewo safe_pump_24 volume low_offset sell_pump_36_1_1h ema_20 safe_pump_48_1h safe_pump_24_1h sell_pump_48_1_1h bb_upperband_1h safe_pump_36_1h high i_offset_sell safe_pump_24_normal sell_pump_48_3 rsi_1h ema_12 sell_pump_48_2 ema_26 safe_pump_24_strict_1h sell_pump_24_1 jaw safe_pump_36 smma_jaw chop safe_pump_36_strict_1h sma ema trima t3 kama bbdelta i_offset_buy cl

Similar Strategies: (based on used indicators)

Strategy: NFI46Offset, Similarity Score: 97.83%

Strategy: NFI46OffsetHOA1_222, Similarity Score: 97.83%

Strategy: NFI46, Similarity Score: 84.78%

Strategy: NFI46Z, Similarity Score: 84.78%

Strategy: NFI46Z_212, Similarity Score: 84.78%

Strategy: NFI46_217, Similarity Score: 84.78%

Strategy: NFI47, Similarity Score: 82.61%

Strategy: NFI47V2, Similarity Score: 82.61%

last change: 2025-01-13 20:12:53