You will be redirected to the original Strategy in 15 seconds.

The BBMod strategy is a trading strategy that uses various indicators to generate buy signals. Here is a breakdown of the important parts of the strategy:

populate_indicators: This function is responsible for populating the indicators used in the strategy. It takes a DataFrame and metadata as input and returns the updated DataFrame with the indicators.

populate_buy_trend: This function is used to determine the buy signals based on specific conditions.

It adds a column called 'buy_tag' to the DataFrame to mark the buy signals.

The strategy uses multiple conditions to identify potential buying opportunities. Some of the important conditions include: is_local_uptrend and is_local_uptrend2: These conditions check for an uptrend based on exponential moving averages (EMA) and the distance between them. It also considers the close price in relation to the lower Bollinger Band. is_local_dip: This condition identifies a local dip in the price based on EMA, RSI, and other factors. is_ewo: This condition involves the EWO (Elliott Wave Oscillator) and various moving averages to find potential buying opportunities. is_clucha: This condition uses different indicators such as rate of change (ROCR), Bollinger Bands, and price movement to detect buying signals. is_cofi: This condition is modified from the "cofi" strategy and involves indicators such as moving averages, fast stochastic, ADX, and EWO. is_nfi_32, is_nfi_33, is_nfix_5, is_nfix_39, is_nfix_49, is_nfi7_33, is_nfi7_37: These conditions are based on various combinations of indicators, including RSI, CTI (custom indicator), moving averages, and volume. Each condition represents a different pattern or set of criteria that the strategy uses to generate buy signals. By combining these conditions, the strategy aims to identify potentially profitable trading opportunities.

populate_buy_trend: This function is used to determine the buy signals based on specific conditions.

It adds a column called 'buy_tag' to the DataFrame to mark the buy signals.

The strategy uses multiple conditions to identify potential buying opportunities. Some of the important conditions include: is_local_uptrend and is_local_uptrend2: These conditions check for an uptrend based on exponential moving averages (EMA) and the distance between them. It also considers the close price in relation to the lower Bollinger Band. is_local_dip: This condition identifies a local dip in the price based on EMA, RSI, and other factors. is_ewo: This condition involves the EWO (Elliott Wave Oscillator) and various moving averages to find potential buying opportunities. is_clucha: This condition uses different indicators such as rate of change (ROCR), Bollinger Bands, and price movement to detect buying signals. is_cofi: This condition is modified from the "cofi" strategy and involves indicators such as moving averages, fast stochastic, ADX, and EWO. is_nfi_32, is_nfi_33, is_nfix_5, is_nfix_39, is_nfix_49, is_nfi7_33, is_nfi7_37: These conditions are based on various combinations of indicators, including RSI, CTI (custom indicator), moving averages, and volume. Each condition represents a different pattern or set of criteria that the strategy uses to generate buy signals. By combining these conditions, the strategy aims to identify potentially profitable trading opportunities.

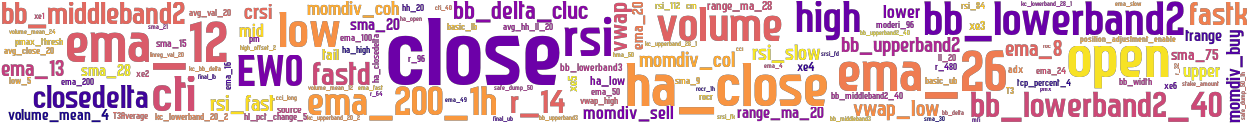

stoploss: -0.99 timeframe: 5m hash(sha256): 12ea6e9bbbee8c851ad45b94c2a1f4e3a86e91dab209f1c84f77677bafdef395 indicators: upper close high_offset_2 position_adjustment_enable volume_mean_12 ema_200_1h safe_dump_50 avg_val_20 rsi_fast volume xe1 ema_20 source ha_closedelta momdiv_coh trange bb_upperband2 volume_mean_24 high ema_8 r_480 cci bb_lowerband3 xe6 final_ub low_5 momdiv_col ha_high pm adx ema_12 sma_28 T3Average ema_slow ema_26 bb_lowerband2_40 bb_upperband2_40 basic_ub ema_49 sma_21 momdiv_buy bb_middleband2 closedelta ema_fast sma_15 ha_open volume_mean_4 tcp_percent_4 avg_close_20 ema_24 cmf rmi_length_v

Similar Strategies: (based on used indicators)

Strategy: BBMod, Similarity Score: 98.11%

Strategy: BBMod1_0, Similarity Score: 98.11%

Strategy: BBMod1_2, Similarity Score: 94.34%

Strategy: BBMod1_3, Similarity Score: 94.34%

Strategy: BBMod1, Similarity Score: 90.57%

Strategy: BB_RPB_TSL, Similarity Score: 86.79%

Strategy: BB_RPB_TSL_221, Similarity Score: 86.79%

Strategy: BB_RPB_TSL_3, Similarity Score: 86.79%

Strategy: BB_RPB_TSL_8, Similarity Score: 86.79%

Strategy: BB_RPB_TSL_meneguzzo, Similarity Score: 86.79%

Strategy: BB_RPB_TSLmeneguzzo, Similarity Score: 86.79%

Strategy: BB_RPB_TSLmeneguzzo_3, Similarity Score: 86.79%

Strategy: BB_RPB_TSLmeneguzzo_3_2, Similarity Score: 86.79%

Strategy: BRTMinus, Similarity Score: 86.79%

Strategy: Discord_1_BB_RPB_TSL, Similarity Score: 86.79%

Strategy: Discord_BB_RPB_TSL, Similarity Score: 86.79%

Strategy: HakimYiech, Similarity Score: 86.79%

Strategy: meneguzzo_v3, Similarity Score: 86.79%

Strategy: meneguzzo_v4_dca, Similarity Score: 86.79%

Strategy: BRTM, Similarity Score: 84.91%

Strategy: BB_RPB_TSL_140, Similarity Score: 83.02%

Strategy: BB_RPB_TSL_4, Similarity Score: 83.02%

Strategy: BB_RPB_TSL_600, Similarity Score: 83.02%

Strategy: BB_RPB, Similarity Score: 75.47%

Strategy: BB_RPB_TSLX, Similarity Score: 75.47%

Strategy: BB_RPB_TSL_Tranz203, Similarity Score: 75.47%

Strategy: BB_RPB_TSL_v104, Similarity Score: 75.47%

Strategy: Discord_1_BB_RPB_TSL_BI, Similarity Score: 75.47%

Strategy: gus_delta, Similarity Score: 75.47%

last change: 2022-07-02 19:54:08