Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BigZ06 strategy is a trading strategy implemented in the form of a class that inherits from the IStrategy class. It consists of several methods for populating indicators and defining buy conditions. Here is a description of the important parts of the strategy:

The populate_indicators method takes a DataFrame and metadata as inputs and populates indicators for the strategy.

It merges informative data from the 1-hour timeframe with the current timeframe, using indicators specific to the 1-hour timeframe.

The populate_buy_trend method is responsible for defining buy conditions based on various indicators.

It creates a list of conditions using logical operations, such as greater than (>) and less than (<), to check for specific patterns and signals in the data. Each condition is represented as a tuple within the conditions list, and it consists of a combination of different criteria, such as the close price being above certain moving averages (ema_200_1h and ema_200), the Chaikin Money Flow (cmf) being below a certain threshold (-0.435), the Relative Strength Index (rsi) being below a threshold (22 or 51), and volume-related conditions. The conditions also involve the Bollinger Bands indicator (bb_lowerband, bb_middleband, bb_upperband), the Historical Volatility (hist), and the Moving Average Convergence Divergence (ema_26 and ema_12). The conditions make use of values stored as attributes of the strategy, such as buy_condition_13_enable, buy_volume_pump_1, buy_bb20_close_bblowerband_safe_1, and others. The buy conditions check for specific patterns, such as price being below the Bollinger Bands, the RSI and MACD values being within certain ranges, and volume-related checks. Overall, the strategy aims to identify potential buying opportunities based on a combination of technical indicators, price patterns, and volume analysis.

It merges informative data from the 1-hour timeframe with the current timeframe, using indicators specific to the 1-hour timeframe.

The populate_buy_trend method is responsible for defining buy conditions based on various indicators.

It creates a list of conditions using logical operations, such as greater than (>) and less than (<), to check for specific patterns and signals in the data. Each condition is represented as a tuple within the conditions list, and it consists of a combination of different criteria, such as the close price being above certain moving averages (ema_200_1h and ema_200), the Chaikin Money Flow (cmf) being below a certain threshold (-0.435), the Relative Strength Index (rsi) being below a threshold (22 or 51), and volume-related conditions. The conditions also involve the Bollinger Bands indicator (bb_lowerband, bb_middleband, bb_upperband), the Historical Volatility (hist), and the Moving Average Convergence Divergence (ema_26 and ema_12). The conditions make use of values stored as attributes of the strategy, such as buy_condition_13_enable, buy_volume_pump_1, buy_bb20_close_bblowerband_safe_1, and others. The buy conditions check for specific patterns, such as price being below the Bollinger Bands, the RSI and MACD values being within certain ranges, and volume-related checks. Overall, the strategy aims to identify potential buying opportunities based on a combination of technical indicators, price patterns, and volume analysis.

startup_candle_count : 200 ema_50_1h: 0.001% hist: -0.001%

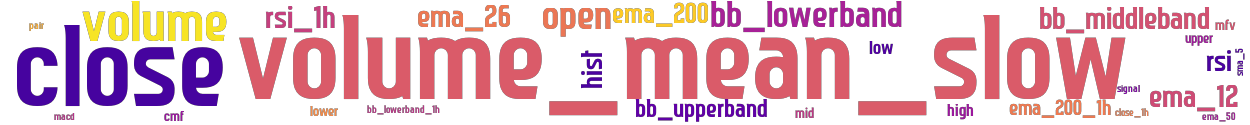

stoploss: -0.99 timeframe: 5m hash(sha256): ebe5bd7ec8902f8259a0c44c252e432cddfb3e5a4225210f1d8c51f8f209323e indicators: upper ema_200 ema_50 close sma_5 bb_lowerband ema_200_1h volume open volume_mean_slow high mid mfv cmf macd rsi_1h bb_lowerband_1h hist lower ema_12 signal cm bb_middleband rsi bb_upperband ema_26 low close_1h

Similar Strategies: (based on used indicators)

Strategy: BcmbigzV1, Similarity Score: 93.1%

Strategy: BigZ07, Similarity Score: 93.1%

Strategy: BigZ07HX, Similarity Score: 93.1%

Strategy: BigZ07H_fix, Similarity Score: 93.1%

last change: 2023-07-03 03:16:50