Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BigZ04 strategy is designed for backtesting trading strategies. Here's a brief description of what the strategy does:

The populate_indicators method is responsible for populating indicators on the provided dataframe. It merges informative 1-hour indicators with the original timeframe indicators and returns the updated dataframe.

The populate_buy_trend method defines various buy conditions based on different indicators and their values.

These conditions are stored in a list called conditions.

Each condition is a combination of multiple logical checks on the dataframe's values, such as the close price, moving averages (ema), Bollinger Bands (bb), relative strength index (rsi), volume, etc. The strategy uses a set of boolean flags (e.g., buy_condition_0_enable, buy_condition_1_enable) to enable or disable specific buy conditions. These flags control which conditions are considered for making buy decisions. For example, one buy condition checks if the close price is above the 200-day exponential moving average (ema), the RSI is below 30, and the current close price is 1.024 times less than the open price three periods ago. Other conditions involve Bollinger Bands, volume-related checks, MACD (moving average convergence divergence), and more. By evaluating these conditions, the strategy determines whether to generate a buy signal for a given trading scenario. The populate_buy_trend method updates the dataframe with buy signals based on the fulfilled conditions and returns the modified dataframe. Note: The provided code snippet seems to be incomplete, and the remaining part of the BigZ04 class is missing. It's essential to have the complete implementation to understand the strategy fully.

The populate_buy_trend method defines various buy conditions based on different indicators and their values.

These conditions are stored in a list called conditions.

Each condition is a combination of multiple logical checks on the dataframe's values, such as the close price, moving averages (ema), Bollinger Bands (bb), relative strength index (rsi), volume, etc. The strategy uses a set of boolean flags (e.g., buy_condition_0_enable, buy_condition_1_enable) to enable or disable specific buy conditions. These flags control which conditions are considered for making buy decisions. For example, one buy condition checks if the close price is above the 200-day exponential moving average (ema), the RSI is below 30, and the current close price is 1.024 times less than the open price three periods ago. Other conditions involve Bollinger Bands, volume-related checks, MACD (moving average convergence divergence), and more. By evaluating these conditions, the strategy determines whether to generate a buy signal for a given trading scenario. The populate_buy_trend method updates the dataframe with buy signals based on the fulfilled conditions and returns the modified dataframe. Note: The provided code snippet seems to be incomplete, and the remaining part of the BigZ04 class is missing. It's essential to have the complete implementation to understand the strategy fully.

startup_candle_count : 200 ema_50_1h: 0.001% hist: -0.001%

Unable to parse Traceback (Logfile Exceeded Limit)

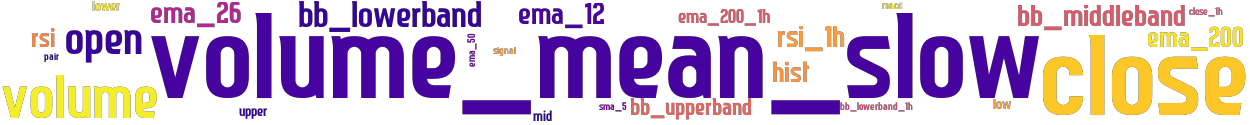

stoploss: -0.99 timeframe: 5m hash(sha256): c65743c3f00ce48a09dcf857f9a2ade70698f4bc9f425c90bcb6c789b2196308 indicators: upper ema_200 ema_50 close sma_5 bb_lowerband ema_200_1h volume open volume_mean_slow mid macd rsi_1h bb_lowerband_1h hist lower ema_12 signal bb_middleband rsi bb_upperband ema_26 low close_1h

Similar Strategies: (based on used indicators)

Strategy: BigZ04HO, Similarity Score: 96%

Strategy: BigZ04HO2, Similarity Score: 96%

Strategy: BigZ04_2, Similarity Score: 96%

Strategy: BigZ04_4, Similarity Score: 96%

Strategy: BigZ04_6, Similarity Score: 96%

Strategy: BigZ04_8, Similarity Score: 96%

Strategy: BigZ04_845, Similarity Score: 96%

Strategy: BigZ04_TSL1, Similarity Score: 96%

Strategy: BigZ04_TSL2, Similarity Score: 96%

Strategy: BigZ04_TSL3, Similarity Score: 96%

Strategy: BigZ04_TSL3_2, Similarity Score: 96%

Strategy: BigZ04_TSL4, Similarity Score: 96%

Strategy: BigZ04_TSL4_2, Similarity Score: 96%

Strategy: BigZ04_TSL4_24, Similarity Score: 96%

Strategy: BigZ04_TSL4_3, Similarity Score: 96%

Strategy: BigZ04_TSL4_69, Similarity Score: 96%

Strategy: BigZ04_TSL4_761, Similarity Score: 96%

Strategy: BigZ06, Similarity Score: 96%

Strategy: Discord_BigZ04_TSL3, Similarity Score: 96%

Strategy: Discord_BigZ04_TSL3a, Similarity Score: 96%

Strategy: big, Similarity Score: 96%

Strategy: big_3, Similarity Score: 96%

Strategy: BcmbigzV1, Similarity Score: 92%

Strategy: BigZ07, Similarity Score: 92%

Strategy: BigZ07HX, Similarity Score: 92%

Strategy: BigZ07H_fix, Similarity Score: 92%

Strategy: BigZ03, Similarity Score: 88%

Strategy: BigZ03HO, Similarity Score: 88%

last change: 2025-06-02 01:17:09