You will be redirected to the original Strategy in 15 seconds.

The BB_RPB_TSL_RNG strategy is a trading strategy that uses various indicators to generate buy signals. Here's a breakdown of what the strategy does:

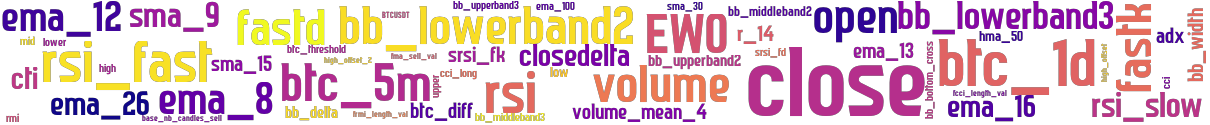

Indicators: The strategy first populates several indicators on the input dataframe, including Bollinger Bands with different standard deviations (2 and 3), BTC price thresholds, Bollinger Band width and delta, Commodity Channel Index (CCI), Relative Momentum Index (RMI), Stochastic Relative Strength Index (StochRSI), closed price delta, Simple Moving Averages (SMA), Chande Trend Index (CTI), Exponential Moving Averages (EMA), Hull Moving Average (HMA), Relative Strength Index (RSI), Elliot Wave Oscillator (EWO), Average Directional Index (ADX), and Williams %R. Buy Trend Conditions: The strategy then defines several conditions for determining buy signals.

These conditions include: Checking if the RMI length is below a certain threshold, CCI length is below another threshold, and StochRSI fastk is below a specified value, indicating a dip in the market.

Checking if the Bollinger Band delta and width are above specified values, and the closed price delta is above a threshold, suggesting a breakout.

Identifying a local uptrend based on EMA values and their differences, and the price being below a certain multiple of the lower Bollinger Band. Considering the EWO, RSI, and EMA values for generating buy signals. Additional Conditions: The strategy also includes conditions related to EWO, fastk, fastd, ADX, and EMA for determining buy signals. Buy Tag: The strategy adds a 'buy_tag' column to the dataframe to mark the occurrence of buy signals. Overall, the BB_RPB_TSL_RNG strategy utilizes multiple indicators and conditions to identify potential buying opportunities in the market.

These conditions include: Checking if the RMI length is below a certain threshold, CCI length is below another threshold, and StochRSI fastk is below a specified value, indicating a dip in the market.

Checking if the Bollinger Band delta and width are above specified values, and the closed price delta is above a threshold, suggesting a breakout.

Identifying a local uptrend based on EMA values and their differences, and the price being below a certain multiple of the lower Bollinger Band. Considering the EWO, RSI, and EMA values for generating buy signals. Additional Conditions: The strategy also includes conditions related to EWO, fastk, fastd, ADX, and EMA for determining buy signals. Buy Tag: The strategy adds a 'buy_tag' column to the dataframe to mark the occurrence of buy signals. Overall, the BB_RPB_TSL_RNG strategy utilizes multiple indicators and conditions to identify potential buying opportunities in the market.

stoploss: -0.99 timeframe: 5m hash(sha256): 16d2a3447cd0c6744c8bd60e65096dffe5a47a3b87aec0660487a871bb4782fe indicators: upper bb_middleband3 bb_upperband3 btc_1d EWO btc_5m ema_13 close high_offset_2 cci_length_val fastk rsi_fast ma_sell_val srsi_fk r_14 bb_middleband2 volume srsi_fd cci_long closedelta bb_bottom_cross high_offset open bb_delta btc_diff fastd btc_threshold sma_15 bb_upperband2 high volume_mean_4 mid bb_width ema_8 ema_16 cci rmi_length_val base_nb_candles_sell hma_50 bb_lowerband3 cti sma_9 ema_100 adx lower ema_12 sma_30 rsi_slow rsi ema_26 low btc_dif bb_lowerband2

Similar Strategies: (based on used indicators)

Strategy: BB_RPB_TSL_RNG, Similarity Score: 98.15%

Strategy: BB_RPB_TSL_RNG_2, Similarity Score: 98.15%

Strategy: BB_RPB_TSL_RNG_2_0, Similarity Score: 98.15%

Strategy: BB_RPB_TSL_RNG_2_2, Similarity Score: 98.15%

Strategy: BB_RPB_TSL_RNG_2_3, Similarity Score: 98.15%

Strategy: BB_RPB_TSL_RNG_2_4, Similarity Score: 98.15%

Strategy: BB_RPB_TSL_RNG_5, Similarity Score: 98.15%

Strategy: BB_RPB_TSL_RNG_724, Similarity Score: 98.15%

Strategy: 1_BB_RPB_TSL_RNG_VWAP, Similarity Score: 96.3%

Strategy: BB_RPB_TSL_RNG_VWAP, Similarity Score: 96.3%

Strategy: BB_RPB_TSL_RNG_VWAP_0, Similarity Score: 96.3%

Strategy: BB_RPB_TSL_RNG_VWAP_2, Similarity Score: 96.3%

Strategy: BB_RPB_TSL_RNG_TBS, Similarity Score: 92.59%

Strategy: BB_RPB_TSL_RNG_TBS_GOLD, Similarity Score: 92.59%

Strategy: BB_RPB_TSL_RNG_TBS_GOLD2, Similarity Score: 92.59%

Strategy: C13Xa, Similarity Score: 92.59%

Strategy: C13Xb, Similarity Score: 92.59%

last change: 2022-07-04 01:01:00