Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The ClucHAnix trading strategy is implemented as a class in Python. It is designed to backtest trading strategies using historical data. Here is a short description of what the strategy does:

populate_indicators function: This function calculates various technical indicators and populates them in the input dataframe.

The indicators include Heikin Ashi candlestick values (open, close, high, low), Bollinger Bands, EMA (Exponential Moving Average), ROCR (Rate of Change Ratio), RSI (Relative Strength Index), and Fisher Transform.

Additionally, it retrieves an informative pair's data and merges it with the current timeframe's data.

populate_buy_trend function: This function defines the conditions for buying or entering a trade. It uses a set of parameters to determine the buy signals based on the calculated indicators. The conditions include comparing the ROCR of the informative pair, Bollinger Bands values, close price delta, and tail value. If the conditions are met, a "buy" signal is generated for the corresponding data points. populate_sell_trend function: This function defines the conditions for selling or exiting a trade. It uses a set of parameters to determine the sell signals based on the calculated indicators. The conditions include comparing the Fisher Transform value, previous high prices, close prices, EMA value, and volume. If the conditions are met, a "sell" signal is generated for the corresponding data points. The strategy is derived from the base class ClucHAnix and is specific to ETH (Ethereum) as indicated by the class name ClucHAnix_ETH.

The indicators include Heikin Ashi candlestick values (open, close, high, low), Bollinger Bands, EMA (Exponential Moving Average), ROCR (Rate of Change Ratio), RSI (Relative Strength Index), and Fisher Transform.

Additionally, it retrieves an informative pair's data and merges it with the current timeframe's data.

populate_buy_trend function: This function defines the conditions for buying or entering a trade. It uses a set of parameters to determine the buy signals based on the calculated indicators. The conditions include comparing the ROCR of the informative pair, Bollinger Bands values, close price delta, and tail value. If the conditions are met, a "buy" signal is generated for the corresponding data points. populate_sell_trend function: This function defines the conditions for selling or exiting a trade. It uses a set of parameters to determine the sell signals based on the calculated indicators. The conditions include comparing the Fisher Transform value, previous high prices, close prices, EMA value, and volume. If the conditions are met, a "sell" signal is generated for the corresponding data points. The strategy is derived from the base class ClucHAnix and is specific to ETH (Ethereum) as indicated by the class name ClucHAnix_ETH.

startup_candle_count : 168 ema_slow: 0.010% rsi: -0.035% fisher: -0.148%

Unable to parse Traceback (Logfile Exceeded Limit)

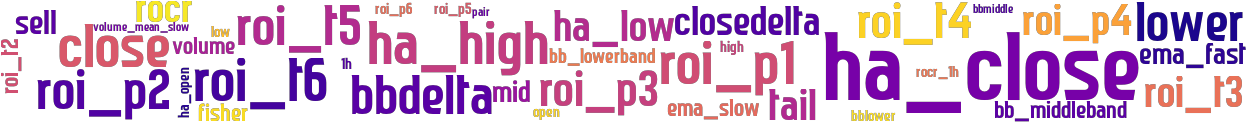

stoploss: -0.99 timeframe: 1m hash(sha256): 53322421c5f172f00a11435ca031955b502f6719e5f6389bc1a63ab8f36084b9 indicators: rocr_1h closedeltaclose roi_p6 closebblower ha_low sellbbmiddleclose close roi_t3 tail bb_lowerband bbdelta volume bbdeltaclose roi_p1 roi_t4 roi_p2 roi_p3 closedelta roi_t5 rocr open ema_fast volume_mean_slow ha_open sellfisher fisher high mid bbdeltatail ha_close roi_p4 ha_high lower rocr1h bb_middleband rsi roi_p5 ema_slow roi_t2 low roi_t6

Similar Strategies: (based on used indicators)

Strategy: CE01, Similarity Score: 97.62%

Strategy: ClucHAnix2_3, Similarity Score: 97.62%

Strategy: ClucHAnixE01VEOffsets, Similarity Score: 97.62%

Strategy: ClucHAnixE01VEOffsets_3, Similarity Score: 97.62%

Strategy: ClucHAnix_5M_E0V1E_DYNAMIC_TB, Similarity Score: 97.62%

Strategy: Discord_1_ClucHAnix, Similarity Score: 97.62%

Strategy: Discord_ClucHAnix_5M_E0V1E, Similarity Score: 97.62%

Strategy: BC_Redmoon, Similarity Score: 80.95%

Strategy: TrailingBuy_ClucHAnix_5m_E0V1E_by_TraNz, Similarity Score: 80.95%

Strategy: TrailingBuy_ClucHAnix_5m_E0V1E_by_TraNz201, Similarity Score: 80.95%

last change: 2025-06-01 23:40:59