Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BBMod strategy is a backtesting strategy that uses various indicators to determine buy signals in a trading system. Here is a brief description of what the strategy does:

The populate_indicators function populates the required indicators for the strategy using the input dataframe and metadata. It merges informative data from a 1-hour timeframe and normal timeframe indicators.

The populate_buy_trend function identifies buy conditions based on a set of criteria.

It assigns a 'buy_tag' to the dataframe to mark potential buy signals.

The strategy incorporates multiple conditions to identify potential buy signals, such as: is_local_uptrend: Checks for an uptrend based on exponential moving averages (EMA) and a lower Bollinger Band factor. is_local_dip: Identifies a local dip in the market using EMA, RSI, and other criteria. is_ewo: Uses a combination of RSI, EMA, and Elder's Force Index (EWO) to detect potential buying opportunities. is_clucha: Implements conditions based on the Clucha indicator and Bollinger Bands. is_cofi: Utilizes modified conditions from the Cofi strategy involving EMA, ADX, and other indicators. is_nfi_32, is_nfi_33, is_nfix_5, is_nfix_39, is_nfix_49, is_nfi7_33, is_nfi7_37: Various conditions based on different combinations of indicators and thresholds. These conditions evaluate specific aspects of the market and asset price movements to generate potential buy signals.

The populate_buy_trend function identifies buy conditions based on a set of criteria.

It assigns a 'buy_tag' to the dataframe to mark potential buy signals.

The strategy incorporates multiple conditions to identify potential buy signals, such as: is_local_uptrend: Checks for an uptrend based on exponential moving averages (EMA) and a lower Bollinger Band factor. is_local_dip: Identifies a local dip in the market using EMA, RSI, and other criteria. is_ewo: Uses a combination of RSI, EMA, and Elder's Force Index (EWO) to detect potential buying opportunities. is_clucha: Implements conditions based on the Clucha indicator and Bollinger Bands. is_cofi: Utilizes modified conditions from the Cofi strategy involving EMA, ADX, and other indicators. is_nfi_32, is_nfi_33, is_nfix_5, is_nfix_39, is_nfix_49, is_nfi7_33, is_nfi7_37: Various conditions based on different combinations of indicators and thresholds. These conditions evaluate specific aspects of the market and asset price movements to generate potential buy signals.

startup_candle_count : 120 ema_50_1h: -0.009% ema_100_1h: 0.234% rsi_1h: 0.005% rmi_length_17: 0.002% srsi_fk: 0.409% srsi_fd: 0.410% hma_50: 0.020% ema_26: 0.001% ema_49: 0.028% ema_50: 0.030% ema_100: 0.094% rsi: -0.053% rsi_slow: -0.716% rsi_84: -13.138% ema_slow: 0.031% adx: 0.873% fisher: 0.929%

Unable to parse Traceback (Logfile Exceeded Limit)

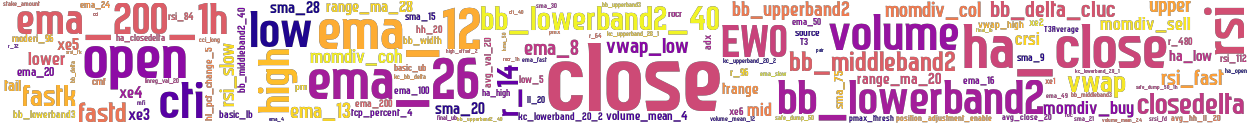

stoploss: -0.99 timeframe: 5m hash(sha256): e2ea71c067dca6931ba9a864468d3dfe1ea24787a699f32995eb405d221319ff indicators: upper close high_offset_2 position_adjustment_enable volume_mean_12 ema_200_1h safe_dump_50 avg_val_20 rsi_fast volume xe1 ema_20 source ha_closedelta momdiv_coh trange bb_upperband2 volume_mean_24 high ema_8 r_480 cci bb_lowerband3 xe6 final_ub low_5 momdiv_col ha_high pm adx ema_12 sma_28 T3Average ema_slow ema_26 bb_lowerband2_40 bb_upperband2_40 basic_ub ema_49 sma_21 momdiv_buy bb_middleband2 closedelta ema_fast sma_15 ha_open volume_mean_4 tcp_percent_4 avg_close_20 ema_24 cmf rmi_length_v

Similar Strategies: (based on used indicators)

Strategy: BBMod1_0, Similarity Score: 98.11%

Strategy: BBMod_6, Similarity Score: 98.11%

Strategy: BBMod1_2, Similarity Score: 94.34%

Strategy: BBMod1_3, Similarity Score: 94.34%

Strategy: BBMod1, Similarity Score: 90.57%

Strategy: BB_RPB_TSL, Similarity Score: 86.79%

Strategy: BB_RPB_TSL_221, Similarity Score: 86.79%

Strategy: BB_RPB_TSL_3, Similarity Score: 86.79%

Strategy: BB_RPB_TSL_8, Similarity Score: 86.79%

Strategy: BB_RPB_TSL_meneguzzo, Similarity Score: 86.79%

Strategy: BB_RPB_TSLmeneguzzo, Similarity Score: 86.79%

Strategy: BB_RPB_TSLmeneguzzo_3, Similarity Score: 86.79%

Strategy: BB_RPB_TSLmeneguzzo_3_2, Similarity Score: 86.79%

Strategy: BRTMinus, Similarity Score: 86.79%

Strategy: Discord_1_BB_RPB_TSL, Similarity Score: 86.79%

Strategy: Discord_BB_RPB_TSL, Similarity Score: 86.79%

Strategy: HakimYiech, Similarity Score: 86.79%

Strategy: meneguzzo_v3, Similarity Score: 86.79%

Strategy: meneguzzo_v4_dca, Similarity Score: 86.79%

Strategy: BRTM, Similarity Score: 84.91%

Strategy: BB_RPB_TSL_140, Similarity Score: 83.02%

Strategy: BB_RPB_TSL_4, Similarity Score: 83.02%

Strategy: BB_RPB_TSL_600, Similarity Score: 83.02%

Strategy: BB_RPB, Similarity Score: 75.47%

Strategy: BB_RPB_TSLX, Similarity Score: 75.47%

Strategy: BB_RPB_TSL_Tranz203, Similarity Score: 75.47%

Strategy: BB_RPB_TSL_v104, Similarity Score: 75.47%

Strategy: Discord_1_BB_RPB_TSL_BI, Similarity Score: 75.47%

Strategy: gus_delta, Similarity Score: 75.47%

last change: 2025-06-02 01:39:07