The bbrsi7sortino strategy is a backtesting strategy that utilizes technical analysis (TA) indicators to generate buy and sell signals for trading. Here is a short description of what the strategy does:

populate_indicators function:

This function adds various TA indicators to the given DataFrame, which contains data from the exchange. The indicators used are:

Relative Strength Index (RSI)

Bollinger Bands with a window of 20 and standard deviations of 1 (bb_lowerband1, bb_middleband1, bb_upperband1)

Bollinger Bands with a window of 30 and standard deviations of 4 (bb_lowerband4, bb_middleband4, bb_upperband4)

The function returns a DataFrame with all the mandatory indicators for the strategy.

populate_buy_trend function: This function populates the buy signal for the DataFrame based on the TA indicators.

The buy signal is triggered when the close price is below the lower Bollinger Band with 4 standard deviations (bb_lowerband4).

The function assigns a value of 1 to the 'buy' column for the corresponding rows where the buy signal is present. The function returns the DataFrame with the 'buy' column populated. populate_sell_trend function: This function populates the sell signal for the DataFrame based on the TA indicators. The sell signal is triggered when the RSI is above 89 and the close price is above the upper Bollinger Band with 1 standard deviation (bb_upperband1). The function assigns a value of 1 to the 'sell' column for the corresponding rows where the sell signal is present. The function returns the DataFrame with the 'sell' column populated. The strategy also includes a dictionary named minimal_roi, which defines the expected return on investment (ROI) at different time intervals (0, 40, 60, and 120).

populate_buy_trend function: This function populates the buy signal for the DataFrame based on the TA indicators.

The buy signal is triggered when the close price is below the lower Bollinger Band with 4 standard deviations (bb_lowerband4).

The function assigns a value of 1 to the 'buy' column for the corresponding rows where the buy signal is present. The function returns the DataFrame with the 'buy' column populated. populate_sell_trend function: This function populates the sell signal for the DataFrame based on the TA indicators. The sell signal is triggered when the RSI is above 89 and the close price is above the upper Bollinger Band with 1 standard deviation (bb_upperband1). The function assigns a value of 1 to the 'sell' column for the corresponding rows where the sell signal is present. The function returns the DataFrame with the 'sell' column populated. The strategy also includes a dictionary named minimal_roi, which defines the expected return on investment (ROI) at different time intervals (0, 40, 60, and 120).

Unable to parse Traceback (Logfile Exceeded Limit)

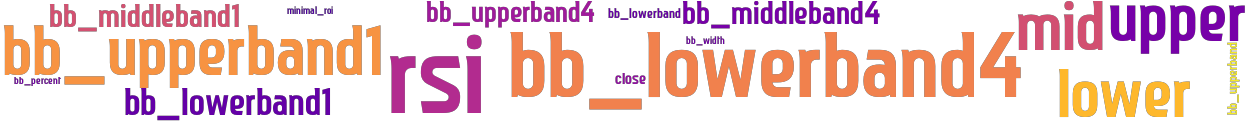

stoploss: -0.45 timeframe: 1h hash(sha256): 1eff892243a12b7235d941b9c67af78619d5922d326325de7d0ca61c0eaca567 indicators: bb_upperband1 mid lower bb_lowerband1 upper bb_upperband4 bb_middleband4 bb_lowerband4 close bb_middleband1 rsi minimal_roi

No similar strategies found. (based on used indicators)

last change: 2025-01-13 12:45:37