Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The ElliotV5HO strategy is a trading strategy that utilizes various indicators to generate buy and sell signals. Here is a breakdown of its key components:

populate_indicators: This function calculates and adds several indicators to the dataframe. It calculates exponential moving averages (EMA) for different time periods and adds them as columns.

It also calculates the Elliott Wave Oscillator (EWO) and the relative strength index (RSI) and adds them as columns.

populate_buy_trend: This function determines the conditions for a buy signal.

It creates a list of conditions that need to be met for a buy signal to be generated. These conditions involve checking if the closing price is below a certain threshold multiplied by the EMA for a specific time period, if the EWO is above a certain value, if the RSI is below a specified threshold, and if the volume is greater than zero. If any of the conditions are met, the 'buy' column in the dataframe is set to 1. populate_sell_trend: This function determines the conditions for a sell signal. It creates a list of conditions that need to be met for a sell signal to be generated. The condition checks if the closing price is above a certain threshold multiplied by the EMA for a specific time period and if the volume is greater than zero. If the condition is met, the 'sell' column in the dataframe is set to 1. should_cancel: This function determines if a trade should be canceled based on the current profit and other factors. If the current profit is below 0.001 and the trade was opened more than 140 minutes ago, a cancel signal is generated with a return value of -0.005. Otherwise, a return value of 1 indicates that the trade should not be canceled. Overall, the strategy uses moving averages, Elliott Wave Oscillator, and RSI to identify potential buy and sell signals based on predefined conditions. It also includes a cancel condition to manage trades based on current profit and time since the trade was opened.

It also calculates the Elliott Wave Oscillator (EWO) and the relative strength index (RSI) and adds them as columns.

populate_buy_trend: This function determines the conditions for a buy signal.

It creates a list of conditions that need to be met for a buy signal to be generated. These conditions involve checking if the closing price is below a certain threshold multiplied by the EMA for a specific time period, if the EWO is above a certain value, if the RSI is below a specified threshold, and if the volume is greater than zero. If any of the conditions are met, the 'buy' column in the dataframe is set to 1. populate_sell_trend: This function determines the conditions for a sell signal. It creates a list of conditions that need to be met for a sell signal to be generated. The condition checks if the closing price is above a certain threshold multiplied by the EMA for a specific time period and if the volume is greater than zero. If the condition is met, the 'sell' column in the dataframe is set to 1. should_cancel: This function determines if a trade should be canceled based on the current profit and other factors. If the current profit is below 0.001 and the trade was opened more than 140 minutes ago, a cancel signal is generated with a return value of -0.005. Otherwise, a return value of 1 indicates that the trade should not be canceled. Overall, the strategy uses moving averages, Elliott Wave Oscillator, and RSI to identify potential buy and sell signals based on predefined conditions. It also includes a cancel condition to manage trades based on current profit and time since the trade was opened.

startup_candle_count : 79 ma_sell_39: -0.013% rsi: 1.417%

Unable to parse Traceback (Logfile Exceeded Limit)

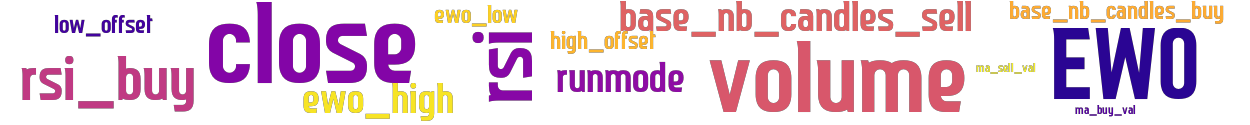

stoploss: -0.189 timeframe: 5m hash(sha256): 98e46eb4ce087e9e337e0f821ec530b4aeb2775b59e4e9d4bc52edc9420eab56 indicators: rsi_buy ma_sell_val volume EWO ewo_high low_offset close ewo_low rsi high_offset base_nb_candles_sell runmode base_nb_candles_buy ma_buy_val

Similar Strategies: (based on used indicators)

Strategy: Discord_SMA_BBRSI, Similarity Score: 93.33%

Strategy: ElliotV5HO4, Similarity Score: 93.33%

Strategy: ElliotV5HOMod1, Similarity Score: 93.33%

Strategy: ElliotV5HOMod2, Similarity Score: 93.33%

Strategy: ElliotV5HOMod3, Similarity Score: 93.33%

Strategy: ElliotV8HO, Similarity Score: 93.33%

Strategy: ElliotV8HO_2, Similarity Score: 93.33%

Strategy: ElliotV8_original_ichiv3, Similarity Score: 93.33%

Strategy: ElliotV8_original_ichiv3_224, Similarity Score: 93.33%

Strategy: ElliotV8_original_ichiv3_465, Similarity Score: 93.33%

Strategy: Luna_1, Similarity Score: 93.33%

Strategy: NASOSv5sera, Similarity Score: 93.33%

Strategy: NZv1, Similarity Score: 93.33%

Strategy: NotAnotherSMAOffsetStrategy_2, Similarity Score: 93.33%

Strategy: NotAnotherSMAOffsetStrategy_3, Similarity Score: 93.33%

Strategy: NotAnotherSMAOffsetStrategy_5, Similarity Score: 93.33%

Strategy: NotAnotherSMAOffsetStrategy_6, Similarity Score: 93.33%

Strategy: Nv2, Similarity Score: 93.33%

Strategy: Nv2b, Similarity Score: 93.33%

last change: 2025-06-02 00:37:32