Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The ViNex strategy is a trading strategy implemented in Python using the FreqTrade library. Here is a short description of what the strategy does:

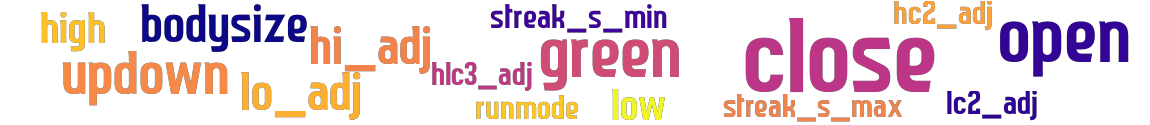

The strategy calculates various indicators based on the input data, such as the 'green' indicator, 'bodysize', 'hi_adj', 'lo_adj', 'hlc3_adj', 'lc2_adj', 'hc2_adj', and streak indicators. The 'green' indicator determines whether the closing price is higher or equal to the opening price.

The 'bodysize' calculates the ratio between the closing price and opening price.

The 'hi_adj' and 'lo_adj' adjust the high and low prices based on the 'green' indicator and the 'bodysize'.

The 'hlc3_adj' calculates the average of the adjusted high, low, and closing prices. The streak indicators track consecutive upward or downward movements in the closing prices over different time intervals. The strategy stores the calculated indicators in a DataFrame and appends it to a CSV file for further analysis. The strategy does not populate any specific buy or sell signals, as the 'buy' and 'sell' columns in the DataFrame are set to False. The 'bot_loop_start' function is called at the beginning of the trading loop and performs some initialization tasks, such as clearing the CSV file if the strategy is not running in live or dry run mode. Overall, the ViNex strategy focuses on calculating various indicators based on price movements, but it doesn't implement specific buying or selling rules. It serves as a foundation for further customization and development of trading strategies.

The 'bodysize' calculates the ratio between the closing price and opening price.

The 'hi_adj' and 'lo_adj' adjust the high and low prices based on the 'green' indicator and the 'bodysize'.

The 'hlc3_adj' calculates the average of the adjusted high, low, and closing prices. The streak indicators track consecutive upward or downward movements in the closing prices over different time intervals. The strategy stores the calculated indicators in a DataFrame and appends it to a CSV file for further analysis. The strategy does not populate any specific buy or sell signals, as the 'buy' and 'sell' columns in the DataFrame are set to False. The 'bot_loop_start' function is called at the beginning of the trading loop and performs some initialization tasks, such as clearing the CSV file if the strategy is not running in live or dry run mode. Overall, the ViNex strategy focuses on calculating various indicators based on price movements, but it doesn't implement specific buying or selling rules. It serves as a foundation for further customization and development of trading strategies.

stoploss: -1 timeframe: 5m hash(sha256): df794a59cebc56a49e0510f7c072894226cb977ae16b9a9cbc2b82994da42624

Was not able to fetch indicators from Strategyfile.

last change: 2023-08-28 21:59:36