Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The ClucHAnixV1 strategy is a trading strategy that uses various indicators to make buy and sell decisions. Here is a short description of what the strategy does:

Populating Indicators:

Calculates Heikin-Ashi candles based on the input dataframe. Adds Heikin-Ashi open, close, high, and low prices to the dataframe.

Calculates Bollinger Bands (mid and lower) based on the typical price of Heikin-Ashi candles.

Calculates delta between the mid Bollinger Band and lower Bollinger Band.

Calculates delta between consecutive Heikin-Ashi close prices. Calculates the difference between the close price and the low price of Heikin-Ashi candles. Calculates various other indicators such as EMA (fast and slow), volume mean (slow), ROCR, RSI, ADX, Aroon, HMA, CCI, and Fisher RSI. Resamples the dataframe based on a specified timeframe and computes additional indicators. Merges informative data from another timeframe into the dataframe. Populating Buy Trend: Sets parameters for the buy conditions. Defines different buy conditions based on the calculated indicators. Assigns a buy tag to the rows that meet each buy condition. Populating Sell Trend: Sets parameters for the sell conditions. Defines a sell condition based on the Fisher indicator, Heikin-Ashi prices, EMA, Bollinger Bands, and volume. Marks the rows that meet the sell condition as sell signals. Chaikin Money Flow Indicator: Calculates the Chaikin Money Flow (CMF) indicator based on the input dataframe. Uses the close, low, high, and volume prices to calculate the CMF. Returns the CMF series. Resampling Data: Copies the input dataframe. Sets the date column as the index. Resamples the data based on a specified interval and factor using OHLC (open, high, low, close) aggregation. Overall, the ClucHAnixV1 strategy combines various technical indicators to identify potential buy and sell signals in the market. It uses Heikin-Ashi candles, Bollinger Bands, moving averages, oscillators like RSI and CCI, and other indicators to make trading decisions. The strategy aims to generate profitable trades by identifying trends and reversals in the market.

Calculates Bollinger Bands (mid and lower) based on the typical price of Heikin-Ashi candles.

Calculates delta between the mid Bollinger Band and lower Bollinger Band.

Calculates delta between consecutive Heikin-Ashi close prices. Calculates the difference between the close price and the low price of Heikin-Ashi candles. Calculates various other indicators such as EMA (fast and slow), volume mean (slow), ROCR, RSI, ADX, Aroon, HMA, CCI, and Fisher RSI. Resamples the dataframe based on a specified timeframe and computes additional indicators. Merges informative data from another timeframe into the dataframe. Populating Buy Trend: Sets parameters for the buy conditions. Defines different buy conditions based on the calculated indicators. Assigns a buy tag to the rows that meet each buy condition. Populating Sell Trend: Sets parameters for the sell conditions. Defines a sell condition based on the Fisher indicator, Heikin-Ashi prices, EMA, Bollinger Bands, and volume. Marks the rows that meet the sell condition as sell signals. Chaikin Money Flow Indicator: Calculates the Chaikin Money Flow (CMF) indicator based on the input dataframe. Uses the close, low, high, and volume prices to calculate the CMF. Returns the CMF series. Resampling Data: Copies the input dataframe. Sets the date column as the index. Resamples the data based on a specified interval and factor using OHLC (open, high, low, close) aggregation. Overall, the ClucHAnixV1 strategy combines various technical indicators to identify potential buy and sell signals in the market. It uses Heikin-Ashi candles, Bollinger Bands, moving averages, oscillators like RSI and CCI, and other indicators to make trading decisions. The strategy aims to generate profitable trades by identifying trends and reversals in the market.

startup_candle_count : 168 ema_slow: 0.010% rsi: -0.035% rsi_14: -0.035% fisher_rsi: -0.148% fisher: -0.148%

Biased Indicators

resample_short

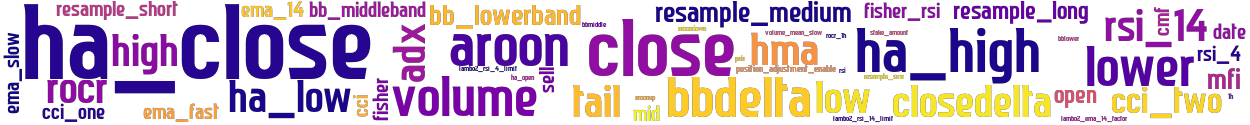

stoploss: -0.99 timeframe: 1m hash(sha256): 69df035c899ef8bdce275d036068b4e241f50aaa8009c8e9a59f055c0a722d69 indicators: rocr_1h closedeltaclose closebblower resample_medium ha_low hma resample_long close cci_one sellbbmiddleclose tail position_adjustment_enable bb_lowerband mfi aroondown bbdelta ema_14 lambo2_rsi_4_limit volume bbdeltaclose rsi_4 resample_short closedelta rocr date open ema_fast volume_mean_slow ha_open rsi_14 sellfisher fisher high mid bbdeltatail fisher_rsi stake_amount ha_close cci cmf open high low close ha_high aroonup adx lower cm lambo2_rsi_14_limit rocr1h bb_middleband rsi ema_slow low re

Similar Strategies: (based on used indicators)

Strategy: ClucHAnixV1_3, Similarity Score: 94.74%

Strategy: ClucHAnix_231, Similarity Score: 71.93%

last change: 2023-07-05 03:50:01