You will be redirected to the original Strategy in 15 seconds.

The BB_RTR strategy is a trading strategy that utilizes various technical indicators to identify buying opportunities in the market. Here are the key components of the strategy:

Indicators:

Bollinger Bands (window=20, stds=2 and stds=3): Used to determine the volatility and potential price levels. CCI (Commodity Channel Index): Calculated with different lengths to gauge the momentum and overbought/oversold conditions.

RMI (Relative Momentum Index): Calculated with different lengths and a momentum factor to identify price reversals.

STOCHRSI (Stochastic RSI): Calculates the Stochastic RSI values for fastk and fastd.

CTI (Cumulative Trading Index): Measures the accumulation/distribution of prices over a specific length. CMF (Chaikin Money Flow): Measures the buying and selling pressure based on the accumulation/distribution of volume. MFI (Money Flow Index): Identifies overbought/oversold conditions based on the relationship between price and volume. EMA (Exponential Moving Average): Calculated with various time periods to assess the trend direction. HMA (Hull Moving Average): A moving average with reduced lag to determine the trend. VWAPB (Volume-Weighted Average Price Bands): Calculates the upper, middle, and lower bands based on volume-weighted prices. RSI (Relative Strength Index): Calculates the RSI values for different time periods. EWO (Elliott Wave Oscillator): Measures the difference between a 50-period and a 200-period EMA. STOCHF (Stochastic Fast): Calculates the Stochastic Fast values for fastk and fastd. ADX (Average Directional Index): Measures the strength of the trend. Additional Calculations: Heikin Ashi: Converts the price data to Heikin Ashi format, which smooths out the price movements. Typical Price: Calculates the typical price using the Heikin Ashi format. Williams %R: Calculates the Williams %R indicator for a specific period. Moving Averages: Calculates various simple moving averages (SMA) for different time periods. Rate of Change (ROCR): Measures the percentage change in price over a specific time period. Volume: Calculates the rolling mean of volume over different periods. Top Percent Change: Measures the percentage change in price from the highest price over different periods. Momentum Divergence: Calculates buy and sell signals based on momentum divergence. Merge Informative Pair: Combines the main timeframe data with informative data from a higher timeframe. Buy Conditions: Pump 1: Checks if the current price is above a certain factor of the rolling maximum price over 48 periods. Pump 2: Checks if the current price is above another factor of the rolling maximum price over 48 periods. Pump 3: Checks if the current price is above a certain factor of the rolling maximum price over 48 periods and also above a factor of the rolling maximum price over 288 periods. The strategy aims to identify potential buying opportunities based on the combination of these indicators and conditions.

RMI (Relative Momentum Index): Calculated with different lengths and a momentum factor to identify price reversals.

STOCHRSI (Stochastic RSI): Calculates the Stochastic RSI values for fastk and fastd.

CTI (Cumulative Trading Index): Measures the accumulation/distribution of prices over a specific length. CMF (Chaikin Money Flow): Measures the buying and selling pressure based on the accumulation/distribution of volume. MFI (Money Flow Index): Identifies overbought/oversold conditions based on the relationship between price and volume. EMA (Exponential Moving Average): Calculated with various time periods to assess the trend direction. HMA (Hull Moving Average): A moving average with reduced lag to determine the trend. VWAPB (Volume-Weighted Average Price Bands): Calculates the upper, middle, and lower bands based on volume-weighted prices. RSI (Relative Strength Index): Calculates the RSI values for different time periods. EWO (Elliott Wave Oscillator): Measures the difference between a 50-period and a 200-period EMA. STOCHF (Stochastic Fast): Calculates the Stochastic Fast values for fastk and fastd. ADX (Average Directional Index): Measures the strength of the trend. Additional Calculations: Heikin Ashi: Converts the price data to Heikin Ashi format, which smooths out the price movements. Typical Price: Calculates the typical price using the Heikin Ashi format. Williams %R: Calculates the Williams %R indicator for a specific period. Moving Averages: Calculates various simple moving averages (SMA) for different time periods. Rate of Change (ROCR): Measures the percentage change in price over a specific time period. Volume: Calculates the rolling mean of volume over different periods. Top Percent Change: Measures the percentage change in price from the highest price over different periods. Momentum Divergence: Calculates buy and sell signals based on momentum divergence. Merge Informative Pair: Combines the main timeframe data with informative data from a higher timeframe. Buy Conditions: Pump 1: Checks if the current price is above a certain factor of the rolling maximum price over 48 periods. Pump 2: Checks if the current price is above another factor of the rolling maximum price over 48 periods. Pump 3: Checks if the current price is above a certain factor of the rolling maximum price over 48 periods and also above a factor of the rolling maximum price over 288 periods. The strategy aims to identify potential buying opportunities based on the combination of these indicators and conditions.

startup_candle_count : 400 rsi_84: 0.309% rsi_112: 0.839% EWO: 0.086% rsi_42_1h: -0.001% ema_200_1h: 0.078%

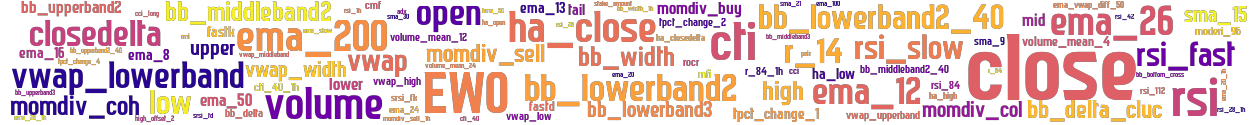

stoploss: -1 timeframe: 5m hash(sha256): cb984e5d3d0777596de5a88223faa966412a49e47f312c38b136092e41a4f31d indicators: upper close high_offset_2 vwap_upperband volume_mean_12 rsi_fast volume ema_20 ha_closedelta momdiv_coh bb_upperband2 volume_mean_24 high tpct_change_2 ema_8 cci bb_lowerband3 rsi_1h momdiv_col ha_high adx ema_12 ema_slow ema_26 cti_40_1h bb_width_1h bb_lowerband2_40 bb_upperband2_40 vwap_width sma_21 momdiv_buy bb_middleband2 r_84_1h closedelta sma_15 ha_open volume_mean_4 ema_20_1h ema_24 cmf rmi_length_val hma_50 vwap lower rsi cti_40 momdiv_sell vwap_middleband bb_middleband3 bb_upperband3 e

Similar Strategies: (based on used indicators)

Strategy: BB_RTR_dca, Similarity Score: 98.08%

Strategy: BB_RTR_dca_0, Similarity Score: 96.15%

Strategy: BB_RTR_dca_157, Similarity Score: 96.15%

Strategy: BB_DCAv2, Similarity Score: 94.23%

Strategy: BB_RTR_X2, Similarity Score: 94.23%

Strategy: Discord_BB_RTR3c, Similarity Score: 94.23%

Strategy: BB_RTR_dca_144, Similarity Score: 92.31%

Strategy: BB_DCAv3, Similarity Score: 90.38%

Strategy: BB_DCAv3b, Similarity Score: 90.38%

Strategy: BB_RTR_X, Similarity Score: 90.38%

Strategy: BB_RTR_2, Similarity Score: 88.46%

Strategy: BB_RTR_3, Similarity Score: 88.46%

Strategy: BB_RTR_dca_1, Similarity Score: 88.46%

Strategy: BB_RTR_dca_250, Similarity Score: 88.46%

Strategy: BB_RTR_dca_test, Similarity Score: 88.46%

Strategy: BB_RTR_dca_v002, Similarity Score: 88.46%

Strategy: BB_RTR_nstp, Similarity Score: 88.46%

Strategy: BB_RTR_stp, Similarity Score: 88.46%

Strategy: BB_RTR_test, Similarity Score: 88.46%

Strategy: Big_boy, Similarity Score: 88.46%

Strategy: Discord_1_BB_RTR, Similarity Score: 88.46%

Strategy: BB_RTR_l2, Similarity Score: 84.62%

Strategy: BB_RPB_TSLX, Similarity Score: 75%

Strategy: BB_RPB_TSL_BI, Similarity Score: 75%

Strategy: BB_RPB_TSL_BIV1, Similarity Score: 75%

Strategy: BB_RPB_TSL_BI_2, Similarity Score: 75%

Strategy: BB_RPB_TSL_BI_3, Similarity Score: 75%

Strategy: BB_RPB_TSL_BI_v4_EWO2_v3, Similarity Score: 75%

Strategy: BB_RPB_TSL_BI_v4_EWO2_v3_0, Similarity Score: 75%

Strategy: BB_RPB_TSL_v104, Similarity Score: 75%

Strategy: BRB, Similarity Score: 75%

Strategy: Discord_1_BB_RPB_TSL_BI, Similarity Score: 75%

Strategy: meneguzzo_v3, Similarity Score: 75%

Strategy: meneguzzo_v4_dca, Similarity Score: 75%

last change: 2023-11-03 01:45:29