You will be redirected to the original Strategy in 15 seconds.

The BBModCE strategy is a trading strategy that utilizes various technical indicators to make buy and sell decisions in the market. Here is a summary of what the strategy does:

Indicator Calculation:

Simple Moving Average (SMA) with a time period of 15. Commodity Trend Index (CTI) with a length of 20.

Exponential Moving Average (EMA) with time periods of 8 and 16.

Relative Strength Index (RSI) with a time period of 14, as well as fast and slow versions with time periods of 4 and 20, respectively.

Elder's Force Index (EWO) with parameters 50 and 200. Williams %R (r_14) with a period of 14. Stochastic Fast (fastk and fastd) with parameters 5, 3, 0, 3, 0. Average Directional Index (ADX). Entry Trend Calculation: The strategy defines different conditions for entering a trade based on a combination of indicators. These conditions include comparisons and thresholds for various indicators such as rate of change (roc_1h), Bollinger Bands width (bb_width_1h), opening price, fastk, fastd, ADX, EWO, CTI, and r_14. The strategy assigns tags to the entry conditions that are met. Exit Trend Calculation: The strategy defines an exit condition based on the crossing of fastk above a specified threshold (sell_fastx). It assigns an exit tag when this condition is met. Leverage Calculation: The strategy returns the proposed leverage value as the leverage_num parameter. Overall, the BBModCE strategy combines various technical indicators to identify potential buying opportunities based on predefined conditions. It also provides an exit condition based on the crossing of fastk. The leverage value is returned based on the provided parameter.

Exponential Moving Average (EMA) with time periods of 8 and 16.

Relative Strength Index (RSI) with a time period of 14, as well as fast and slow versions with time periods of 4 and 20, respectively.

Elder's Force Index (EWO) with parameters 50 and 200. Williams %R (r_14) with a period of 14. Stochastic Fast (fastk and fastd) with parameters 5, 3, 0, 3, 0. Average Directional Index (ADX). Entry Trend Calculation: The strategy defines different conditions for entering a trade based on a combination of indicators. These conditions include comparisons and thresholds for various indicators such as rate of change (roc_1h), Bollinger Bands width (bb_width_1h), opening price, fastk, fastd, ADX, EWO, CTI, and r_14. The strategy assigns tags to the entry conditions that are met. Exit Trend Calculation: The strategy defines an exit condition based on the crossing of fastk above a specified threshold (sell_fastx). It assigns an exit tag when this condition is met. Leverage Calculation: The strategy returns the proposed leverage value as the leverage_num parameter. Overall, the BBModCE strategy combines various technical indicators to identify potential buying opportunities based on predefined conditions. It also provides an exit condition based on the crossing of fastk. The leverage value is returned based on the provided parameter.

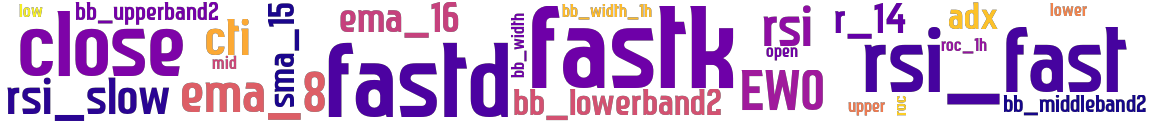

stoploss: -0.99 timeframe: 5m hash(sha256): 9ce1e07b2d9b535e0ff9994068858ed1b4dc98843442181dd1222d63c3aac9b3 indicators: upper EWO close fastk rsi_fast r_14 bb_middleband2 open fastd sma_15 bb_upperband2 mid bb_width ema_8 ema_16 cti roc_1h adx roc lower rsi_slow rsi low bb_lowerband2 bb_width_1h

Similar Strategies: (based on used indicators)

Strategy: BBMCE, Similarity Score: 96.15%

Strategy: BBMCE2, Similarity Score: 96.15%

Strategy: BBMX, Similarity Score: 96.15%

Strategy: BBModCE, Similarity Score: 96.15%

Strategy: BBModCESpot_2, Similarity Score: 96.15%

Strategy: BBModCE_3, Similarity Score: 96.15%

Strategy: BBModCE_4, Similarity Score: 96.15%

Strategy: BBModCE_5, Similarity Score: 96.15%

Strategy: E0V1E_3, Similarity Score: 96.15%

last change: 2024-06-01 06:26:19