Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The ClucHAnix strategy is a trading strategy that utilizes various indicators to generate buy and sell signals. Here is a brief description of what the strategy does:

populate_indicators: This function calculates and populates several indicators such as Heikin-Ashi candles, Bollinger Bands, exponential moving averages (EMA), relative strength index (RSI), rate of change (ROCR), and more. These indicators provide insights into the market trends and help identify potential trading opportunities.

populate_buy_trend: This function defines the conditions for buying an asset.

It uses a combination of indicators such as EMA, RSI, Bollinger Bands, and the rate of change to identify favorable buying opportunities.

The conditions include checking if the asset's price is below a certain EMA threshold, RSI values are below specific limits, and other conditions related to Bollinger Bands and price movement. populate_sell_trend: This function determines the conditions for selling an asset. It considers indicators such as the Fisher Transform, Heikin-Ashi candles, EMA, and Bollinger Bands to identify potential selling points. The conditions involve checking if the Fisher Transform value exceeds a specified threshold, Heikin-Ashi candle patterns, EMA relationship with the asset's price, and volume requirements. The ClucDCA class inherits from the ClucHAnix strategy, indicating that it extends or modifies the behavior of the parent strategy. Overall, the ClucHAnix strategy combines multiple indicators to generate buy and sell signals, aiming to capture profitable trading opportunities in the market.

populate_buy_trend: This function defines the conditions for buying an asset.

It uses a combination of indicators such as EMA, RSI, Bollinger Bands, and the rate of change to identify favorable buying opportunities.

The conditions include checking if the asset's price is below a certain EMA threshold, RSI values are below specific limits, and other conditions related to Bollinger Bands and price movement. populate_sell_trend: This function determines the conditions for selling an asset. It considers indicators such as the Fisher Transform, Heikin-Ashi candles, EMA, and Bollinger Bands to identify potential selling points. The conditions involve checking if the Fisher Transform value exceeds a specified threshold, Heikin-Ashi candle patterns, EMA relationship with the asset's price, and volume requirements. The ClucDCA class inherits from the ClucHAnix strategy, indicating that it extends or modifies the behavior of the parent strategy. Overall, the ClucHAnix strategy combines multiple indicators to generate buy and sell signals, aiming to capture profitable trading opportunities in the market.

Unable to parse Traceback (Logfile Exceeded Limit)

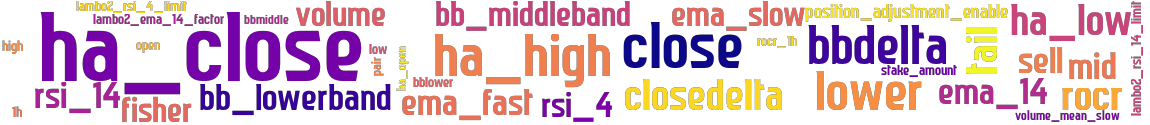

stoploss: -0.99 timeframe: 1m hash(sha256): 44f00e52bacbe27b2356a769124b6334d36468531b3bfd1a46c9e40b0d14cf0b indicators: rocr_1h closedeltaclose closebblower ha_low sellbbmiddleclose close tail position_adjustment_enable bb_lowerband bbdelta ema_14 lambo2_rsi_4_limit volume bbdeltaclose rsi_4 closedelta rocr open ema_fast volume_mean_slow ha_open rsi_14 sellfisher fisher high mid bbdeltatail stake_amount ha_close ha_high lower lambo2_rsi_14_limit rocr1h bb_middleband rsi ema_slow low lambo2_ema_14_factor

Similar Strategies: (based on used indicators)

Strategy: ClucHAnixV1, Similarity Score: 94.87%

Strategy: ClucHAnixV1_3, Similarity Score: 94.87%

Strategy: ClucHAnixHV270, Similarity Score: 82.05%

Strategy: ClucHAnixV2_0, Similarity Score: 82.05%

Strategy: ClucHAnix_11, Similarity Score: 82.05%

Strategy: ClucHAnix_8, Similarity Score: 82.05%

last change: 2025-01-15 12:56:19