You will be redirected to the original Strategy in 15 seconds.

The ClucHAnix strategy is a trading strategy implemented as a class that inherits from the IStrategy class. It involves several steps and indicators to make trading decisions. In the populate_indicators method, the strategy calculates and adds various indicators to the input dataframe.

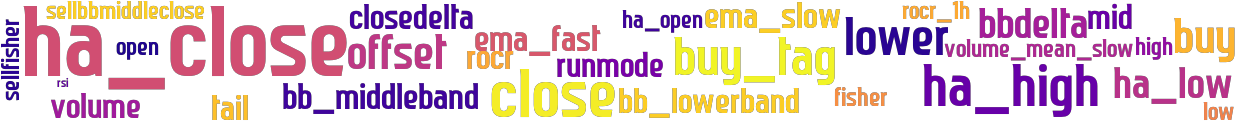

These indicators include Heikin-Ashi candles (open, close, high, low), Bollinger Bands, exponential moving averages (EMA), volume mean, rate of change ratio (ROCR), relative strength index (RSI), and Fisher transform.

Additionally, it retrieves informative data on a higher timeframe and merges it with the current dataframe.

The populate_buy_trend method populates the buy trend based on specific conditions. It uses parameters and conditions involving the rate of change, Bollinger Bands, candlestick patterns, and exponential moving averages to determine buy signals. If the conditions are met, the corresponding row in the dataframe is marked with a 'buy' value of 1. The populate_sell_trend method populates the sell trend based on certain parameters and conditions. It checks for the Fisher transform value, candlestick patterns, exponential moving averages, and volume to identify sell signals. If the conditions are satisfied, the corresponding row in the dataframe is marked with a 'sell' value of 1. The ClucHAnix_ETH class is a subclass of the ClucHAnix strategy specifically designed for Ethereum (ETH) trading. It inherits the populate_indicators method from its parent class and adds additional functionality related to trailing buy orders. It provides methods to confirm trade entry, calculate trailing buy offsets, and handle trailing buy logic based on price movements. Overall, the ClucHAnix strategy aims to generate buy and sell signals based on a combination of technical indicators and conditions. It utilizes indicators such as Bollinger Bands, moving averages, RSI, and candlestick patterns to identify potential trading opportunities.

These indicators include Heikin-Ashi candles (open, close, high, low), Bollinger Bands, exponential moving averages (EMA), volume mean, rate of change ratio (ROCR), relative strength index (RSI), and Fisher transform.

Additionally, it retrieves informative data on a higher timeframe and merges it with the current dataframe.

The populate_buy_trend method populates the buy trend based on specific conditions. It uses parameters and conditions involving the rate of change, Bollinger Bands, candlestick patterns, and exponential moving averages to determine buy signals. If the conditions are met, the corresponding row in the dataframe is marked with a 'buy' value of 1. The populate_sell_trend method populates the sell trend based on certain parameters and conditions. It checks for the Fisher transform value, candlestick patterns, exponential moving averages, and volume to identify sell signals. If the conditions are satisfied, the corresponding row in the dataframe is marked with a 'sell' value of 1. The ClucHAnix_ETH class is a subclass of the ClucHAnix strategy specifically designed for Ethereum (ETH) trading. It inherits the populate_indicators method from its parent class and adds additional functionality related to trailing buy orders. It provides methods to confirm trade entry, calculate trailing buy offsets, and handle trailing buy logic based on price movements. Overall, the ClucHAnix strategy aims to generate buy and sell signals based on a combination of technical indicators and conditions. It utilizes indicators such as Bollinger Bands, moving averages, RSI, and candlestick patterns to identify potential trading opportunities.

stoploss: -0.99 timeframe: 1m hash(sha256): 7021eecb2255d09bf7ad191f6e1d5c7cd81454c39768bd3af67d005896675475 indicators: rocr_1h ha_low sellbbmiddleclose close tail bb_lowerband bbdelta volume closedelta rocr open ema_fast volume_mean_slow buy_tag ha_open sellfisher fisher high mid ha_close buy ha_high lower bb_middleband rsi offset ema_slow runmode low

Similar Strategies: (based on used indicators)

Strategy: ClucHAnix_5M_E0V1E_DYNAMIC_TB, Similarity Score: 96.67%

Strategy: Discord_ClucHAnix_5M_E0V1E, Similarity Score: 96.67%

Strategy: TrailingBuyStratCluc_172, Similarity Score: 96.67%

Strategy: BC_Redmoon, Similarity Score: 90%

Strategy: CDO, Similarity Score: 90%

Strategy: CDOv2, Similarity Score: 90%

Strategy: CDOv2b, Similarity Score: 90%

Strategy: ClucHAnix13X, Similarity Score: 90%

Strategy: ClucHAnix_5gh, Similarity Score: 90%

Strategy: ClucHAnix_5m1, Similarity Score: 90%

Strategy: ClucHAnix_5mTB1, Similarity Score: 90%

Strategy: ClucHAnix_5mTB1_2, Similarity Score: 90%

Strategy: ClucHAnix_5mTB1_3, Similarity Score: 90%

Strategy: ClucHAnix_5mTB1_711, Similarity Score: 90%

Strategy: ClucHAnix_5mTB1_733, Similarity Score: 90%

Strategy: ClucHAnix_hhll_tures, Similarity Score: 90%

Strategy: Discord_ClucHAnix_5m1c, Similarity Score: 90%

Strategy: TrailingBuy_ClucHAnix_5m_E0V1E_by_TraNz, Similarity Score: 90%

Strategy: TrailingBuy_ClucHAnix_5m_E0V1E_by_TraNz201, Similarity Score: 90%

last change: 2022-07-02 19:54:08