You will be redirected to the original Strategy in 15 seconds.

The BB_RTR strategy is a trading strategy that utilizes various indicators to generate buy signals. Here is a short description of what the strategy does:

The strategy first calculates Bollinger Bands with two standard deviations and three standard deviations based on the typical price. It calculates the width of the Bollinger Bands and the delta between the lower bands of two and three standard deviations.

It calculates the Commodity Channel Index (CCI) for different lengths and adds the CCI values to the dataframe.

It calculates the Relative Momentum Index (RMI) for different lengths and adds the RMI values to the dataframe.

It calculates the Stochastic RSI (STOCHRSI) and adds the fastk and fastd values to the dataframe. It calculates various moving averages (SMA and EMA) with different time periods and adds them to the dataframe. It calculates the Chalkin Money Flow (CMF), Money Flow Index (MFI), and Average Directional Index (ADX) and adds them to the dataframe. It calculates the Elder's Force Index (EFI) and adds it to the dataframe. It calculates the Heikin-Ashi open, close, high, and low prices and adds them to the dataframe. It calculates Bollinger Bands for Heikin-Ashi close prices and adds the bands to the dataframe. It calculates various other indicators such as rate of change (ROCR), Williams %R (r_14), volume moving averages, and percentage changes. It calculates momentum divergence (momdiv) and adds the buy, sell, cohesion, and collapse signals to the dataframe. It retrieves informative data on a higher timeframe (1 hour) and calculates indicators for the informative data. It merges the informative data with the current timeframe data. In the populate_buy_trend method, the strategy sets conditions for generating buy signals based on certain criteria, such as the maximum close price over a rolling 48-period indicating a pump. The strategy assigns a buy tag to the corresponding rows in the dataframe. Please note that this is a simplified description of the strategy, and the actual implementation may involve more complexity and details.

It calculates the Commodity Channel Index (CCI) for different lengths and adds the CCI values to the dataframe.

It calculates the Relative Momentum Index (RMI) for different lengths and adds the RMI values to the dataframe.

It calculates the Stochastic RSI (STOCHRSI) and adds the fastk and fastd values to the dataframe. It calculates various moving averages (SMA and EMA) with different time periods and adds them to the dataframe. It calculates the Chalkin Money Flow (CMF), Money Flow Index (MFI), and Average Directional Index (ADX) and adds them to the dataframe. It calculates the Elder's Force Index (EFI) and adds it to the dataframe. It calculates the Heikin-Ashi open, close, high, and low prices and adds them to the dataframe. It calculates Bollinger Bands for Heikin-Ashi close prices and adds the bands to the dataframe. It calculates various other indicators such as rate of change (ROCR), Williams %R (r_14), volume moving averages, and percentage changes. It calculates momentum divergence (momdiv) and adds the buy, sell, cohesion, and collapse signals to the dataframe. It retrieves informative data on a higher timeframe (1 hour) and calculates indicators for the informative data. It merges the informative data with the current timeframe data. In the populate_buy_trend method, the strategy sets conditions for generating buy signals based on certain criteria, such as the maximum close price over a rolling 48-period indicating a pump. The strategy assigns a buy tag to the corresponding rows in the dataframe. Please note that this is a simplified description of the strategy, and the actual implementation may involve more complexity and details.

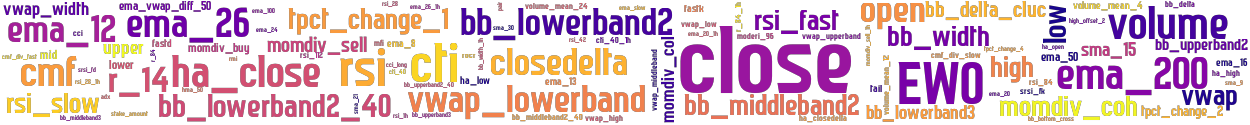

stoploss: -0.998 timeframe: 5m hash(sha256): e8ab7d7deab462ea3250715b40a402e98323c6fef45187aa91699e309a6ff233 indicators: upper close high_offset_2 cmf_div_slow vwap_upperband volume_mean_12 rsi_fast volume ema_20 ha_closedelta momdiv_coh bb_upperband2 volume_mean_24 high tpct_change_2 ema_8 cci bb_lowerband3 rsi_1h momdiv_col ha_high adx ema_12 ema_slow ema_26 cti_40_1h bb_width_1h bb_lowerband2_40 bb_upperband2_40 vwap_width sma_21 momdiv_buy bb_middleband2 r_84_1h closedelta sma_15 ha_open volume_mean_4 ema_20_1h ema_24 cmf rmi_length_val hma_50 vwap lower rsi cti_40 momdiv_sell vwap_middleband bb_middleband3 bb

Similar Strategies: (based on used indicators)

Strategy: BB_RTR_dca_157, Similarity Score: 98.08%

Strategy: BB_RTR, Similarity Score: 96.15%

Strategy: BB_RTR_dca, Similarity Score: 96.15%

Strategy: BB_DCAv2, Similarity Score: 94.23%

Strategy: BB_RTR_X2, Similarity Score: 94.23%

Strategy: BB_RTR_dca_144, Similarity Score: 94.23%

Strategy: Discord_BB_RTR3c, Similarity Score: 94.23%

Strategy: BB_DCAv3, Similarity Score: 90.38%

Strategy: BB_DCAv3b, Similarity Score: 90.38%

Strategy: BB_RTR_2, Similarity Score: 90.38%

Strategy: BB_RTR_3, Similarity Score: 90.38%

Strategy: BB_RTR_X, Similarity Score: 90.38%

Strategy: BB_RTR_dca_1, Similarity Score: 90.38%

Strategy: BB_RTR_dca_250, Similarity Score: 90.38%

Strategy: BB_RTR_dca_test, Similarity Score: 90.38%

Strategy: BB_RTR_dca_v002, Similarity Score: 90.38%

Strategy: BB_RTR_nstp, Similarity Score: 90.38%

Strategy: BB_RTR_stp, Similarity Score: 90.38%

Strategy: BB_RTR_test, Similarity Score: 90.38%

Strategy: Big_boy, Similarity Score: 90.38%

Strategy: Discord_1_BB_RTR, Similarity Score: 90.38%

Strategy: BB_RTR_l2, Similarity Score: 86.54%

Strategy: meneguzzo_v3, Similarity Score: 75%

Strategy: meneguzzo_v4_dca, Similarity Score: 75%

last change: 2023-08-01 06:24:13