Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The CombinedBinHAndClucHyperV3 strategy is a trading strategy that combines two different approaches: BinHV45 and ClucMay72018. In the BinHV45 strategy, the following conditions are checked:

The lower value of the Bollinger Bands (based on a specified time window) must be positive. The difference between the middle value and the lower value of the Bollinger Bands must be greater than a percentage (buy_a_bbdelta_rate) of the closing price.

The absolute difference between consecutive closing prices must be greater than a percentage (buy_a_closedelta_rate) of the closing price.

The absolute difference between the closing price and the lowest price within the time window (buy_a_time_window) must be less than a percentage (buy_a_tail_rate) of the difference between the middle and lower values of the Bollinger Bands.

The closing price must be less than the previous lower value of the Bollinger Bands. The closing price must be less than or equal to the previous closing price. The middle value of the Bollinger Bands (based on sell_bb_mid_slow_window) must be greater than a calculated threshold, which depends on buy_a_min_sell_rate and a rate derived from the average true range (ATR) calculated over a specified time window (buy_a_atr_window). In the ClucMay72018 strategy, the following conditions are checked: The closing price must be less than a moving average (ema_slow) calculated over a specified time period (buy_b_ema_slow). The closing price must be less than a percentage (buy_b_close_rate) of the lower value of the Bollinger Bands (based on a specified time window). The volume must be less than a certain number (buy_b_volume_mean_slow_num) times the previous moving average of the volume (buy_b_volume_mean_slow_window). If any of these conditions are met, a "buy" signal is generated for the respective row in the dataframe. In the sell trend, the strategy checks if the closing price is greater than the middle value of the Bollinger Bands (based on sell_bb_mid_slow_window). If so, a "sell" signal is generated for that row in the dataframe.

The absolute difference between consecutive closing prices must be greater than a percentage (buy_a_closedelta_rate) of the closing price.

The absolute difference between the closing price and the lowest price within the time window (buy_a_time_window) must be less than a percentage (buy_a_tail_rate) of the difference between the middle and lower values of the Bollinger Bands.

The closing price must be less than the previous lower value of the Bollinger Bands. The closing price must be less than or equal to the previous closing price. The middle value of the Bollinger Bands (based on sell_bb_mid_slow_window) must be greater than a calculated threshold, which depends on buy_a_min_sell_rate and a rate derived from the average true range (ATR) calculated over a specified time window (buy_a_atr_window). In the ClucMay72018 strategy, the following conditions are checked: The closing price must be less than a moving average (ema_slow) calculated over a specified time period (buy_b_ema_slow). The closing price must be less than a percentage (buy_b_close_rate) of the lower value of the Bollinger Bands (based on a specified time window). The volume must be less than a certain number (buy_b_volume_mean_slow_num) times the previous moving average of the volume (buy_b_volume_mean_slow_window). If any of these conditions are met, a "buy" signal is generated for the respective row in the dataframe. In the sell trend, the strategy checks if the closing price is greater than the middle value of the Bollinger Bands (based on sell_bb_mid_slow_window). If so, a "sell" signal is generated for that row in the dataframe.

Unable to parse Traceback (Logfile Exceeded Limit)

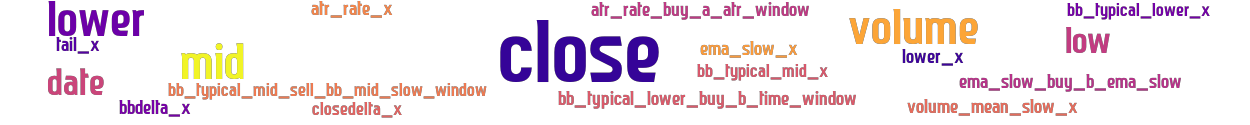

stoploss: -0.06 timeframe: 1m hash(sha256): 82200df31c45c2cb8b5c3ad3199c9d9cd0866d995374ba392cda4e752cdb88be indicators: bb_typical_mid_sell_bb_mid_slow_window bb_typical_lower_x close atr_rate_x ema_slow_x ema_slow_buy_b_ema_slow bb_typical_mid_x volume closedelta_x bbdelta_x date volume_mean_slow_x lower_x mid bb_typical_lower_buy_b_time_window atr_rate_buy_a_atr_window lower low tail_x

Similar Strategies: (based on used indicators)

Strategy: CBCHv3, Similarity Score: 95%

Strategy: TheCluc, Similarity Score: 90%

Strategy: tSmoothScalp20230110, Similarity Score: 90%

last change: 2025-06-02 00:22:48