Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The bbrsi6 strategy is designed to backtest trading decisions based on technical analysis indicators. Here's a breakdown of what the strategy does:

populate_indicators: This function calculates and adds various technical analysis (TA) indicators to the provided DataFrame. It includes the following indicators:

Relative Strength Index (RSI): It calculates the RSI indicator using the price data in the DataFrame.

Bollinger Bands (bb_lowerband1, bb_middleband1, bb_upperband1): It calculates the Bollinger Bands indicator with a window of 20 and 1 standard deviation from the typical price.

Bollinger Bands (bb_lowerband3, bb_middleband3, bb_upperband3): It calculates the Bollinger Bands indicator with a window of 30 and 3 standard deviations from the typical price.

populate_buy_trend: This function populates the buy signal for the given DataFrame based on the TA indicators. The buy signal is triggered when the closing price is below the lower Bollinger Band with 3 standard deviations (bb_lowerband3). populate_sell_trend: This function populates the sell signal for the given DataFrame based on the TA indicators. The sell signal is triggered when two conditions are met simultaneously: the RSI indicator is greater than 97, and the closing price is above the middle Bollinger Band with 1 standard deviation (bb_middleband1). Overall, the strategy uses the RSI indicator and Bollinger Bands to generate buy and sell signals. It suggests buying when the price is below the lower Bollinger Band and selling when the RSI is high and the price is above the middle Bollinger Band.

Bollinger Bands (bb_lowerband1, bb_middleband1, bb_upperband1): It calculates the Bollinger Bands indicator with a window of 20 and 1 standard deviation from the typical price.

Bollinger Bands (bb_lowerband3, bb_middleband3, bb_upperband3): It calculates the Bollinger Bands indicator with a window of 30 and 3 standard deviations from the typical price.

populate_buy_trend: This function populates the buy signal for the given DataFrame based on the TA indicators. The buy signal is triggered when the closing price is below the lower Bollinger Band with 3 standard deviations (bb_lowerband3). populate_sell_trend: This function populates the sell signal for the given DataFrame based on the TA indicators. The sell signal is triggered when two conditions are met simultaneously: the RSI indicator is greater than 97, and the closing price is above the middle Bollinger Band with 1 standard deviation (bb_middleband1). Overall, the strategy uses the RSI indicator and Bollinger Bands to generate buy and sell signals. It suggests buying when the price is below the lower Bollinger Band and selling when the RSI is high and the price is above the middle Bollinger Band.

startup_candle_count : 30 rsi: -15.641% bb_lowerband3: -0.010% bb_middleband3: 0.005% bb_upperband3: 0.019%

Unable to parse Traceback (Logfile Exceeded Limit)

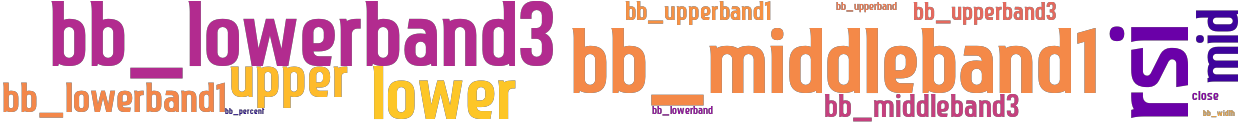

stoploss: -0.38 timeframe: 1h hash(sha256): 168fd24e2730d44c37d2d95232954e60fb79fb925154264a3b26c26ddab4a0aa indicators: bb_upperband1 mid lower bb_lowerband1 upper bb_middleband3 bb_upperband3 close bb_middleband1 rsi bb_lowerband3

No similar strategies found. (based on used indicators)

last change: 2025-06-01 22:48:44