Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The ClucHAnix trading strategy is a backtesting strategy that uses a combination of technical indicators to generate buy and sell signals for trading. Here's a brief description of how the strategy works:

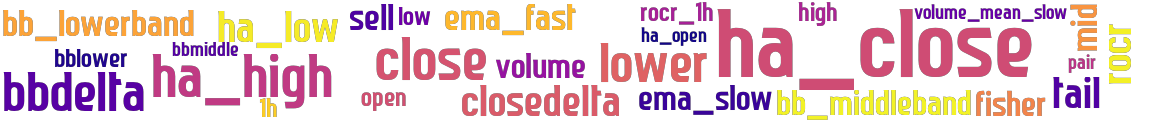

Indicator Calculation: The strategy starts by calculating various indicators based on the input price data. These indicators include Heikin-Ashi candlestick values, Bollinger Bands, moving averages (EMA), RSI (Relative Strength Index), and others.

Informative Data: The strategy retrieves additional informative data on a higher timeframe (1 hour) and merges it with the main data, filling any missing values.

Buy Signal Generation: The strategy generates buy signals based on certain conditions.

These conditions include the rate of change (ROCR) of the Heikin-Ashi close price, Bollinger Bands dynamics, closing price changes, and tail length. If these conditions are met, a buy signal is triggered. Sell Signal Generation: The strategy generates sell signals based on different conditions. These conditions involve the Fisher Transform indicator, Heikin-Ashi high prices, closing prices, moving averages, Bollinger Bands, and trading volume. If these conditions are met, a sell signal is triggered. The ClucHAnix_ETH class is a subclass of ClucHAnix and likely specifies additional parameters or customizations specific to trading Ethereum (ETH) pairs. Overall, the ClucHAnix strategy aims to capture trading opportunities based on the analyzed technical indicators and generate buy and sell signals accordingly.

Informative Data: The strategy retrieves additional informative data on a higher timeframe (1 hour) and merges it with the main data, filling any missing values.

Buy Signal Generation: The strategy generates buy signals based on certain conditions.

These conditions include the rate of change (ROCR) of the Heikin-Ashi close price, Bollinger Bands dynamics, closing price changes, and tail length. If these conditions are met, a buy signal is triggered. Sell Signal Generation: The strategy generates sell signals based on different conditions. These conditions involve the Fisher Transform indicator, Heikin-Ashi high prices, closing prices, moving averages, Bollinger Bands, and trading volume. If these conditions are met, a sell signal is triggered. The ClucHAnix_ETH class is a subclass of ClucHAnix and likely specifies additional parameters or customizations specific to trading Ethereum (ETH) pairs. Overall, the ClucHAnix strategy aims to capture trading opportunities based on the analyzed technical indicators and generate buy and sell signals accordingly.

Unable to parse Traceback (Logfile Exceeded Limit)

stoploss: -0.231 timeframe: 1m hash(sha256): acdf6026a23b5c3ff1748c1aed5f5d5160ef7392f7dadb12a7adb3d025414b88 indicators: rocr_1h closedeltaclose closebblower ha_low sellbbmiddleclose close tail bb_lowerband bbdelta volume bbdeltaclose closedelta rocr open ema_fast volume_mean_slow ha_open sellfisher fisher high mid bbdeltatail ha_close ha_high lower rocr1h bb_middleband rsi ema_slow low

Similar Strategies: (based on used indicators)

Strategy: CE01, Similarity Score: 96.77%

Strategy: ClucHAnix2_3, Similarity Score: 96.77%

Strategy: ClucHAnix3_2, Similarity Score: 96.77%

Strategy: ClucHAnixE01VEOffsets, Similarity Score: 96.77%

Strategy: ClucHAnixE01VEOffsets_3, Similarity Score: 96.77%

Strategy: ClucHAnixHV270, Similarity Score: 96.77%

Strategy: ClucHAnixV1, Similarity Score: 96.77%

Strategy: ClucHAnixV1_3, Similarity Score: 96.77%

Strategy: ClucHAnixV2_0, Similarity Score: 96.77%

Strategy: ClucHAnix_0, Similarity Score: 96.77%

Strategy: ClucHAnix_0_future, Similarity Score: 96.77%

Strategy: ClucHAnix_11, Similarity Score: 96.77%

Strategy: ClucHAnix_231, Similarity Score: 96.77%

Strategy: ClucHAnix_5M_E0V1E_DYNAMIC_TB, Similarity Score: 96.77%

Strategy: ClucHAnix_8, Similarity Score: 96.77%

Strategy: ClucHAnix_932, Similarity Score: 96.77%

Strategy: Discord_1_ClucHAnix, Similarity Score: 96.77%

Strategy: Discord_ClucHAnix_5M_E0V1E, Similarity Score: 96.77%

last change: 2025-01-15 01:59:14