The Price_down1_v25 strategy is a backtesting strategy that involves several technical indicators and calculations to make trading decisions. Here is a short description of what the strategy does:

Populating Indicators:

Heikin-Ashi candles are calculated based on the input dataframe. Bollinger Bands with standard deviations of 2 and 3 are calculated using the typical price.

Additional Bollinger Bands and related calculations are performed.

Exponential Moving Averages (EMA) and other indicators such as ATR, ROCR, CMF, and RSI are calculated.

Merge Informative Dataframes: Dataframes for different timeframes (e.g., 1h, 1d) are fetched and merged with the main dataframe. Various indicators are calculated for the merged dataframes. Drop Redundant Columns: Unnecessary columns from the merged dataframes are dropped. Moving Averages: Moving Averages (MA) with different time periods are calculated. Hull Moving Average (HMA), Simple Moving Averages (SMA), and Exponential Moving Averages (EMA) are calculated. Additional Indicators: Other indicators such as EWO, RSI, and CCI are calculated. The strategy utilizes a range of technical indicators to analyze price data and generate trading signals. It combines various moving averages, Bollinger Bands, Heikin-Ashi candles, and other indicators to identify potential buying or selling opportunities in the market. The specific trading rules and logic based on these indicators are not mentioned in the code snippet provided.

Additional Bollinger Bands and related calculations are performed.

Exponential Moving Averages (EMA) and other indicators such as ATR, ROCR, CMF, and RSI are calculated.

Merge Informative Dataframes: Dataframes for different timeframes (e.g., 1h, 1d) are fetched and merged with the main dataframe. Various indicators are calculated for the merged dataframes. Drop Redundant Columns: Unnecessary columns from the merged dataframes are dropped. Moving Averages: Moving Averages (MA) with different time periods are calculated. Hull Moving Average (HMA), Simple Moving Averages (SMA), and Exponential Moving Averages (EMA) are calculated. Additional Indicators: Other indicators such as EWO, RSI, and CCI are calculated. The strategy utilizes a range of technical indicators to analyze price data and generate trading signals. It combines various moving averages, Bollinger Bands, Heikin-Ashi candles, and other indicators to identify potential buying or selling opportunities in the market. The specific trading rules and logic based on these indicators are not mentioned in the code snippet provided.

Traceback (most recent call last): File "/freqtrade/freqtrade/main.py", line 42, in main return_code = args['func'](args) ^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/commands/optimize_commands.py", line 58, in start_backtesting backtesting.start() File "/freqtrade/freqtrade/optimize/backtesting.py", line 1401, in start min_date, max_date = self.backtest_one_strategy(strat, data, timerange) ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/optimize/backtesting.py", line 1318, in backtest_one_strategy preprocessed = self.strategy.advise_all_indicators(data) ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/strategy/interface.py", line 1378, in advise_all_indicators return {pair: self.advise_indicators(pair_data.copy(), {'pair': pair}).copy() ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/strategy/interface.py", line 1378, inreturn {pair: self.advise_indicators(pair_data.copy(), {'pair': pair}).copy() ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/strategy/interface.py", line 1410, in advise_indicators return self.populate_indicators(dataframe, metadata) ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/user_data/strategies/price_down_latest_v25.py", line 627, in populate_indicators dataframe['tpct_change__2'] = self.top_percent_change_dca(dataframe,2) ^^^^^^^^^^^^^^^^^^^^^^^^^^^ AttributeError: 'price_down_latest_v25' object has no attribute 'top_percent_change_dca'

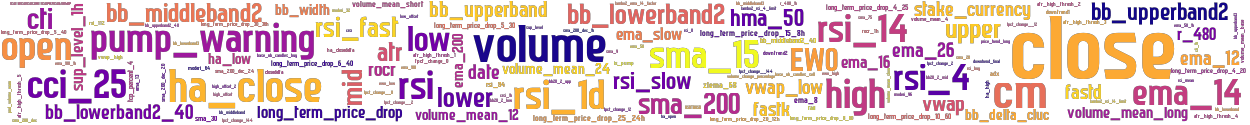

stoploss: -0.99 timeframe: 5m hash(sha256): cf31f68c9a10ef9d758aa96f888a038257bc39f118bcd5836c631e0adcd394b6 indicators: rsi_buy upper close high_offset_2 bb_lowerband volume_mean_12 is_pump downtrend2 rsi_fast r_480_1h lambo2_rsi_4_limit volume rsi_4 low_offset sup_level_1h ha_closedelta rsi_14 bb_upperband2 volume_mean_24 high tpct_change_2 r_480 ema_8 price_trend_long long_term_price_drop_25_24h bb_lowerband3 bb20_2_mid atr ha_high adx ema_12 sma_28 downtrend_final tpct_change_12 ema_slow ema_26 rsi_1d bb_lowerband2_40 bb_upperband2_40 zlema_68 ewo_high ewo_low long_term_price_drop_8_60 moderi_64 USDTBUSDUSDCDA

Similar Strategies: (based on used indicators)

Strategy: price_down_latest_v28, Similarity Score: 93.48%

Strategy: Price_down_dca_latest_v26_1, Similarity Score: 86.96%

last change: 2025-01-11 19:03:13