Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BigZ04HO strategy is a trading strategy implemented as a class in Python. Here's a short description of what the strategy does:

The strategy includes the following components:

populate_indicators: This function calculates and adds various indicators to the given dataframe using the provided metadata. It merges information from the 1-hour timeframe and populates the indicators for the current timeframe.

populate_buy_trend: This function defines the conditions for initiating buy trades based on the calculated indicators.

It uses a list of conditions, each represented as a logical expression.

If any of the conditions are met, a buy trade is triggered. The strategy includes multiple buy conditions, each with its own set of criteria. Some of the important criteria used in the buy conditions include: Price conditions: Checking if the close price is above certain moving averages (ema_200, ema_200_1h) and below certain Bollinger Bands (bb_lowerband). Volume conditions: Comparing current and previous volume values, and checking if they meet certain criteria (buy_volume_pump_1, buy_volume_drop_1). Technical indicators: Utilizing indicators such as RSI (rsi, rsi_1h), histogram (hist), and MACD (ema_26, ema_12). Candlestick patterns: Examining the relationship between the open and close prices and their position relative to Bollinger Bands. These conditions help determine when to enter a buy trade based on the given market conditions.

populate_buy_trend: This function defines the conditions for initiating buy trades based on the calculated indicators.

It uses a list of conditions, each represented as a logical expression.

If any of the conditions are met, a buy trade is triggered. The strategy includes multiple buy conditions, each with its own set of criteria. Some of the important criteria used in the buy conditions include: Price conditions: Checking if the close price is above certain moving averages (ema_200, ema_200_1h) and below certain Bollinger Bands (bb_lowerband). Volume conditions: Comparing current and previous volume values, and checking if they meet certain criteria (buy_volume_pump_1, buy_volume_drop_1). Technical indicators: Utilizing indicators such as RSI (rsi, rsi_1h), histogram (hist), and MACD (ema_26, ema_12). Candlestick patterns: Examining the relationship between the open and close prices and their position relative to Bollinger Bands. These conditions help determine when to enter a buy trade based on the given market conditions.

startup_candle_count : 200 ema_50_1h: -0.001% macd: -0.001% signal: -0.002% hist: 0.002%

Unable to parse Traceback (Logfile Exceeded Limit)

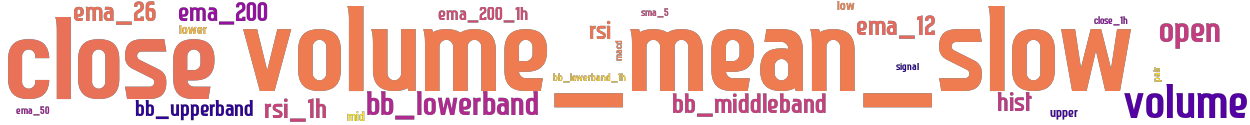

stoploss: -0.99 timeframe: 5m hash(sha256): 5bd36307866135085162decc414c01c2c2802f5b8482088689dedf3ca7208524 indicators: upper ema_200 ema_50 close sma_5 bb_lowerband ema_200_1h volume open volume_mean_slow mid macd rsi_1h bb_lowerband_1h hist lower ema_12 signal bb_middleband rsi bb_upperband ema_26 low close_1h

Similar Strategies: (based on used indicators)

Strategy: BigZ04, Similarity Score: 96%

Strategy: BigZ04HO2, Similarity Score: 96%

Strategy: BigZ04_2, Similarity Score: 96%

Strategy: BigZ04_4, Similarity Score: 96%

Strategy: BigZ04_6, Similarity Score: 96%

Strategy: BigZ04_8, Similarity Score: 96%

Strategy: BigZ04_845, Similarity Score: 96%

Strategy: BigZ04_TSL1, Similarity Score: 96%

Strategy: BigZ04_TSL2, Similarity Score: 96%

Strategy: BigZ04_TSL3, Similarity Score: 96%

Strategy: BigZ04_TSL3_2, Similarity Score: 96%

Strategy: BigZ04_TSL4, Similarity Score: 96%

Strategy: BigZ04_TSL4_2, Similarity Score: 96%

Strategy: BigZ04_TSL4_24, Similarity Score: 96%

Strategy: BigZ04_TSL4_3, Similarity Score: 96%

Strategy: BigZ04_TSL4_69, Similarity Score: 96%

Strategy: BigZ04_TSL4_761, Similarity Score: 96%

Strategy: BigZ06, Similarity Score: 96%

Strategy: Discord_BigZ04_TSL3, Similarity Score: 96%

Strategy: Discord_BigZ04_TSL3a, Similarity Score: 96%

Strategy: big, Similarity Score: 96%

Strategy: big_3, Similarity Score: 96%

Strategy: BcmbigzV1, Similarity Score: 92%

Strategy: BigZ07, Similarity Score: 92%

Strategy: BigZ07HX, Similarity Score: 92%

Strategy: BigZ07H_fix, Similarity Score: 92%

Strategy: BigZ03, Similarity Score: 88%

Strategy: BigZ03HO, Similarity Score: 88%

last change: 2025-06-01 23:49:04