Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BBRSIV2 strategy is a trading strategy that uses a combination of indicators to generate buy and sell signals. Here's a breakdown of what the strategy does:

populate_indicators: This function adds several technical analysis (TA) indicators to the given DataFrame. The indicators used in this strategy are the Relative Strength Index (RSI) and Bollinger Bands.

The RSI measures the strength and speed of price movements, while Bollinger Bands consist of three lines that envelope the price and provide insights into volatility and potential price reversals.

populate_buy_trend: Based on the TA indicators, this function populates the buy signal for the DataFrame.

The buy signal is triggered when the closing price is below the lower Bollinger Band, indicating a potential oversold condition. This condition is further validated by ensuring that the volume is not zero. populate_sell_trend: Similarly, based on the TA indicators, this function populates the sell signal for the DataFrame. The sell signal is triggered when the closing price is above the middle Bollinger Band, suggesting a potential overbought condition. Overall, the BBRSIV2 strategy aims to identify buying opportunities when the price is near the lower Bollinger Band and selling opportunities when the price is near the middle Bollinger Band. The strategy utilizes the RSI and Bollinger Bands to gauge market conditions and make informed trading decisions.

The RSI measures the strength and speed of price movements, while Bollinger Bands consist of three lines that envelope the price and provide insights into volatility and potential price reversals.

populate_buy_trend: Based on the TA indicators, this function populates the buy signal for the DataFrame.

The buy signal is triggered when the closing price is below the lower Bollinger Band, indicating a potential oversold condition. This condition is further validated by ensuring that the volume is not zero. populate_sell_trend: Similarly, based on the TA indicators, this function populates the sell signal for the DataFrame. The sell signal is triggered when the closing price is above the middle Bollinger Band, suggesting a potential overbought condition. Overall, the BBRSIV2 strategy aims to identify buying opportunities when the price is near the lower Bollinger Band and selling opportunities when the price is near the middle Bollinger Band. The strategy utilizes the RSI and Bollinger Bands to gauge market conditions and make informed trading decisions.

Unable to parse Traceback (Logfile Exceeded Limit)

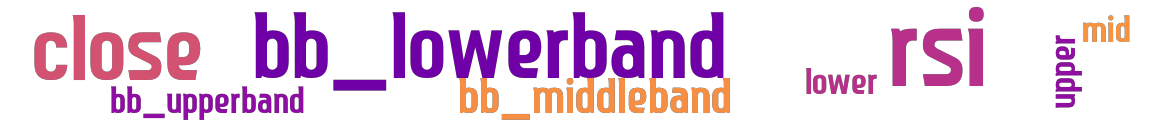

stoploss: -0.171 timeframe: 30m hash(sha256): 5533a34953e46121279fbdac412b25edf4c6952a6ea4dfdcabe4aa7feedf2b71 indicators: upper mid lower bb_middleband rsi close bb_upperband bb_lowerband

No similar strategies found. (based on used indicators)

last change: 2025-01-15 01:13:16