The BB_DCAv3 trading strategy is an implementation of a backtesting strategy that utilizes various technical indicators to make trading decisions. It populates a DataFrame with a multitude of indicators, aiming to capture different aspects of market trends and price movements. Some of the key indicators and features of this strategy include:

Bollinger Bands (BB): Calculates Bollinger Bands with different standard deviations (2 and 3) to identify potential overbought or oversold conditions.

Commodity Channel Index (CCI): Computes CCI values for multiple lengths, with a focus on lengths specified for buying decisions.

Relative Strength Index (RSI): Calculates RSI values for different time periods, helping to identify potential momentum shifts.

Stochastic RSI (SRSI): Computes fastk and fastd values for the Stochastic RSI indicator. Simple Moving Averages (SMA) and Exponential Moving Averages (EMA): Computes SMAs and EMAs for various time periods, capturing different trends. Chande Trendscore Indicator (CTI): Calculates CTI and its mean to assess the overall trend strength. Chaikin Money Flow (CMF) and Money Flow Index (MFI): Measures money flow and buying/selling pressure. Average Directional Index (ADX): Computes ADX values to gauge trend strength. Elliott Wave Oscillator (EWO): Calculates EWO values to identify potential wave patterns. Heikin Ashi: Converts price data to Heikin Ashi candlestick representation for smoother trends. Williams %R (r_14): Calculates Williams %R values for momentum analysis. Volume Analysis: Includes rolling averages of volume to assess trading activity. Various other indicators: Including TEMA, ROCR, Top Percent Change, and more. These indicators collectively provide insights into price trends, momentum shifts, volatility, and potential buying or selling opportunities. The strategy seems to incorporate multiple technical signals to guide trading decisions. Keep in mind that successful trading strategies require careful parameter tuning and risk management.

Commodity Channel Index (CCI): Computes CCI values for multiple lengths, with a focus on lengths specified for buying decisions.

Relative Strength Index (RSI): Calculates RSI values for different time periods, helping to identify potential momentum shifts.

Stochastic RSI (SRSI): Computes fastk and fastd values for the Stochastic RSI indicator. Simple Moving Averages (SMA) and Exponential Moving Averages (EMA): Computes SMAs and EMAs for various time periods, capturing different trends. Chande Trendscore Indicator (CTI): Calculates CTI and its mean to assess the overall trend strength. Chaikin Money Flow (CMF) and Money Flow Index (MFI): Measures money flow and buying/selling pressure. Average Directional Index (ADX): Computes ADX values to gauge trend strength. Elliott Wave Oscillator (EWO): Calculates EWO values to identify potential wave patterns. Heikin Ashi: Converts price data to Heikin Ashi candlestick representation for smoother trends. Williams %R (r_14): Calculates Williams %R values for momentum analysis. Volume Analysis: Includes rolling averages of volume to assess trading activity. Various other indicators: Including TEMA, ROCR, Top Percent Change, and more. These indicators collectively provide insights into price trends, momentum shifts, volatility, and potential buying or selling opportunities. The strategy seems to incorporate multiple technical signals to guide trading decisions. Keep in mind that successful trading strategies require careful parameter tuning and risk management.

Traceback (most recent call last): File "/home/ftuser/.local/lib/python3.11/site-packages/pandas/core/indexes/base.py", line 3791, in get_loc return self._engine.get_loc(casted_key) ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "index.pyx", line 152, in pandas._libs.index.IndexEngine.get_loc File "index.pyx", line 181, in pandas._libs.index.IndexEngine.get_loc File "pandas/_libs/hashtable_class_helper.pxi", line 7080, in pandas._libs.hashtable.PyObjectHashTable.get_item File "pandas/_libs/hashtable_class_helper.pxi", line 7088, in pandas._libs.hashtable.PyObjectHashTable.get_item KeyError: 'EWO' The above exception was the direct cause of the following exception: Traceback (most recent call last): File "/freqtrade/freqtrade/main.py", line 42, in main return_code = args['func'](args) ^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/commands/optimize_commands.py", line 58, in start_backtesting backtesting.start() File "/freqtrade/freqtrade/optimize/backtesting.py", line 1401, in start min_date, max_date = self.backtest_one_strategy(strat, data, timerange) ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/optimize/backtesting.py", line 1318, in backtest_one_strategy preprocessed = self.strategy.advise_all_indicators(data) ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/strategy/interface.py", line 1378, in advise_all_indicators return {pair: self.advise_indicators(pair_data.copy(), {'pair': pair}).copy() ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/strategy/interface.py", line 1378, inreturn {pair: self.advise_indicators(pair_data.copy(), {'pair': pair}).copy() ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/strategy/interface.py", line 1410, in advise_indicators return self.populate_indicators(dataframe, metadata) ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/user_data/strategies/BB_DCAv3.py", line 483, in populate_indicators ((dataframe['EWO'] > 5.6) & ~~~~~~~~~^^^^^^^ File "/home/ftuser/.local/lib/python3.11/site-packages/pandas/core/frame.py", line 3893, in __getitem__ indexer = self.columns.get_loc(key) ^^^^^^^^^^^^^^^^^^^^^^^^^ File "/home/ftuser/.local/lib/python3.11/site-packages/pandas/core/indexes/base.py", line 3798, in get_loc raise KeyError(key) from err KeyError: 'EWO'

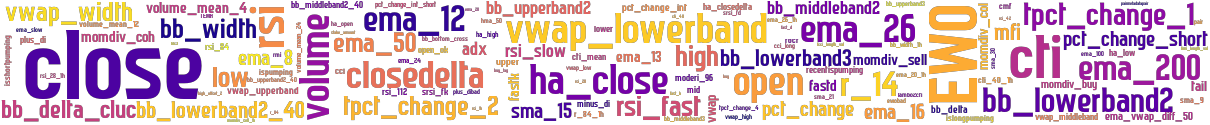

stoploss: -0.998 timeframe: 5m hash(sha256): 6d5593deab8abe2149ace8b4d3f95fbc09363eb5e87acd412a31417a08640204 indicators: upper close high_offset_2 cti_mean vwap_upperband volume_mean_12 isshortpumping rsi_fast volume ema_20 ha_closedelta momdiv_coh bb_upperband2 volume_mean_24 high tpct_change_2 ewobad ema_8 cci bb_lowerband3 rsi_1h momdiv_col ha_high adx ema_12 ema_slow ema_26 cti_40_1h bb_width_1h bb_lowerband2_40 bb_upperband2_40 vwap_width ispumping sma_21 momdiv_buy bb_middleband2 r_84_1h closedelta plus_di sma_15 islongpumping ha_open volume_mean_4 fast_d ema_20_1h ema_24 cmf rmi_length_val hma_50 vwap recen

Similar Strategies: (based on used indicators)

Strategy: BB_DCAv3b, Similarity Score: 98.08%

Strategy: BB_RTR_X, Similarity Score: 98.08%

Strategy: BB_DCAv2, Similarity Score: 86.54%

Strategy: BB_RTR_X2, Similarity Score: 86.54%

Strategy: BB_RTR, Similarity Score: 82.69%

Strategy: BB_RTR_dca, Similarity Score: 82.69%

Strategy: BB_RTR_dca_0, Similarity Score: 82.69%

Strategy: BB_RTR_dca_144, Similarity Score: 82.69%

Strategy: BB_RTR_dca_157, Similarity Score: 82.69%

Strategy: Discord_BB_RTR3c, Similarity Score: 82.69%

Strategy: BB_RTR_2, Similarity Score: 80.77%

Strategy: BB_RTR_3, Similarity Score: 80.77%

Strategy: BB_RTR_dca_1, Similarity Score: 80.77%

Strategy: BB_RTR_dca_250, Similarity Score: 80.77%

Strategy: BB_RTR_dca_test, Similarity Score: 80.77%

Strategy: BB_RTR_dca_v002, Similarity Score: 80.77%

Strategy: BB_RTR_nstp, Similarity Score: 80.77%

Strategy: BB_RTR_stp, Similarity Score: 80.77%

Strategy: BB_RTR_test, Similarity Score: 80.77%

Strategy: Big_boy, Similarity Score: 80.77%

Strategy: Discord_1_BB_RTR, Similarity Score: 80.77%

Strategy: BB_RTR_l2, Similarity Score: 76.92%

last change: 2024-05-05 03:55:24