Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The ElliotV7 strategy is a trading strategy that utilizes various technical indicators to generate buy and sell signals. Here is a breakdown of what the strategy does:

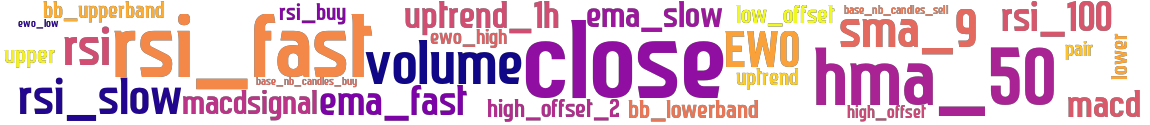

In the populate_indicators method, the strategy calculates and adds several indicators to the input dataframe. These indicators include moving averages (ma_buy and ma_sell), Bollinger Bands (bb_upperband and bb_lowerband), Hull Moving Average (hma_50), simple moving average (sma_9), EWO (Elliott Wave Oscillator) indicator (EWO), MACD (Moving Average Convergence Divergence) indicators (macd and macdsignal), and RSI (Relative Strength Index) indicators (rsi, rsi_fast, rsi_slow, and rsi_100).

The populate_buy_trend method defines the conditions for a buy signal.

The conditions include an uptrend in the 1-hour timeframe (uptrend_1h > 0), a low RSI value (rsi_fast < 35), the closing price below the moving average (ma_buy) multiplied by a low offset (low_offset), a high EWO value (EWO > ewo_high), a low RSI value (rsi < rsi_buy), positive volume, and the closing price below the moving average (ma_sell) multiplied by a high offset (high_offset).

If any of these conditions are met, the buy column in the dataframe is set to 1. The populate_sell_trend method defines the conditions for a sell signal. The conditions include a crossover of the simple moving average (sma_9) above the Hull Moving Average (hma_50), the closing price above the moving average (ma_sell) multiplied by a high offset (high_offset_2) and RSI value above 50, or a crossover of the simple moving average (sma_9) below the Hull Moving Average (hma_50) and the closing price above the moving average (ma_sell) multiplied by a high offset (high_offset). If any of these conditions are met, the sell column in the dataframe is set to 1. The strategy calculates the emadif (EMA difference) by subtracting two exponential moving averages (ema1 and ema2) from the dataframe and normalizing the result by dividing it by the closing price. The emadif is returned as the output. Overall, the ElliotV7 strategy combines multiple indicators and conditions to generate buy and sell signals based on trends, moving averages, oscillators, and volume.

The populate_buy_trend method defines the conditions for a buy signal.

The conditions include an uptrend in the 1-hour timeframe (uptrend_1h > 0), a low RSI value (rsi_fast < 35), the closing price below the moving average (ma_buy) multiplied by a low offset (low_offset), a high EWO value (EWO > ewo_high), a low RSI value (rsi < rsi_buy), positive volume, and the closing price below the moving average (ma_sell) multiplied by a high offset (high_offset).

If any of these conditions are met, the buy column in the dataframe is set to 1. The populate_sell_trend method defines the conditions for a sell signal. The conditions include a crossover of the simple moving average (sma_9) above the Hull Moving Average (hma_50), the closing price above the moving average (ma_sell) multiplied by a high offset (high_offset_2) and RSI value above 50, or a crossover of the simple moving average (sma_9) below the Hull Moving Average (hma_50) and the closing price above the moving average (ma_sell) multiplied by a high offset (high_offset). If any of these conditions are met, the sell column in the dataframe is set to 1. The strategy calculates the emadif (EMA difference) by subtracting two exponential moving averages (ema1 and ema2) from the dataframe and normalizing the result by dividing it by the closing price. The emadif is returned as the output. Overall, the ElliotV7 strategy combines multiple indicators and conditions to generate buy and sell signals based on trends, moving averages, oscillators, and volume.

Unable to parse Traceback (Logfile Exceeded Limit)

stoploss: -0.32 timeframe: 5m hash(sha256): 9ada800378d8ab5a9989234d5d111d4d2e9ddb2196093d3b564daa28ddad75a4 indicators: rsi_buy upper EWO ewo_high ewo_low high_offset_2 close bb_lowerband rsi_fast ma_sell_val ma_buy_val volume low_offset high_offset uptrend_1h ema_fast base_nb_candles_buy macdsignal uptrend macd base_nb_candles_sell hma_50 sma_9 lower rsi_slow rsi ema_slow bb_upperband rsi_100

Similar Strategies: (based on used indicators)

Strategy: ElliotV7_392, Similarity Score: 96.67%

Strategy: Discord_ElliotV6, Similarity Score: 93.33%

last change: 2025-01-14 00:39:14