You will be redirected to the original Strategy in 15 seconds.

The ClucHAnix_5m1 strategy is designed to backtest trading strategies using a 5-minute timeframe. Here's a breakdown of what the strategy does:

In the populate_indicators method:

It calculates Heikin-Ashi candles based on the input dataframe. It adds columns for Heikin-Ashi open, close, high, and low prices.

It calculates Bollinger Bands based on the typical price of Heikin-Ashi candles.

It adds columns for Bollinger Bands' lower band, middle band, delta, and other indicators such as moving averages and RSI.

It retrieves additional informative data on a higher timeframe (1 hour) and merges it with the current dataframe. It calculates percentage changes and other derived indicators. In the populate_buy_trend method: It identifies buy signals based on specific conditions: Rate of Change (ROCR) on the 1-hour timeframe is greater than a predefined value. Various conditions related to Bollinger Bands, candlestick patterns, and moving averages. In the populate_sell_trend method: It identifies sell signals based on specific conditions: Fisher transform indicator value is greater than a predefined value. Conditions related to candlestick patterns, moving averages, and volume. The ClucHAnix_5mTB1 class inherits from ClucHAnix_5m1 and adds additional functionality to manage trailing buy orders. The strategy implements various indicators and conditions to generate buy and sell signals based on the given timeframe and market data.

It calculates Bollinger Bands based on the typical price of Heikin-Ashi candles.

It adds columns for Bollinger Bands' lower band, middle band, delta, and other indicators such as moving averages and RSI.

It retrieves additional informative data on a higher timeframe (1 hour) and merges it with the current dataframe. It calculates percentage changes and other derived indicators. In the populate_buy_trend method: It identifies buy signals based on specific conditions: Rate of Change (ROCR) on the 1-hour timeframe is greater than a predefined value. Various conditions related to Bollinger Bands, candlestick patterns, and moving averages. In the populate_sell_trend method: It identifies sell signals based on specific conditions: Fisher transform indicator value is greater than a predefined value. Conditions related to candlestick patterns, moving averages, and volume. The ClucHAnix_5mTB1 class inherits from ClucHAnix_5m1 and adds additional functionality to manage trailing buy orders. The strategy implements various indicators and conditions to generate buy and sell signals based on the given timeframe and market data.

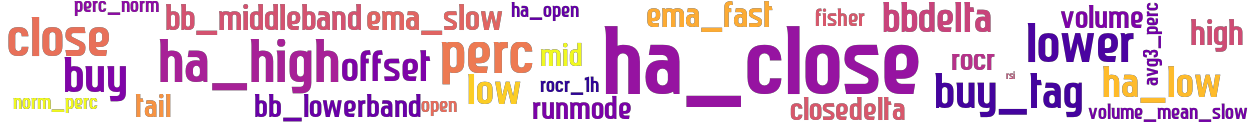

stoploss: -0.99 timeframe: 5m hash(sha256): 11059a27e6f166f3ded1966fe9babc72b1b06245a8b46bc162a4dc2d934fb8b1 indicators: rocr_1h ha_low close perc_norm tail bb_lowerband bbdelta volume perc closedelta rocr open ema_fast volume_mean_slow buy_tag ha_open fisher high mid ha_close buy ha_high lower bb_middleband rsi offset ema_slow runmode low avg3_perc norm_perc

Similar Strategies: (based on used indicators)

Strategy: CDO, Similarity Score: 96.88%

Strategy: CDOv2, Similarity Score: 96.88%

Strategy: CDOv2b, Similarity Score: 96.88%

Strategy: ClucHAnix13X, Similarity Score: 96.88%

Strategy: ClucHAnix_5gh, Similarity Score: 96.88%

Strategy: ClucHAnix_5m1, Similarity Score: 96.88%

Strategy: ClucHAnix_5mTB1_2, Similarity Score: 96.88%

Strategy: ClucHAnix_5mTB1_3, Similarity Score: 96.88%

Strategy: ClucHAnix_5mTB1_733, Similarity Score: 96.88%

Strategy: Discord_ClucHAnix_5m1c, Similarity Score: 96.88%

Strategy: ClucHAnix_5M_E0V1E_DYNAMIC_TB, Similarity Score: 93.75%

Strategy: ClucHAnix_5mTB1_711, Similarity Score: 93.75%

Strategy: Discord_ClucHAnix_5M_E0V1E, Similarity Score: 93.75%

Strategy: BC_Redmoon, Similarity Score: 84.38%

Strategy: ClucHAnix_hhll_tures, Similarity Score: 84.38%

Strategy: TrailingBuyStratCluc, Similarity Score: 84.38%

Strategy: TrailingBuyStratCluc_172, Similarity Score: 84.38%

Strategy: TrailingBuy_ClucHAnix_5m_E0V1E_by_TraNz, Similarity Score: 84.38%

Strategy: TrailingBuy_ClucHAnix_5m_E0V1E_by_TraNz201, Similarity Score: 84.38%

last change: 2022-08-03 02:01:19