Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BB_RPB_TSL strategy is a trading strategy implemented as a class in Python. It inherits from the IStrategy class, indicating that it is designed to be used within a specific backtesting framework. The strategy consists of several methods that perform different tasks:

populate_indicators: This method takes a DataFrame and additional metadata as input and returns a modified DataFrame with populated indicators.

It calls two other methods, informative_1h_indicators and normal_tf_indicators, to calculate and merge different indicators into the DataFrame.

populate_buy_trend: This method takes a DataFrame and metadata as input and returns a modified DataFrame with buy signals.

It calculates various conditions based on the DataFrame's columns and assigns a buy tag to the corresponding rows. The conditions involve checks on indicators such as RMI, CCI, SRSI, Bollinger Bands, EMA, RSI, EWO (Elliott Wave Oscillator), and more. The strategy's buy conditions include criteria such as price dips, squeeze conditions (Bollinger Bands and Keltner Channels), local uptrends and dips, EMA offsets, deadfish patterns, ClucHA patterns, COFI (Combining Oscillators with Fundamental Indicators) patterns, gumbo1 patterns, squeeze momentum patterns, and KC_BB (Keltner Channels and Bollinger Bands) patterns. Each condition is a combination of multiple indicators and their respective threshold values. Overall, the strategy aims to identify potential buying opportunities based on various technical analysis indicators and patterns.

It calls two other methods, informative_1h_indicators and normal_tf_indicators, to calculate and merge different indicators into the DataFrame.

populate_buy_trend: This method takes a DataFrame and metadata as input and returns a modified DataFrame with buy signals.

It calculates various conditions based on the DataFrame's columns and assigns a buy tag to the corresponding rows. The conditions involve checks on indicators such as RMI, CCI, SRSI, Bollinger Bands, EMA, RSI, EWO (Elliott Wave Oscillator), and more. The strategy's buy conditions include criteria such as price dips, squeeze conditions (Bollinger Bands and Keltner Channels), local uptrends and dips, EMA offsets, deadfish patterns, ClucHA patterns, COFI (Combining Oscillators with Fundamental Indicators) patterns, gumbo1 patterns, squeeze momentum patterns, and KC_BB (Keltner Channels and Bollinger Bands) patterns. Each condition is a combination of multiple indicators and their respective threshold values. Overall, the strategy aims to identify potential buying opportunities based on various technical analysis indicators and patterns.

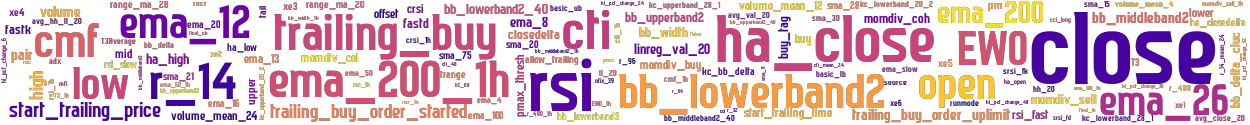

stoploss: -0.99 timeframe: 5m hash(sha256): 7893e8ebe7178723a3f1e86f79debfa3c41f60000063519c481a7569bcd01b33 indicators: upper close volume_mean_12 ema_200_1h avg_val_20 rsi_fast r_480_1h volume xe1 ema_20 source ha_closedelta momdiv_coh buy_tag trange bb_upperband2 volume_mean_24 high ema_8 r_480 cci bb_lowerband3 rsi_1h xe6 final_ub momdiv_col ha_high pm adx ema_12 sma_28 T3Average ema_slow ema_26 runmode bb_width_1h bb_lowerband2_40 cmf_1h bb_upperband2_40 basic_ub sma_21 momdiv_buy bb_middleband2 closedelta sma_15 ha_open volume_mean_4 avg_close_20 EWO_1h cmf rmi_length_val kc_lowerband_20_2 lower roc T3 r_32

Similar Strategies: (based on used indicators)

Strategy: BB_RPB_TSL, Similarity Score: 91.38%

Strategy: BB_RPB_TSL_221, Similarity Score: 91.38%

Strategy: BB_RPB_TSL_3, Similarity Score: 91.38%

Strategy: BB_RPB_TSL_8, Similarity Score: 91.38%

Strategy: BB_RPB_TSL_meneguzzo, Similarity Score: 91.38%

Strategy: BB_RPB_TSLmeneguzzo, Similarity Score: 91.38%

Strategy: BB_RPB_TSLmeneguzzo_3, Similarity Score: 91.38%

Strategy: BB_RPB_TSLmeneguzzo_3_2, Similarity Score: 91.38%

Strategy: Discord_1_BB_RPB_TSL, Similarity Score: 91.38%

Strategy: Discord_BB_RPB_TSL, Similarity Score: 91.38%

Strategy: HakimYiech, Similarity Score: 91.38%

Strategy: BB_RPB_TSL_4, Similarity Score: 89.66%

Strategy: BB_RPB_TSL_600, Similarity Score: 87.93%

Strategy: BRTMinus, Similarity Score: 87.93%

Strategy: meneguzzo_v3, Similarity Score: 86.21%

Strategy: meneguzzo_v4_dca, Similarity Score: 86.21%

Strategy: BRTM, Similarity Score: 84.48%

Strategy: BB_RPB_TSLX, Similarity Score: 82.76%

Strategy: BB_RPB_TSL_v104, Similarity Score: 82.76%

Strategy: Discord_1_BB_RPB_TSL_BI, Similarity Score: 82.76%

Strategy: BBMod1, Similarity Score: 81.03%

Strategy: BBMod1_2, Similarity Score: 81.03%

Strategy: BBMod1_3, Similarity Score: 81.03%

Strategy: BB_RPB, Similarity Score: 79.31%

Strategy: BB_RPB_TSL_Tranz203, Similarity Score: 79.31%

Strategy: gus_delta, Similarity Score: 79.31%

Strategy: BBMod, Similarity Score: 77.59%

Strategy: BBMod1_0, Similarity Score: 77.59%

Strategy: BBMod_6, Similarity Score: 77.59%

Strategy: BB_RPB_TSL_BI, Similarity Score: 75.86%

Strategy: BB_RPB_TSL_BIV1, Similarity Score: 75.86%

Strategy: BB_RPB_TSL_BI_2, Similarity Score: 75.86%

Strategy: BB_RPB_TSL_BI_3, Similarity Score: 75.86%

Strategy: BB_RPB_TSL_BI_v4_EWO2_v3, Similarity Score: 75.86%

Strategy: BB_RPB_TSL_BI_v4_EWO2_v3_0, Similarity Score: 75.86%

Strategy: BRB, Similarity Score: 75.86%

last change: 2024-05-02 16:14:55