Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The NostalgiaForInfinityNext strategy is a backtesting strategy that involves multiple steps and indicators to make buying decisions in a trading system. Here is a breakdown of the important parts of the strategy:

Indicators:

The strategy begins by populating various indicators based on the provided dataframe and metadata. This includes indicators for BTC (Bitcoin) on different timeframes (5 minutes and 1 hour) as well as an informative timeframe.

BTC Base and Info Timeframes: If the strategy has BTC as the base timeframe, additional indicators are calculated for the BTC/USDT pair on the base timeframe.

Similarly, if it has BTC on the informative timeframe, indicators are calculated for the BTC/USDT pair on the informative timeframe.

These indicators are merged into the main dataframe. Informative Timeframe: If an informative timeframe is specified, informative indicators are calculated based on the main dataframe and metadata. These indicators are merged into the main dataframe. Resampled Timeframe: If a resampled timeframe is specified, the main dataframe is resampled to the desired timeframe. Indicators are calculated for the resampled dataframe, and the resampled dataframe is merged back into the main dataframe. Normal Timeframe Indicators: Finally, indicators are calculated for the normal (5-minute) timeframe of the main dataframe. Buy Trend Conditions: The strategy determines buy conditions based on a combination of indicators and buy protection parameters. Buy protection parameters include conditions related to EMAs (Exponential Moving Averages), SMAs (Simple Moving Averages), safe dips, safe pumps, and BTC not being in a downtrend. The strategy has multiple buy conditions (up to 4) that can be enabled or disabled individually. Each buy condition consists of a set of logical conditions that must be met for a buy signal to be generated. Overall, the strategy involves calculating various indicators, merging dataframes, and applying buy conditions based on a combination of indicators and buy protection parameters.

BTC Base and Info Timeframes: If the strategy has BTC as the base timeframe, additional indicators are calculated for the BTC/USDT pair on the base timeframe.

Similarly, if it has BTC on the informative timeframe, indicators are calculated for the BTC/USDT pair on the informative timeframe.

These indicators are merged into the main dataframe. Informative Timeframe: If an informative timeframe is specified, informative indicators are calculated based on the main dataframe and metadata. These indicators are merged into the main dataframe. Resampled Timeframe: If a resampled timeframe is specified, the main dataframe is resampled to the desired timeframe. Indicators are calculated for the resampled dataframe, and the resampled dataframe is merged back into the main dataframe. Normal Timeframe Indicators: Finally, indicators are calculated for the normal (5-minute) timeframe of the main dataframe. Buy Trend Conditions: The strategy determines buy conditions based on a combination of indicators and buy protection parameters. Buy protection parameters include conditions related to EMAs (Exponential Moving Averages), SMAs (Simple Moving Averages), safe dips, safe pumps, and BTC not being in a downtrend. The strategy has multiple buy conditions (up to 4) that can be enabled or disabled individually. Each buy condition consists of a set of logical conditions that must be met for a buy signal to be generated. Overall, the strategy involves calculating various indicators, merging dataframes, and applying buy conditions based on a combination of indicators and buy protection parameters.

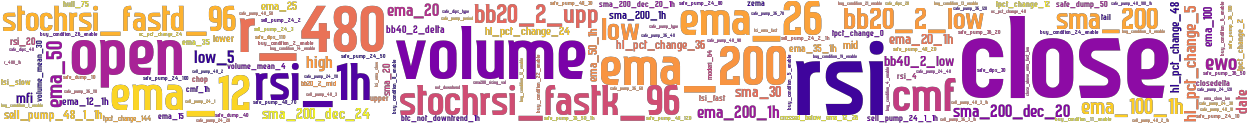

stoploss: -0.99 timeframe: 30m hash(sha256): 011a047cbebe6922c7fc6c53b7659207002bf4b49797e5b074037a9e087f6bb7 indicators: sell_pump_36_3_1h sma_200_1h upper safe_pump_type safe_pump_24_30 close tsi_ema_fast ema_15 sell_pump_36_2 sma_5 buy_condition_4_enable sell_pump_24_1_1h safe_pump_period ema_25 ema_200_1h buy_condition_27_enable safe_dump_50 ewo sma200_rising_val buy_condition_6_enable buy_condition_16_enable r_480_1h safe_pump_24_100 volume rsi_4 sma_200_dec_20 safe_pump_24_120 safe_dips_70 sell_pump_36_1_1h ema_20 safe_pump_48_30 safe_pump_48_100_1h oc_pct_change_48 sell_pump_48_1_1h high tpct_change_2 safe_d

Similar Strategies: (based on used indicators)

Strategy: NostalgiaForInfinityNext2, Similarity Score: 97.37%

Strategy: NostalgiaForInfinityNext_960, Similarity Score: 94.74%

Strategy: Infinity, Similarity Score: 92.11%

Strategy: Infinity_0, Similarity Score: 92.11%

Strategy: Infinity_1, Similarity Score: 92.11%

Strategy: NFINextMultiOffsetAndHO2, Similarity Score: 92.11%

Strategy: Nostalgia, Similarity Score: 92.11%

Strategy: NostalgiaForInfinityV8_9_1, Similarity Score: 92.11%

Strategy: NFINextMultiOffsetAndHO, Similarity Score: 89.47%

Strategy: NFI731_BUSD, Similarity Score: 86.84%

Strategy: Nostalgia_2, Similarity Score: 86.84%

Strategy: NostalgiaForInfinityNext_2, Similarity Score: 84.21%

Strategy: NostalgiaForInfinityNext_ChangeToTower_V2, Similarity Score: 84.21%

Strategy: NostalgiaForInfinityV8, Similarity Score: 84.21%

Strategy: NFIV8_SMA, Similarity Score: 81.58%

Strategy: NostalgiaForInfinityNext_919, Similarity Score: 81.58%

last change: 2023-07-01 11:47:03