The BollingerBounce strategy is a trading strategy that utilizes various technical analysis indicators to determine entry and exit points for trades. Here is a brief description of what the strategy does:

In the populate_indicators method, several indicators are calculated and added to the DataFrame:

MFI (Money Flow Index)

SMA (Simple Moving Average) with a time period of 40

MACD (Moving Average Convergence Divergence)

Stochastic Fast %K and %D

RSI (Relative Strength Index)

Fisher RSI

Bollinger Bands (upper, middle, and lower bands) using a weighted calculation

EMA (Exponential Moving Average) with time periods of 5, 10, 50, and 100

SAR (Stop and Reverse)

The populate_entry_trend method determines the conditions for entering a trade based on the calculated indicators:

If enabled, the MFI should be less than or equal to a specified value (buy_mfi)

If enabled, the Fisher RSI should be less than a specified value (buy_fisher)

The Bollinger Band gain should be greater than or equal to a specified value (buy_bb_gain)

The close price should be higher than the open price

The open price should be below the lower Bollinger Band, and the close price should be at or above the lower Bollinger Band

The volume should be greater than 0

The populate_exit_trend method determines the conditions for exiting a trade based on the calculated indicators:

If enabled, the strategy can hold positions without selling (sell_hold)

Otherwise, the sell signal is determined by the following conditions:

If the open price or the close price is above the upper Bollinger Band

If the Fisher RSI is higher than a specified value (sell_fisher) and the SAR (Stop and Reverse) is above the close price

The strategy uses these indicators and conditions to generate buy and sell signals, which can be used for backtesting and evaluating the performance of the trading strategy.

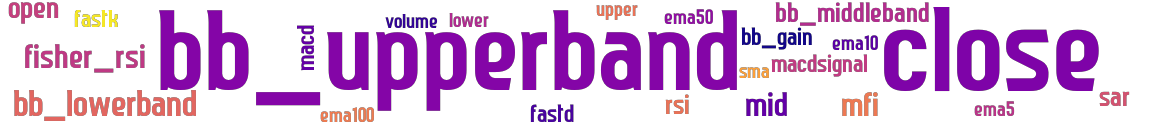

stoploss: 0 timeframe: 5m hash(sha256): 5d02f338b92d7d0d4349cbcf686db3e2654f767bcc5abea067f3901fbb3cedb9 indicators: upper close bb_gain mfi bb_lowerband ema5 fastk sma volume open fastd ema10 sar macdsignal mid fisher_rsi ema100 macd lower bb_middleband rsi bb_upperband ema50

Similar Strategies: (based on used indicators)

Strategy: BollingerBounce, Similarity Score: 95.83%

Strategy: ComboHold, Similarity Score: 95.83%

Strategy: BTCBigDrop, Similarity Score: 91.67%

Strategy: BTCBigDrop_2, Similarity Score: 91.67%

Strategy: BTCJump, Similarity Score: 91.67%

Strategy: BTCNDrop, Similarity Score: 91.67%

Strategy: BTCNDrop_2, Similarity Score: 91.67%

Strategy: BTCNSeq, Similarity Score: 91.67%

Strategy: BTCNSeq_2, Similarity Score: 91.67%

Strategy: BigDrop, Similarity Score: 91.67%

Strategy: BigDrop_2, Similarity Score: 91.67%

Strategy: KeltnerBounce, Similarity Score: 91.67%

Strategy: KeltnerBounce_2, Similarity Score: 91.67%

Strategy: NDrop, Similarity Score: 91.67%

Strategy: NDrop_2, Similarity Score: 91.67%

Strategy: NSeq, Similarity Score: 91.67%

Strategy: NSeq_2, Similarity Score: 91.67%

last change: 2025-01-14 17:25:14