You will be redirected to the original Strategy in 15 seconds.

The strategy, named BB_RTR, implements various technical indicators to generate trading signals. It uses Bollinger Bands with two standard deviations and three standard deviations to create upper and lower bands. It calculates the width of the Bollinger Bands and the delta between the lower bands.

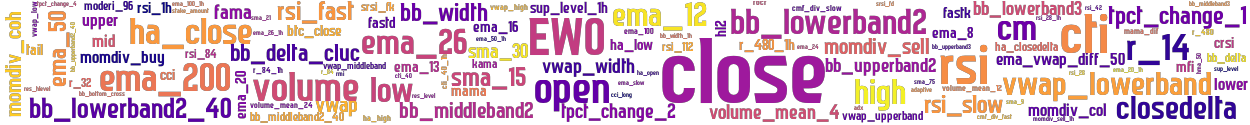

It also computes various other indicators such as Commodity Channel Index (CCI), Relative Momentum Index (RMI), Stochastic RSI, Chakin Money Flow (CMF), Moving Averages (SMA and EMA), Volume Weighted Average Price (VWAP), Relative Strength Index (RSI), Elliott Wave Oscillator (EWO), Average Directional Index (ADX), Heikin Ashi candles, and Williams %R.

The strategy applies different time periods and lengths to these indicators and stores their values in the dataframe.

It also calculates other derived features such as percentage changes, momentum divergence, typical price, Rate of Change (ROC), and volume averages. Additionally, it incorporates informative data from the BTC/USDT pair on a 5-minute timeframe to enhance its analysis. The strategy's purpose is to provide a framework for backtesting and evaluating the performance of trading strategies based on these indicators and signals.

It also computes various other indicators such as Commodity Channel Index (CCI), Relative Momentum Index (RMI), Stochastic RSI, Chakin Money Flow (CMF), Moving Averages (SMA and EMA), Volume Weighted Average Price (VWAP), Relative Strength Index (RSI), Elliott Wave Oscillator (EWO), Average Directional Index (ADX), Heikin Ashi candles, and Williams %R.

The strategy applies different time periods and lengths to these indicators and stores their values in the dataframe.

It also calculates other derived features such as percentage changes, momentum divergence, typical price, Rate of Change (ROC), and volume averages. Additionally, it incorporates informative data from the BTC/USDT pair on a 5-minute timeframe to enhance its analysis. The strategy's purpose is to provide a framework for backtesting and evaluating the performance of trading strategies based on these indicators and signals.

stoploss: -0.333 timeframe: 5m hash(sha256): 0d8b9ab46abd1a58ec53113d76def5fd3e491731aa081e0413ea2b8e4ff69e72 indicators: upper close cmf_div_slow vwap_upperband volume_mean_12 rsi_fast r_480_1h volume sup_level_1h ema_20 ha_closedelta momdiv_coh bb_upperband2 volume_mean_24 high hl2 tpct_change_2 ema_8 r_480 cci bb_lowerband3 rsi_1h momdiv_col ha_high adx ema_12 ema_slow ema_26 cti_40_1h bb_width_1h bb_lowerband2_40 bb_upperband2_40 res_level adaptive vwap_width sma_21 momdiv_buy bb_middleband2 r_84_1h closedelta sma_15 ha_open volume_mean_4 ema_20_1h ema_24 cmf rmi_length_val mama hma_50 vwap lower r_32 rsi cti_

Similar Strategies: (based on used indicators)

Strategy: BB_RTR_3, Similarity Score: 96.43%

Strategy: BB_RTR_dca_1, Similarity Score: 96.43%

Strategy: BB_RTR_dca_250, Similarity Score: 96.43%

Strategy: BB_RTR_dca_test, Similarity Score: 96.43%

Strategy: BB_RTR_dca_v002, Similarity Score: 96.43%

Strategy: BB_RTR_nstp, Similarity Score: 96.43%

Strategy: BB_RTR_stp, Similarity Score: 96.43%

Strategy: BB_RTR_test, Similarity Score: 96.43%

Strategy: Big_boy, Similarity Score: 96.43%

Strategy: Discord_1_BB_RTR, Similarity Score: 96.43%

Strategy: BB_RTR_dca_144, Similarity Score: 87.5%

Strategy: BB_RTR_l2, Similarity Score: 87.5%

Strategy: BB_RTR_dca_0, Similarity Score: 82.14%

Strategy: BB_RTR_dca_157, Similarity Score: 82.14%

Strategy: BB_DCAv2, Similarity Score: 80.36%

Strategy: BB_DCAv3, Similarity Score: 80.36%

Strategy: BB_DCAv3b, Similarity Score: 80.36%

Strategy: BB_RTR, Similarity Score: 80.36%

Strategy: BB_RTR_X, Similarity Score: 80.36%

Strategy: BB_RTR_X2, Similarity Score: 80.36%

Strategy: BB_RTR_dca, Similarity Score: 80.36%

Strategy: Discord_BB_RTR3c, Similarity Score: 80.36%

last change: 2022-08-20 21:08:25