You will be redirected to the original Strategy in 15 seconds.

The BB_RPB_TSL strategy is a trading strategy that uses various technical indicators to determine buy signals in the market. Here's a breakdown of its important components:

populate_indicators function: This function calculates and adds the necessary indicators to the input dataframe for the strategy to use. It merges the informative 1-hour indicators with the current timeframe indicators.

populate_buy_trend function: This function determines the buy signals based on specific conditions and assigns a buy tag to the corresponding rows in the dataframe.

is_dip: Checks for a dip in indicators such as RMI, CCI, and SRSI.

is_break: Looks for a breakout based on indicators like Bollinger Bands, delta, and width. is_local_uptrend: Identifies a local uptrend using EMA and Bollinger Bands. is_local_dip: Recognizes a local dip using EMA, RSI, CRSI, and other factors. is_ewo: Considers the EWO indicator, RSI, and EMA for generating a buy signal. is_ewo_2: Uses various indicators, including EMA, RSI, and EWO, for identifying a buy opportunity. is_nfi_13: Considers indicators like EMA, SMA, CTI, and EWO to find a buy signal. is_nfi_32: Checks for specific conditions related to RSI, SMA, CTI, and EWO. is_nfi_33: Analyzes conditions such as EMA, EWO, RSI, and volume to generate a buy signal. is_nfi_38: Considers indicators like PM, SMA, EWO, CTI, RSI, and CRSI for identifying a buy opportunity. is_additional_check: Performs additional checks based on indicators from a 1-hour timeframe. If any of the conditions are met, the corresponding buy tag is appended to the 'buy_tag' column in the dataframe. This strategy combines multiple indicators and conditions to generate buy signals, providing a systematic approach to backtesting and evaluating trading strategies.

populate_buy_trend function: This function determines the buy signals based on specific conditions and assigns a buy tag to the corresponding rows in the dataframe.

is_dip: Checks for a dip in indicators such as RMI, CCI, and SRSI.

is_break: Looks for a breakout based on indicators like Bollinger Bands, delta, and width. is_local_uptrend: Identifies a local uptrend using EMA and Bollinger Bands. is_local_dip: Recognizes a local dip using EMA, RSI, CRSI, and other factors. is_ewo: Considers the EWO indicator, RSI, and EMA for generating a buy signal. is_ewo_2: Uses various indicators, including EMA, RSI, and EWO, for identifying a buy opportunity. is_nfi_13: Considers indicators like EMA, SMA, CTI, and EWO to find a buy signal. is_nfi_32: Checks for specific conditions related to RSI, SMA, CTI, and EWO. is_nfi_33: Analyzes conditions such as EMA, EWO, RSI, and volume to generate a buy signal. is_nfi_38: Considers indicators like PM, SMA, EWO, CTI, RSI, and CRSI for identifying a buy opportunity. is_additional_check: Performs additional checks based on indicators from a 1-hour timeframe. If any of the conditions are met, the corresponding buy tag is appended to the 'buy_tag' column in the dataframe. This strategy combines multiple indicators and conditions to generate buy signals, providing a systematic approach to backtesting and evaluating trading strategies.

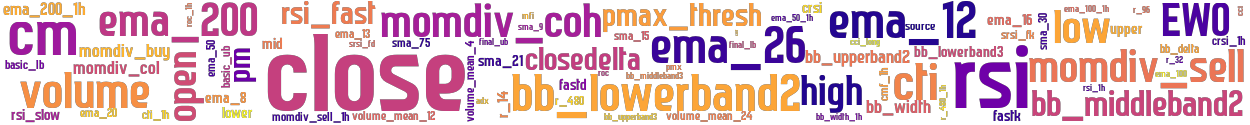

stoploss: -0.99 timeframe: 5m hash(sha256): c50c7379db86784c472c5cb4994db91060488f9a8f34500240e9bf9dc509ca77 indicators: upper close volume_mean_12 ema_200_1h rsi_fast r_480_1h volume ema_20 source momdiv_coh bb_upperband2 volume_mean_24 high r_480 ema_8 cci bb_lowerband3 rsi_1h final_ub momdiv_col pm adx ema_12 ema_26 bb_width_1h cmf_1h basic_ub sma_21 momdiv_buy bb_middleband2 closedelta sma_15 volume_mean_4 cmf rmi_length_val lower roc r_32 rsi momdiv_sell crsi_1h bb_middleband3 bb_upperband3 ema_50 mfi srsi_fk r_14 srsi_fd cci_long momdiv_sell_1h ema_50_1h mid bb_width ema_16 sma_75 sma_9 basic_lb cm rsi_slow

Similar Strategies: (based on used indicators)

Strategy: BB_RPB_TSL_v103, Similarity Score: 96.72%

Strategy: BB_RPB_TSL_BI, Similarity Score: 85.25%

Strategy: BB_RPB_TSL_BIV1, Similarity Score: 85.25%

Strategy: BB_RPB_TSL_BI_2, Similarity Score: 85.25%

Strategy: BB_RPB_TSL_BI_3, Similarity Score: 85.25%

Strategy: BB_RPB_TSL_BI_v4_EWO2_v3_0, Similarity Score: 85.25%

Strategy: BRB, Similarity Score: 85.25%

Strategy: Discord_1_BB_RPB_TSL_BI, Similarity Score: 80.33%

last change: 2023-04-26 07:44:05