Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BB_RPB_TSL_v103 strategy is a trading strategy implemented as a class in Python. Here is a brief description of what the strategy does:

populate_indicators: This function takes a DataFrame and metadata as input and populates the indicators for the strategy. It merges informative data from a 1-hour timeframe and applies normal time frame indicators.

populate_buy_trend: This function determines the conditions for buying based on various indicators.

It initializes an empty list of conditions and assigns an empty string to the 'buy_tag' column in the DataFrame.

The strategy considers the following conditions for buying: is_dip: Determines if the RMI, CCI, and SRSI indicators meet specific criteria. is_break: Checks if the BB delta, BB width, and closedelta meet specific values. is_local_uptrend: Considers the EMA indicators, open values, and BB lowerband to identify a local uptrend. is_local_dip: Checks for a local dip based on EMA indicators, open values, RSI, CRSI, and closedelta. is_ewo: Considers RSI, EMA, and EWO indicators for buying. is_ewo_2: Considers a combination of indicators including EMA, RSI, and EWO for buying. is_nfi_13: Checks specific conditions involving EMA, SMA, CTI, and EWO for buying. is_nfi_32: Checks specific conditions involving RSI, SMA, CTI, and close values for buying. is_nfi_33: Checks specific conditions involving EMA, EWO, RSI, volume, and r_14 for buying. is_nfi_38: Considers various indicators including PM, SMA, EWO, CTI, r_14, and CRSI_1h for buying. The strategy appends the respective buy tags to the 'buy_tag' column based on the fulfilled conditions. If any conditions are met, an additional check is performed using the roc_1h and bb_width_1h indicators. Overall, the strategy combines multiple indicators to determine potential buying opportunities based on specific criteria.

populate_buy_trend: This function determines the conditions for buying based on various indicators.

It initializes an empty list of conditions and assigns an empty string to the 'buy_tag' column in the DataFrame.

The strategy considers the following conditions for buying: is_dip: Determines if the RMI, CCI, and SRSI indicators meet specific criteria. is_break: Checks if the BB delta, BB width, and closedelta meet specific values. is_local_uptrend: Considers the EMA indicators, open values, and BB lowerband to identify a local uptrend. is_local_dip: Checks for a local dip based on EMA indicators, open values, RSI, CRSI, and closedelta. is_ewo: Considers RSI, EMA, and EWO indicators for buying. is_ewo_2: Considers a combination of indicators including EMA, RSI, and EWO for buying. is_nfi_13: Checks specific conditions involving EMA, SMA, CTI, and EWO for buying. is_nfi_32: Checks specific conditions involving RSI, SMA, CTI, and close values for buying. is_nfi_33: Checks specific conditions involving EMA, EWO, RSI, volume, and r_14 for buying. is_nfi_38: Considers various indicators including PM, SMA, EWO, CTI, r_14, and CRSI_1h for buying. The strategy appends the respective buy tags to the 'buy_tag' column based on the fulfilled conditions. If any conditions are met, an additional check is performed using the roc_1h and bb_width_1h indicators. Overall, the strategy combines multiple indicators to determine potential buying opportunities based on specific criteria.

startup_candle_count : 50 rsi_1h: -0.535% rmi_length_17: 1.717% ema_12: -0.001% ema_13: -0.001% ema_16: -0.002% ema_20: -0.002% ema_26: -0.040% rsi: 1.737% rsi_fast: 0.006% rsi_slow: 2.186% adx: 32.037% pm: 0.003%

Unable to parse Traceback (Logfile Exceeded Limit)

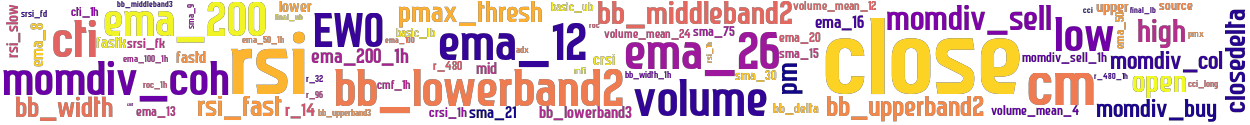

stoploss: -0.99 timeframe: 5m hash(sha256): 6895058a7cbfb11df7778eae5eac83afb25986321e45e0e36dbd971ce5826611 indicators: upper close volume_mean_12 ema_200_1h rsi_fast r_480_1h volume ema_20 source momdiv_coh bb_upperband2 volume_mean_24 high r_480 ema_8 cci bb_lowerband3 rsi_1h final_ub momdiv_col pm adx ema_12 ema_26 bb_width_1h cmf_1h basic_ub sma_21 momdiv_buy bb_middleband2 closedelta sma_15 volume_mean_4 cmf rmi_length_val lower roc r_32 rsi momdiv_sell crsi_1h bb_middleband3 bb_upperband3 ema_50 mfi srsi_fk r_14 srsi_fd cci_long momdiv_sell_1h ema_50_1h mid bb_width ema_16 sma_75 sma_9 basic_lb cm rsi_slow

Similar Strategies: (based on used indicators)

Strategy: BB_RPB_TSL_5, Similarity Score: 96.72%

Strategy: BB_RPB_TSL_BI, Similarity Score: 85.25%

Strategy: BB_RPB_TSL_BIV1, Similarity Score: 85.25%

Strategy: BB_RPB_TSL_BI_2, Similarity Score: 85.25%

Strategy: BB_RPB_TSL_BI_3, Similarity Score: 85.25%

Strategy: BB_RPB_TSL_BI_v4_EWO2_v3_0, Similarity Score: 85.25%

Strategy: BRB, Similarity Score: 85.25%

Strategy: Discord_1_BB_RPB_TSL_BI, Similarity Score: 80.33%

last change: 2024-08-02 08:44:10