Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The ElliotV7 strategy is a trading strategy implemented as a class in Python. Here is a short description of what the strategy does:

The populate_indicators method is used to calculate various technical indicators based on the provided dataframe and metadata. These indicators include moving averages, Bollinger Bands, Hull Moving Average, Simple Moving Average, Exponential Weighted Oscillator (EWO), MACD, and RSI (Relative Strength Index).

The calculated indicators are added as additional columns to the dataframe.

The populate_buy_trend method is responsible for determining the buy signals based on specific conditions.

These conditions include checking for an uptrend in the 1-hour timeframe, a low RSI value, the close price being below a moving average multiplied by a certain offset, a high EWO value, a low RSI value, and a positive volume. If any of these conditions are met, the corresponding row in the dataframe is marked as a buy signal. The populate_sell_trend method is used to identify sell signals based on certain conditions. These conditions involve checking for a crossover of the Simple Moving Average (SMA) and the Hull Moving Average (HMA), the close price being above a moving average multiplied by a specific offset, a high RSI value, positive volume, and the RSI fast line being greater than the RSI slow line. If any of these conditions are satisfied, the respective row in the dataframe is marked as a sell signal. Overall, the ElliotV7 strategy combines multiple technical indicators and specific conditions to generate buy and sell signals for trading.

The calculated indicators are added as additional columns to the dataframe.

The populate_buy_trend method is responsible for determining the buy signals based on specific conditions.

These conditions include checking for an uptrend in the 1-hour timeframe, a low RSI value, the close price being below a moving average multiplied by a certain offset, a high EWO value, a low RSI value, and a positive volume. If any of these conditions are met, the corresponding row in the dataframe is marked as a buy signal. The populate_sell_trend method is used to identify sell signals based on certain conditions. These conditions involve checking for a crossover of the Simple Moving Average (SMA) and the Hull Moving Average (HMA), the close price being above a moving average multiplied by a specific offset, a high RSI value, positive volume, and the RSI fast line being greater than the RSI slow line. If any of these conditions are satisfied, the respective row in the dataframe is marked as a sell signal. Overall, the ElliotV7 strategy combines multiple technical indicators and specific conditions to generate buy and sell signals for trading.

startup_candle_count : 39 ema_fast_1h: -0.010% ema_slow_1h: -0.005% ma_buy_14: 0.001% rsi: 11.433% rsi_fast: 0.138% rsi_slow: 8.625%

Unable to parse Traceback (Logfile Exceeded Limit)

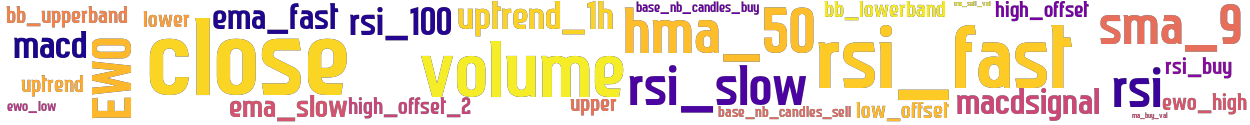

stoploss: -0.32 timeframe: 5m hash(sha256): 233e88dda8fc40328451af3f9dc80f2ef7beeab34932eb398e390b0f5bdc303a indicators: rsi_buy upper EWO ewo_high close high_offset_2 ewo_low bb_lowerband rsi_fast ma_sell_val ma_buy_val volume low_offset high_offset uptrend_1h ema_fast base_nb_candles_buy macdsignal uptrend macd base_nb_candles_sell hma_50 sma_9 lower rsi_slow rsi ema_slow bb_upperband rsi_100

Similar Strategies: (based on used indicators)

Strategy: ElliotV7_2, Similarity Score: 96.67%

Strategy: Discord_ElliotV6, Similarity Score: 93.33%

last change: 2025-06-01 22:59:09