You will be redirected to the original Strategy in 15 seconds.

The ClucHAnix_5m1 strategy is a trading strategy that uses various indicators to make buy and sell decisions. Here is a breakdown of its key components:

Indicators:

Heikin-Ashi candles: The strategy calculates the Heikin-Ashi open, close, high, and low prices. Bollinger Bands: Calculates the middle and lower bands based on the Heikin-Ashi typical price and a specified window size and number of standard deviations.

Price deltas: Calculates the absolute difference between the current and previous Heikin-Ashi close prices.

Tail: Calculates the absolute difference between the close price and the low price.

Exponential Moving Averages (EMA): Calculates fast and slow EMAs of the Heikin-Ashi close prices. Volume mean: Calculates the rolling mean of the volume over a specified window size. Rate of Change Ratio (ROCR): Calculates the ROCR indicator based on the Heikin-Ashi close prices. Relative Strength Index (RSI): Calculates the RSI indicator. Fisher Transform: Calculates the Fisher Transform indicator based on the RSI. Informative Pair Data: Retrieves data from an informative pair (timeframe: 1 hour) and calculates additional indicators (e.g., Heikin-Ashi close prices, ROCR). Buy Trend: Determines buy signals based on various conditions: ROCR of the informative pair is greater than a specified value. Lower Bollinger Band is positive. Bollinger Band delta is greater than a percentage of the Heikin-Ashi close price. Price delta is greater than a percentage of the Heikin-Ashi close price. Tail is less than a percentage of the Bollinger Band delta. Heikin-Ashi close price is less than the previous lower band. Heikin-Ashi close price is less than or equal to the previous close price. Heikin-Ashi close price is less than the slow EMA. Heikin-Ashi close price is less than a specified percentage of the lower Bollinger Band. Sell Trend: Determines sell signals based on various conditions: Fisher Transform value is greater than a specified value. Heikin-Ashi high price is less than or equal to the previous high price for two consecutive candles. Heikin-Ashi close price is less than or equal to the previous close price. Fast EMA is greater than the Heikin-Ashi close price. Heikin-Ashi close price multiplied by a specified percentage is greater than the middle Bollinger Band. Volume is greater than zero. Trailing Buy: Implements trailing buy functionality: Trailing buy order is initiated when a buy signal is detected for the current candle. Updates the trailing buy order's parameters (e.g., uplimit) based on the current price and trailing buy offset. Trailing buy order is triggered when the current price is lower than the trailing buy order's uplimit. Stops the trailing buy if the current price exceeds a certain threshold or if the trailing buy offset is None. This strategy combines multiple indicators and conditions to generate buy and sell signals, and it includes trailing buy functionality to optimize entry points in a dynamically changing market.

Price deltas: Calculates the absolute difference between the current and previous Heikin-Ashi close prices.

Tail: Calculates the absolute difference between the close price and the low price.

Exponential Moving Averages (EMA): Calculates fast and slow EMAs of the Heikin-Ashi close prices. Volume mean: Calculates the rolling mean of the volume over a specified window size. Rate of Change Ratio (ROCR): Calculates the ROCR indicator based on the Heikin-Ashi close prices. Relative Strength Index (RSI): Calculates the RSI indicator. Fisher Transform: Calculates the Fisher Transform indicator based on the RSI. Informative Pair Data: Retrieves data from an informative pair (timeframe: 1 hour) and calculates additional indicators (e.g., Heikin-Ashi close prices, ROCR). Buy Trend: Determines buy signals based on various conditions: ROCR of the informative pair is greater than a specified value. Lower Bollinger Band is positive. Bollinger Band delta is greater than a percentage of the Heikin-Ashi close price. Price delta is greater than a percentage of the Heikin-Ashi close price. Tail is less than a percentage of the Bollinger Band delta. Heikin-Ashi close price is less than the previous lower band. Heikin-Ashi close price is less than or equal to the previous close price. Heikin-Ashi close price is less than the slow EMA. Heikin-Ashi close price is less than a specified percentage of the lower Bollinger Band. Sell Trend: Determines sell signals based on various conditions: Fisher Transform value is greater than a specified value. Heikin-Ashi high price is less than or equal to the previous high price for two consecutive candles. Heikin-Ashi close price is less than or equal to the previous close price. Fast EMA is greater than the Heikin-Ashi close price. Heikin-Ashi close price multiplied by a specified percentage is greater than the middle Bollinger Band. Volume is greater than zero. Trailing Buy: Implements trailing buy functionality: Trailing buy order is initiated when a buy signal is detected for the current candle. Updates the trailing buy order's parameters (e.g., uplimit) based on the current price and trailing buy offset. Trailing buy order is triggered when the current price is lower than the trailing buy order's uplimit. Stops the trailing buy if the current price exceeds a certain threshold or if the trailing buy offset is None. This strategy combines multiple indicators and conditions to generate buy and sell signals, and it includes trailing buy functionality to optimize entry points in a dynamically changing market.

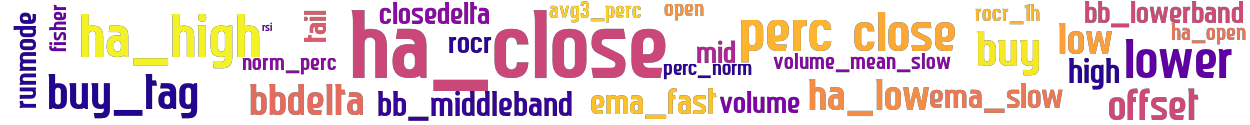

stoploss: -0.99 timeframe: 5m hash(sha256): b360b019fc39aa4b21ec35e88f75d9db03536aa79aeae24f4c30976bd109492b indicators: rocr_1h ha_low close perc_norm tail bb_lowerband bbdelta volume perc closedelta rocr open ema_fast volume_mean_slow buy_tag ha_open fisher high mid ha_close buy ha_high lower bb_middleband rsi offset ema_slow runmode low avg3_perc norm_perc

Similar Strategies: (based on used indicators)

Strategy: CDO, Similarity Score: 96.88%

Strategy: CDOv2, Similarity Score: 96.88%

Strategy: CDOv2b, Similarity Score: 96.88%

Strategy: ClucHAnix13X, Similarity Score: 96.88%

Strategy: ClucHAnix_5gh, Similarity Score: 96.88%

Strategy: ClucHAnix_5m1, Similarity Score: 96.88%

Strategy: ClucHAnix_5mTB1, Similarity Score: 96.88%

Strategy: ClucHAnix_5mTB1_2, Similarity Score: 96.88%

Strategy: ClucHAnix_5mTB1_3, Similarity Score: 96.88%

Strategy: Discord_ClucHAnix_5m1c, Similarity Score: 96.88%

Strategy: ClucHAnix_5M_E0V1E_DYNAMIC_TB, Similarity Score: 93.75%

Strategy: ClucHAnix_5mTB1_711, Similarity Score: 93.75%

Strategy: Discord_ClucHAnix_5M_E0V1E, Similarity Score: 93.75%

Strategy: BC_Redmoon, Similarity Score: 84.38%

Strategy: ClucHAnix_hhll_tures, Similarity Score: 84.38%

Strategy: TrailingBuyStratCluc, Similarity Score: 84.38%

Strategy: TrailingBuyStratCluc_172, Similarity Score: 84.38%

Strategy: TrailingBuy_ClucHAnix_5m_E0V1E_by_TraNz, Similarity Score: 84.38%

Strategy: TrailingBuy_ClucHAnix_5m_E0V1E_by_TraNz201, Similarity Score: 84.38%

last change: 2022-07-02 19:54:08