The ComboHold strategy is a trading strategy that involves the use of multiple technical indicators for making buy/sell decisions. Here are the key components of the strategy:

Data Preparation:

The strategy starts by retrieving the price data for a given trading pair and timeframe. It also fetches Bitcoin (BTC) price data on a 5-minute timeframe.

The strategy merges the main pair's data with BTC data, aligning them.

Indicator Calculation: The strategy calculates various technical indicators, including: Average Directional Index (ADX) Directional Movement indicators (DM Plus and DM Minus) Money Flow Index (MFI) Simple Moving Average (SMA) Moving Average Convergence Divergence (MACD) Stochastic Fast (Fast %K and %D) Relative Strength Index (RSI) Fisher Transform of RSI Bollinger Bands (Upper Band, Middle Band, Lower Band) Exponential Moving Averages (EMA) of different periods Linear Regression Slope of EMA Parabolic SAR (Stop and Reverse) Condition Generation: The strategy generates buy/sell conditions based on combinations of indicator values.

It allows for enabling/disabling specific conditions based on configurable parameters. Examples of conditions include: MFI, Fisher RSI, and Bollinger Bands conditions for drop in price (ndrop and bigdrop) Fisher RSI and Bollinger Bands conditions for sequential increase in price (nseq) EMA angle and difference conditions for EMA bounce MACD, ADX, MFI, Fisher RSI, SAR, and Bollinger Bands conditions for MACD crossover Return of Conditions: The strategy returns a list of conditions that need to be satisfied for a buy/sell signal. These conditions are used in the backtesting process to simulate trading decisions. Note: The strategy emphasizes using a minimal number of indicators for optimal performance and provides parameters to enable/disable specific conditions based on the desired strategy configuration.

The strategy merges the main pair's data with BTC data, aligning them.

Indicator Calculation: The strategy calculates various technical indicators, including: Average Directional Index (ADX) Directional Movement indicators (DM Plus and DM Minus) Money Flow Index (MFI) Simple Moving Average (SMA) Moving Average Convergence Divergence (MACD) Stochastic Fast (Fast %K and %D) Relative Strength Index (RSI) Fisher Transform of RSI Bollinger Bands (Upper Band, Middle Band, Lower Band) Exponential Moving Averages (EMA) of different periods Linear Regression Slope of EMA Parabolic SAR (Stop and Reverse) Condition Generation: The strategy generates buy/sell conditions based on combinations of indicator values.

It allows for enabling/disabling specific conditions based on configurable parameters. Examples of conditions include: MFI, Fisher RSI, and Bollinger Bands conditions for drop in price (ndrop and bigdrop) Fisher RSI and Bollinger Bands conditions for sequential increase in price (nseq) EMA angle and difference conditions for EMA bounce MACD, ADX, MFI, Fisher RSI, SAR, and Bollinger Bands conditions for MACD crossover Return of Conditions: The strategy returns a list of conditions that need to be satisfied for a buy/sell signal. These conditions are used in the backtesting process to simulate trading decisions. Note: The strategy emphasizes using a minimal number of indicators for optimal performance and provides parameters to enable/disable specific conditions based on the desired strategy configuration.

Unable to parse Traceback (Logfile Exceeded Limit)

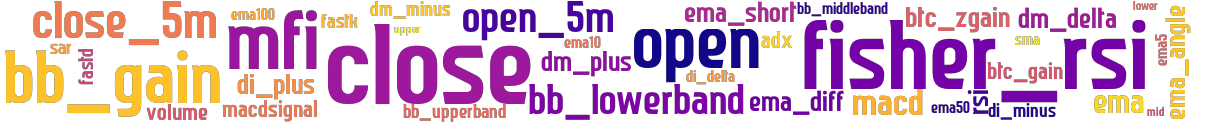

stoploss: 0 timeframe: 5m hash(sha256): 792aafb1405224c8d4e39224ccb79da122c1ae383f2e852e97d77b82b7a68d62 indicators: upper btc_gain close btc_zgain open_5m dm_delta bb_gain mfi bb_lowerband ema5 fastk sma volume ema_dif open fastd dm_plus ema10 sar ema_diff macdsignal ema mid ema_angle fisher_rsi ema100 di_plus macd di_delta adx lower bb_middleband rsi di_minus bb_upperband ema_short ema50 close_5m dm_minus

Similar Strategies: (based on used indicators)

Strategy: BTCJump, Similarity Score: 85%

last change: 2025-01-15 06:28:59