Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The "cryptohassle" strategy is a trading strategy designed for backtesting. Here is a short description of what the strategy does:

The strategy uses various indicators to make trading decisions. It starts by populating indicators such as Heikin-Ashi candles, Momentum (MOM), and Moving Average Convergence Divergence (MACD) on the given dataframe.

Heikin-Ashi candles are a modified form of Japanese candlestick charts.

The SSL Channels indicator is then applied to the dataframe.

SSL Channels are calculated based on the average of highs and lows, forming a channel. The lines of the channel "flip" when the close price crosses either of the two lines. The strategy provides trading ideas based on channel crossings and confirmation signals. Next, the strategy populates the buy trend by identifying specific conditions. These conditions include the cross above signals of SSL Channels, Momentum, and MACD, along with a volume threshold of 1000. Similarly, the sell trend is populated by detecting a cross below signal between the SSL Channels and considering a volume threshold greater than 0. Overall, the strategy combines multiple indicators and conditions to generate buy and sell signals for trading.

Heikin-Ashi candles are a modified form of Japanese candlestick charts.

The SSL Channels indicator is then applied to the dataframe.

SSL Channels are calculated based on the average of highs and lows, forming a channel. The lines of the channel "flip" when the close price crosses either of the two lines. The strategy provides trading ideas based on channel crossings and confirmation signals. Next, the strategy populates the buy trend by identifying specific conditions. These conditions include the cross above signals of SSL Channels, Momentum, and MACD, along with a volume threshold of 1000. Similarly, the sell trend is populated by detecting a cross below signal between the SSL Channels and considering a volume threshold greater than 0. Overall, the strategy combines multiple indicators and conditions to generate buy and sell signals for trading.

startup_candle_count : 50 ha_macd: -24.716% ha_macdsignal: 190.985% ha_macdhist: 8.294%

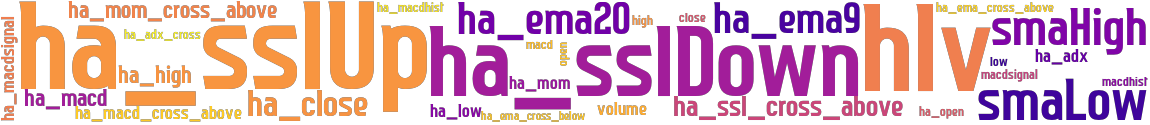

stoploss: -0.2 timeframe: 1h hash(sha256): 217abd28aa5be1acee14746dc2c6dab837a30dff4cffde9135b0ce59537dcd69 indicators: ha_sslUp ha_low close ha_macdhist macdhist ha_macd_cross_above ha_macd volume smaHigh open hlv ha_macdsignal ha_open smaLow ha_sslUpdataframeha_sslDown high macdsignal ha_close macd ha_mom_cross_above ha_mom ha_high ha_ssl_cross_above ha_sslDown low

No similar strategies found. (based on used indicators)

last change: 2023-06-24 09:08:40