Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BB_RTR strategy is a trading strategy that involves the use of various technical indicators to generate buy and sell signals. Here's a breakdown of what the strategy does:

It calculates Bollinger Bands with two different standard deviations (2 and 3) using the typical price of the asset. It calculates the width of the Bollinger Bands and the delta between the lower bands of two different standard deviations.

It calculates the Commodity Channel Index (CCI) for various lengths and stores them in different columns.

It calculates the Relative Strength Index (RSI) for different time periods.

It calculates the Stochastic RSI (STOCHRSI) and stores the fastk and fastd values. It calculates the Chande Trend Index (CTI) using a length of 20. It calculates the Chande Momentum Oscillator (RMI) for various lengths. It calculates the Chaikin Money Flow (CMF). It calculates the Money Flow Index (MFI). It calculates various Exponential Moving Averages (EMA) and Simple Moving Averages (SMA) for different time periods. It calculates the Volume Weighted Average Price (VWAP) and its upper, middle, and lower bands. It calculates the Williams %R (W%R) for different periods. It calculates the Elder's Force Index (EFI) using a 50 and 200 period EMA. It calculates the Average Directional Index (ADX). It calculates the Heikin-Ashi candles and stores the open, close, high, and low values. It calculates Bollinger Bands for Heikin-Ashi candles with a window of 40 and 2 standard deviations. It calculates various other indicators such as rate of change (ROCR), momentum divergence (momdiv), Hull Moving Average (HMA), Moving Average of Moving Average (MAMA), Kaufman's Adaptive Moving Average (KAMA), etc. It calculates various statistical measures such as percent change, mean, etc. for volume and price. It utilizes data from different timeframes, such as 5 minutes and 1 hour, to calculate additional indicators. Overall, the strategy incorporates a wide range of technical indicators to analyze price, volume, and momentum dynamics in order to generate trading signals.

It calculates the Commodity Channel Index (CCI) for various lengths and stores them in different columns.

It calculates the Relative Strength Index (RSI) for different time periods.

It calculates the Stochastic RSI (STOCHRSI) and stores the fastk and fastd values. It calculates the Chande Trend Index (CTI) using a length of 20. It calculates the Chande Momentum Oscillator (RMI) for various lengths. It calculates the Chaikin Money Flow (CMF). It calculates the Money Flow Index (MFI). It calculates various Exponential Moving Averages (EMA) and Simple Moving Averages (SMA) for different time periods. It calculates the Volume Weighted Average Price (VWAP) and its upper, middle, and lower bands. It calculates the Williams %R (W%R) for different periods. It calculates the Elder's Force Index (EFI) using a 50 and 200 period EMA. It calculates the Average Directional Index (ADX). It calculates the Heikin-Ashi candles and stores the open, close, high, and low values. It calculates Bollinger Bands for Heikin-Ashi candles with a window of 40 and 2 standard deviations. It calculates various other indicators such as rate of change (ROCR), momentum divergence (momdiv), Hull Moving Average (HMA), Moving Average of Moving Average (MAMA), Kaufman's Adaptive Moving Average (KAMA), etc. It calculates various statistical measures such as percent change, mean, etc. for volume and price. It utilizes data from different timeframes, such as 5 minutes and 1 hour, to calculate additional indicators. Overall, the strategy incorporates a wide range of technical indicators to analyze price, volume, and momentum dynamics in order to generate trading signals.

startup_candle_count : 400 ema_200: -0.013% rsi_84: -0.369% rsi_112: -0.975% EWO: 1.969% mama_diff: 0.001% kama: -0.003% rsi_42_1h: -0.002% ema_200_1h: 0.035%

Unable to parse Traceback (Logfile Exceeded Limit)

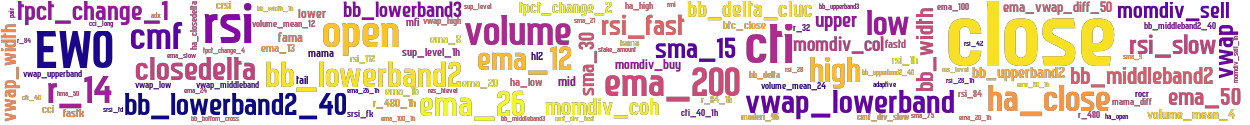

stoploss: -0.998 timeframe: 5m hash(sha256): fe1ff0878fc9722ab510250ab0726057a326090bf4a40ce82e8c1d2bfde291fe indicators: upper close cmf_div_slow vwap_upperband volume_mean_12 rsi_fast r_480_1h volume sup_level_1h ema_20 ha_closedelta momdiv_coh bb_upperband2 volume_mean_24 high hl2 tpct_change_2 ema_8 r_480 cci bb_lowerband3 rsi_1h momdiv_col ha_high adx ema_12 ema_slow ema_26 cti_40_1h bb_width_1h bb_lowerband2_40 bb_upperband2_40 res_level adaptive vwap_width sma_21 momdiv_buy bb_middleband2 r_84_1h closedelta sma_15 ha_open volume_mean_4 ema_20_1h ema_24 cmf rmi_length_val mama hma_50 vwap lower r_32 rsi cti_

Similar Strategies: (based on used indicators)

Strategy: BB_RTR_2, Similarity Score: 96.43%

Strategy: BB_RTR_3, Similarity Score: 96.43%

Strategy: BB_RTR_dca_250, Similarity Score: 96.43%

Strategy: BB_RTR_dca_test, Similarity Score: 96.43%

Strategy: BB_RTR_dca_v002, Similarity Score: 96.43%

Strategy: BB_RTR_nstp, Similarity Score: 96.43%

Strategy: BB_RTR_stp, Similarity Score: 96.43%

Strategy: BB_RTR_test, Similarity Score: 96.43%

Strategy: Big_boy, Similarity Score: 96.43%

Strategy: Discord_1_BB_RTR, Similarity Score: 96.43%

Strategy: BB_RTR_dca_144, Similarity Score: 87.5%

Strategy: BB_RTR_l2, Similarity Score: 87.5%

Strategy: BB_RTR_dca_0, Similarity Score: 82.14%

Strategy: BB_RTR_dca_157, Similarity Score: 82.14%

Strategy: BB_DCAv2, Similarity Score: 80.36%

Strategy: BB_DCAv3, Similarity Score: 80.36%

Strategy: BB_DCAv3b, Similarity Score: 80.36%

Strategy: BB_RTR, Similarity Score: 80.36%

Strategy: BB_RTR_X, Similarity Score: 80.36%

Strategy: BB_RTR_X2, Similarity Score: 80.36%

Strategy: BB_RTR_dca, Similarity Score: 80.36%

Strategy: Discord_BB_RTR3c, Similarity Score: 80.36%

last change: 2025-01-13 14:28:00