Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The "BB_RPB_TSL_BI" strategy is a backtesting strategy that incorporates various indicators to determine buy signals for trading. Here is a brief description of its functionality:

The strategy consists of two main methods: "populate_indicators" and "populate_buy_trend."

In the "populate_indicators" method, the strategy calculates and merges different indicators based on the input dataframe and metadata. It uses informative 1-hour indicators and normal time frame indicators to generate additional data for analysis.

The "populate_buy_trend" method defines a set of conditions to identify potential buying opportunities.

It checks for multiple conditions such as RMI (Relative Momentum Index), CCI (Commodity Channel Index), SRSI (Stochastic RSI), BB (Bollinger Bands), EMA (Exponential Moving Average), RSI (Relative Strength Index), EWO (Elliott Wave Oscillator), CTI (Composite Trend Index), CRSI (Cumulative RSI), and various price-related factors.

The strategy evaluates these conditions to determine if the current market situation aligns with the defined buy signals. Overall, the strategy utilizes a combination of technical indicators and price patterns to generate buy signals for trading. By backtesting this strategy on historical data, one can evaluate its effectiveness in different market conditions and assess its potential profitability.

The "populate_buy_trend" method defines a set of conditions to identify potential buying opportunities.

It checks for multiple conditions such as RMI (Relative Momentum Index), CCI (Commodity Channel Index), SRSI (Stochastic RSI), BB (Bollinger Bands), EMA (Exponential Moving Average), RSI (Relative Strength Index), EWO (Elliott Wave Oscillator), CTI (Composite Trend Index), CRSI (Cumulative RSI), and various price-related factors.

The strategy evaluates these conditions to determine if the current market situation aligns with the defined buy signals. Overall, the strategy utilizes a combination of technical indicators and price patterns to generate buy signals for trading. By backtesting this strategy on historical data, one can evaluate its effectiveness in different market conditions and assess its potential profitability.

startup_candle_count : 50 rsi_1h: 0.731% rmi_length_17: -4.846% ema_16: -0.002% ema_20: -0.010% ema_26: -0.016% rsi: 0.539% rsi_fast: 0.002% rsi_slow: 3.853% bb_lowerband2_40: -0.005% bb_middleband2_40: -0.025% bb_upperband2_40: -0.046% bb_delta_cluc: -10.245% adx: -7.240% pm: -0.001%

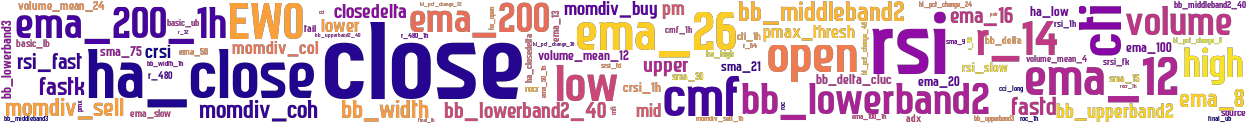

stoploss: -0.99 timeframe: 5m hash(sha256): 651fcfe9cc698c92e90ec14dff0240b2b3761223d6d16fec8afe4aa619915e55 indicators: upper close volume_mean_12 ema_200_1h rsi_fast r_480_1h volume ema_20 source ha_closedelta momdiv_coh bb_upperband2 volume_mean_24 high ema_8 r_480 cci bb_lowerband3 rsi_1h final_ub momdiv_col ha_high pm adx ema_12 ema_slow ema_26 bb_width_1h bb_lowerband2_40 cmf_1h bb_upperband2_40 basic_ub sma_21 momdiv_buy bb_middleband2 closedelta sma_15 ha_open volume_mean_4 cmf rmi_length_val lower roc r_32 rsi momdiv_sell crsi_1h bb_middleband3 bb_upperband3 ema_50 tail mfi srsi_fk r_14 srsi_fd cci_long r

Similar Strategies: (based on used indicators)

Strategy: BB_RPB_TSL_BIV1, Similarity Score: 98.28%

Strategy: BB_RPB_TSL_BI_2, Similarity Score: 98.28%

Strategy: BB_RPB_TSL_BI_3, Similarity Score: 98.28%

Strategy: BB_RPB_TSL_BI_v4_EWO2_v3_0, Similarity Score: 98.28%

Strategy: BRB, Similarity Score: 98.28%

Strategy: Discord_1_BB_RPB_TSL_BI, Similarity Score: 93.1%

Strategy: BB_RPB_TSLX, Similarity Score: 91.38%

Strategy: BB_RPB_TSL_v104, Similarity Score: 91.38%

Strategy: BB_RPB_TSL_5, Similarity Score: 86.21%

Strategy: BB_RPB_TSL_BI_v4_EWO2_v3, Similarity Score: 86.21%

Strategy: BB_RPB_TSL_v103, Similarity Score: 86.21%

Strategy: BB_RPB_TSL_4, Similarity Score: 81.03%

Strategy: BB_RPB_TSL, Similarity Score: 79.31%

Strategy: BB_RPB_TSL_140, Similarity Score: 79.31%

Strategy: BB_RPB_TSL_221, Similarity Score: 79.31%

Strategy: BB_RPB_TSL_3, Similarity Score: 79.31%

Strategy: BB_RPB_TSL_8, Similarity Score: 79.31%

Strategy: BB_RPB_TSL_meneguzzo, Similarity Score: 79.31%

Strategy: BB_RPB_TSLmeneguzzo, Similarity Score: 79.31%

Strategy: BB_RPB_TSLmeneguzzo_3, Similarity Score: 79.31%

Strategy: BB_RPB_TSLmeneguzzo_3_2, Similarity Score: 79.31%

Strategy: Discord_1_BB_RPB_TSL, Similarity Score: 79.31%

Strategy: Discord_BB_RPB_TSL, Similarity Score: 79.31%

Strategy: HakimYiech, Similarity Score: 79.31%

Strategy: BRTMinus, Similarity Score: 75.86%

Strategy: meneguzzo_v3, Similarity Score: 75.86%

Strategy: meneguzzo_v4_dca, Similarity Score: 75.86%

Strategy: BB_RPB_TSL_600, Similarity Score: 74.14%

Strategy: BRTM, Similarity Score: 74.14%

last change: 2024-05-02 14:29:58